Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer each question with a brief explanation. Thank you! LO1 How much would you have to invest today in an account that pays 3.00% APR,

Answer each question with a brief explanation. Thank you!

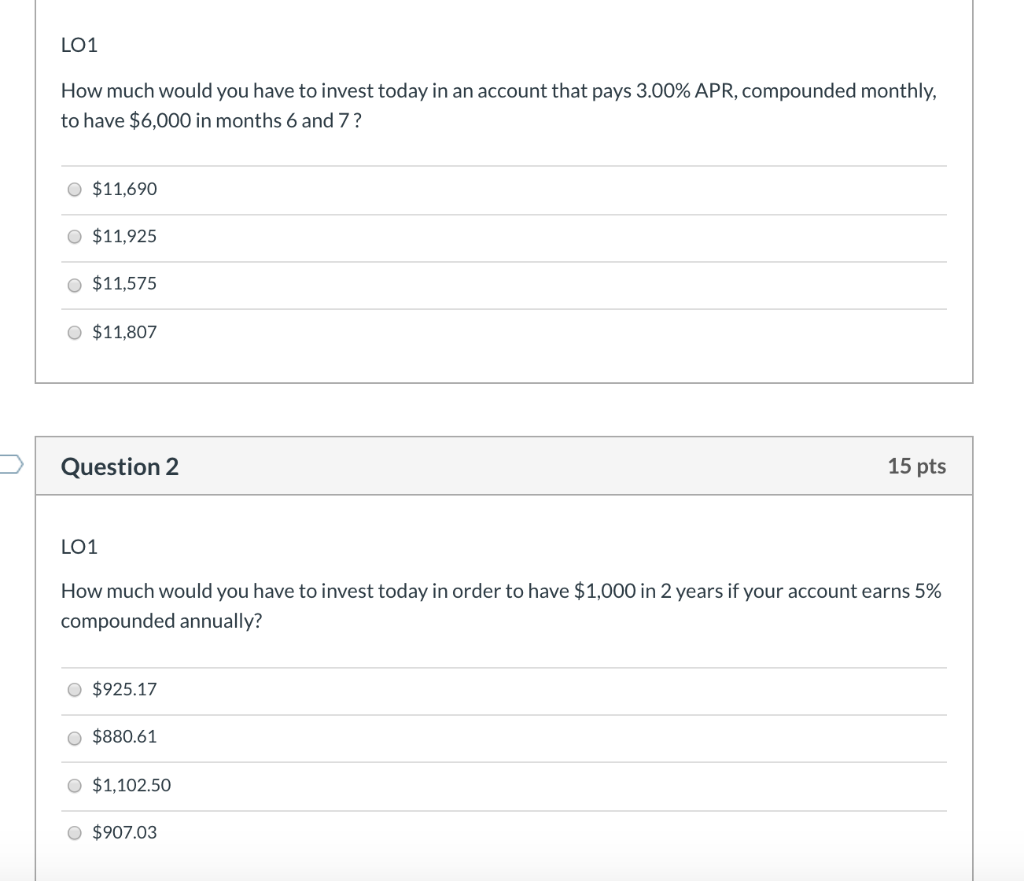

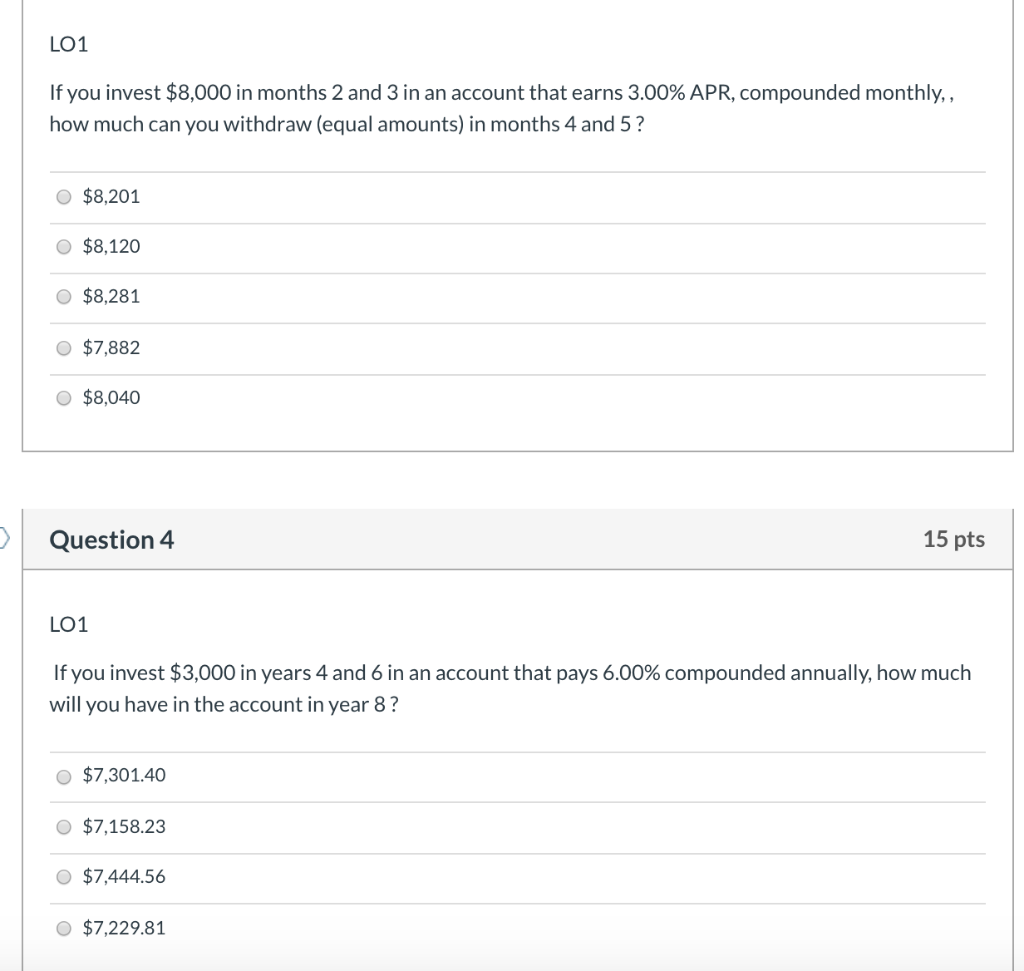

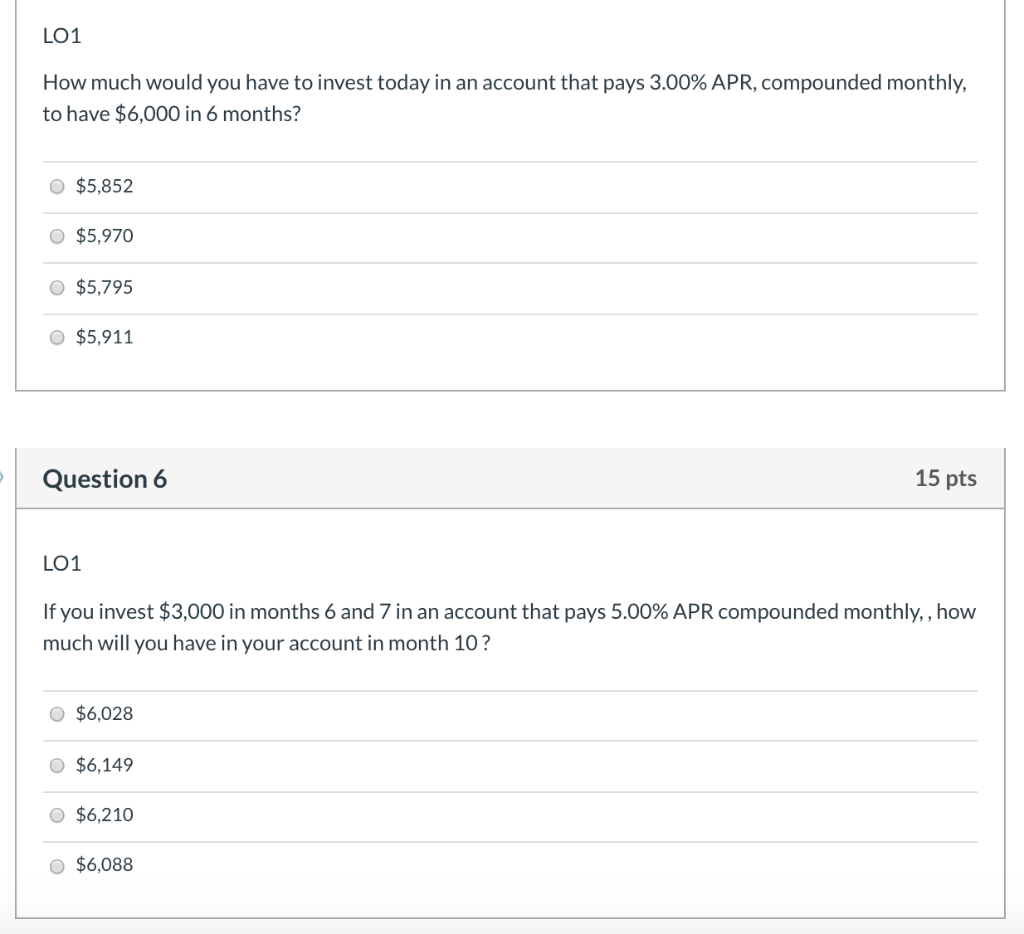

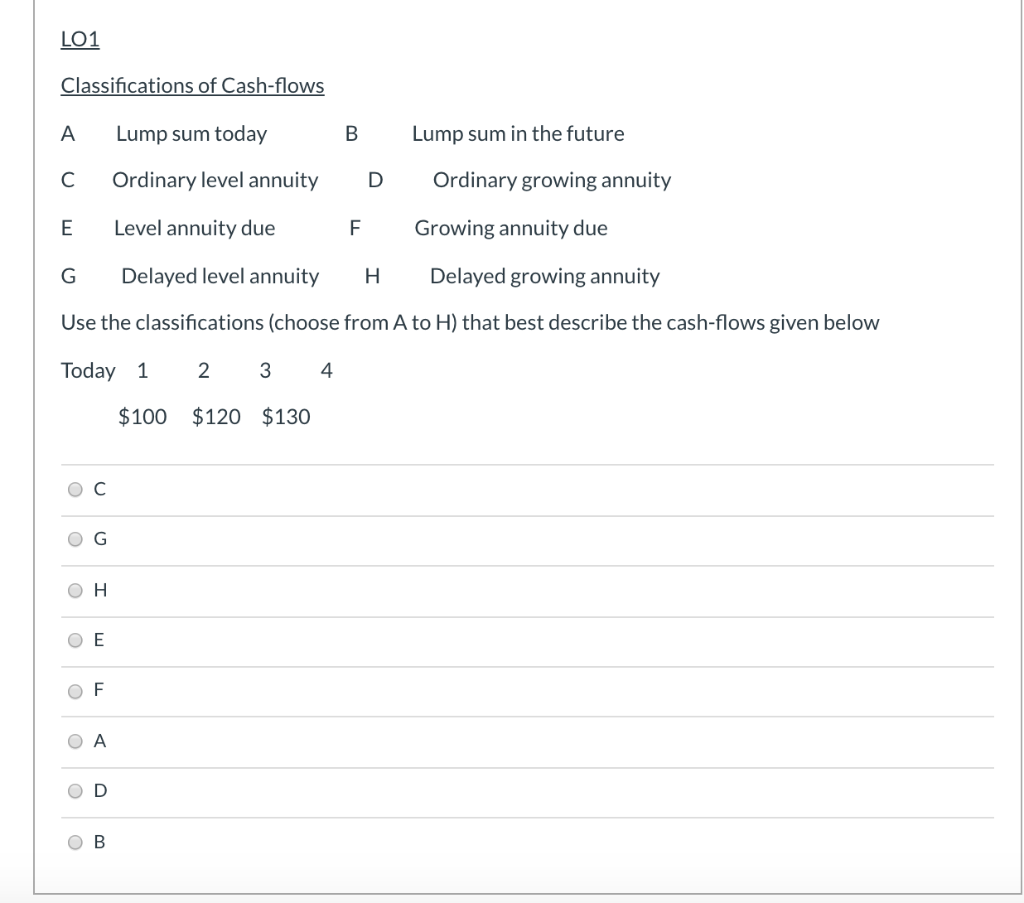

LO1 How much would you have to invest today in an account that pays 3.00% APR, compounded monthly, to have $6,000 in months 6 and 7? $11,690 $11,925 $11,575 $11,807 Question 2 15 pts LO1 How much would you have to invest today in