Answered step by step

Verified Expert Solution

Question

1 Approved Answer

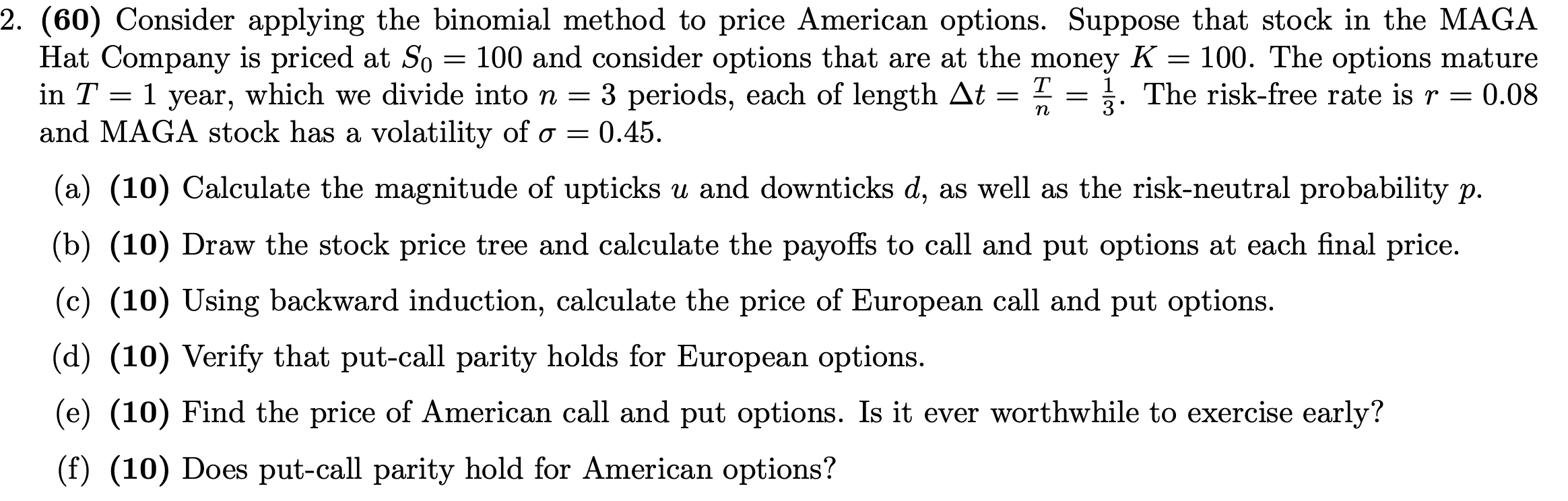

2. (60) Consider applying the binomial method to price American options. Suppose that stock in the MAGA Hat Company is priced at S =

2. (60) Consider applying the binomial method to price American options. Suppose that stock in the MAGA Hat Company is priced at S = 100 and consider options that are at the money K = 100. The options mature So in T = 1 year, which we divide into n = 3 periods, each of length t = 3. The risk-free rate is r = 0.08 and MAGA stock has a volatility of = 0.45. = T n = (a) (10) Calculate the magnitude of upticks u and downticks d, as well as the risk-neutral probability p. (b) (10) Draw the stock price tree and calculate the payoffs to call and put options at each final price. (c) (10) Using backward induction, calculate the price of European call and put options. (d) (10) Verify that put-call parity holds for European options. (e) (10) Find the price of American call and put options. Is it ever worthwhile to exercise early? (f) (10) Does put-call parity hold for American options?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started