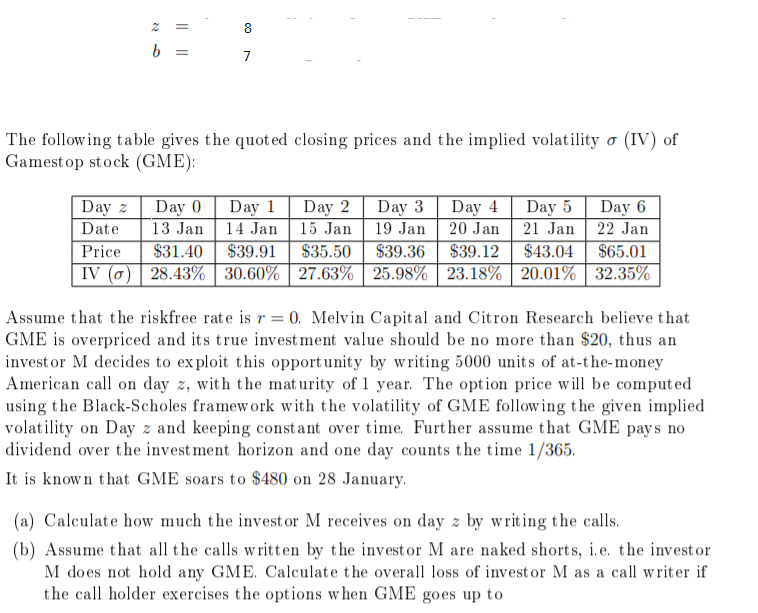

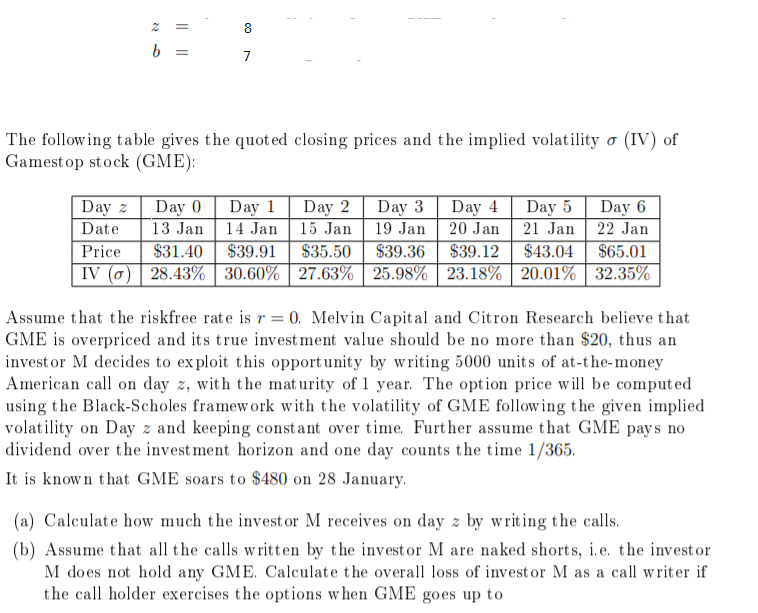

2 8 b= 7 The following table gives the quoted closing prices and the implied volatility o (IV) of Gamestop stock (GME): Day 2 Day 0 Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Date 13 Jan 14 Jan 15 Jan 19 Jan 20 Jan 21 Jan 22 Jan Price $31.40 $39.91 $35.50 $39.36 $39.12 $43.04 $65.01 IV (0) 28.43% 30.60% 27.63% 25.98% 23.18% 20.01% 32.35% Assume that the riskfree rate is r = 0. Melvin Capital and Citron Research believe that GME is overpriced and its true investment value should be no more than $20, thus an investor M decides to exploit this opportunity by writing 5000 units of at-the-money American call on day z, with the maturity of 1 year. The option price will be computed using the Black-Scholes framework with the volatility of GME following the given implied volatility on Day z and keeping constant over time. Further assume that GME pays no dividend over the investment horizon and one day counts the time 1/365, It is known that GME soars to $480 on 28 January, (a) Calculate how much the investor M receives on day z by writing the calls. (b) Assume that all the calls written by the investor M are naked shorts, i.e. the investor M does not hold any GME. Calculate the overall loss of investor M as a call writer if the call holder exercises the options when GME goes up to 2 8 b= 7 The following table gives the quoted closing prices and the implied volatility o (IV) of Gamestop stock (GME): Day 2 Day 0 Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Date 13 Jan 14 Jan 15 Jan 19 Jan 20 Jan 21 Jan 22 Jan Price $31.40 $39.91 $35.50 $39.36 $39.12 $43.04 $65.01 IV (0) 28.43% 30.60% 27.63% 25.98% 23.18% 20.01% 32.35% Assume that the riskfree rate is r = 0. Melvin Capital and Citron Research believe that GME is overpriced and its true investment value should be no more than $20, thus an investor M decides to exploit this opportunity by writing 5000 units of at-the-money American call on day z, with the maturity of 1 year. The option price will be computed using the Black-Scholes framework with the volatility of GME following the given implied volatility on Day z and keeping constant over time. Further assume that GME pays no dividend over the investment horizon and one day counts the time 1/365, It is known that GME soars to $480 on 28 January, (a) Calculate how much the investor M receives on day z by writing the calls. (b) Assume that all the calls written by the investor M are naked shorts, i.e. the investor M does not hold any GME. Calculate the overall loss of investor M as a call writer if the call holder exercises the options when GME goes up to