Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(2) (60 pts) Say that today is January 1, 2010 and firms A and B decide to engage in a plain vanilla interest rate swap

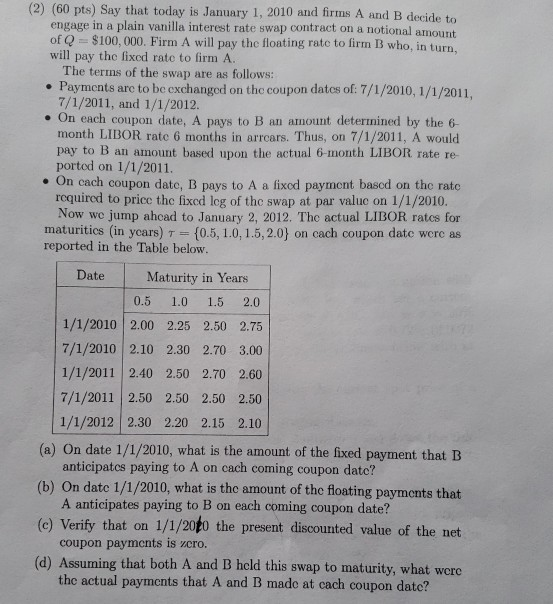

(2) (60 pts) Say that today is January 1, 2010 and firms A and B decide to engage in a plain vanilla interest rate swap contract on a notional amount of Q =$100,000. Firm A will pay the floating rate to firm B who, in turn, will pay the fixed rate to firm A. The terms of the swap are as follows: Payments are to be exchanged on the coupon dates of: 7/1/2010, 1/1/2011, 7/1/2011, and 1/1/2012. On each coupon date, A pays to B an amount determined by the 6- month LIBOR rate 6 months in arrears. Thus, on 7/1/2011, A would pay to B an amount based upon the actual 6-month LIBOR rate re ported on 1/1/2011. On cach coupon date, B pays to A a fixed payment based on the rate required to price the fixed leg of the swap at par value on 1/1/2010. Now we jump ahead to January 2, 2012. The actual LIBOR rates for maturitics (in years) T = 0.5, 1.0, 1.5, 2.0) on cach coupon date were as reported in the Table below. Date Maturity in Years 0.5 1.0 1.5 2.0 1/1/2010 2.00 2.25 2.50 2.75 7/1/2010 2.10 2.30 2.70 3.00 1/1/2011 2.40 2.50 2.70 2.60 7/1/2011 2.50 2.50 2.50 2.50 1/1/2012 2.30 2.20 2.15 2.10 (a) On date 1/1/2010, what is the amount of the fixed payment that B anticipates paying to A on cach coming coupon date? (b) On date 1/1/2010, what is the amount of the floating payments that A anticipates paying to B on each coming coupon date? (c) Verify that on 1/1/2000 the present discounted value of the net coupon payments is vcro. (d) Assuming that both A and B held this swap to maturity, what were the actual payments that A and B made at cach coupon date? (2) (60 pts) Say that today is January 1, 2010 and firms A and B decide to engage in a plain vanilla interest rate swap contract on a notional amount of Q =$100,000. Firm A will pay the floating rate to firm B who, in turn, will pay the fixed rate to firm A. The terms of the swap are as follows: Payments are to be exchanged on the coupon dates of: 7/1/2010, 1/1/2011, 7/1/2011, and 1/1/2012. On each coupon date, A pays to B an amount determined by the 6- month LIBOR rate 6 months in arrears. Thus, on 7/1/2011, A would pay to B an amount based upon the actual 6-month LIBOR rate re ported on 1/1/2011. On cach coupon date, B pays to A a fixed payment based on the rate required to price the fixed leg of the swap at par value on 1/1/2010. Now we jump ahead to January 2, 2012. The actual LIBOR rates for maturitics (in years) T = 0.5, 1.0, 1.5, 2.0) on cach coupon date were as reported in the Table below. Date Maturity in Years 0.5 1.0 1.5 2.0 1/1/2010 2.00 2.25 2.50 2.75 7/1/2010 2.10 2.30 2.70 3.00 1/1/2011 2.40 2.50 2.70 2.60 7/1/2011 2.50 2.50 2.50 2.50 1/1/2012 2.30 2.20 2.15 2.10 (a) On date 1/1/2010, what is the amount of the fixed payment that B anticipates paying to A on cach coming coupon date? (b) On date 1/1/2010, what is the amount of the floating payments that A anticipates paying to B on each coming coupon date? (c) Verify that on 1/1/2000 the present discounted value of the net coupon payments is vcro. (d) Assuming that both A and B held this swap to maturity, what were the actual payments that A and B made at cach coupon date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started