order to have $1,000 in 2 years if your account earns 5% compounded annually? $925.17 $880.61 $1,102.50 $907.03 LO1 If you invest $8,000 in months 2 and 3 in an account that earns 3.00% APR, compounded monthly,, how much can you withdraw (equal amounts) in months 4 and 5? $8,201 $8,120 O $8,281 o$7,882 $8,040 Question 4 15 pts LO1 If you invest $3,000 in years 4 and 6 in an account that pays 6.00% compounded annually, how much will you have in the account in year 8? $7,301.40 $7,158.23 $7,444.56 $7,229.81 LO1 How much would you have to invest today in an account that pays 3.00% APR, compounded monthly, to have $6,000 in 6 months? O $5,852 $5,970 $5,795 O $5,911 Question 6 15 pts LO1 If you invest $3,000 in months 6 and 7 in an account that pays 5.00% APR compounded monthly, how much will you have in your account in month 10 ? $6,028 $6,149 O $6,210 $6,088 LO1 Classifications of Cash-flows A Lump sum today B Lump sum in the future C Ordinary level annuity D Ordinary growing annuity E Level annuity due F Growing annuity due G Delayed level annuity H Delayed growing annuity Use the classifications (choose from A to H) that best describe the cash-flows given below Today 1 2 3 4 $100 $120 $130 oc OG OH OE OF OD OBStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started