Answered step by step

Verified Expert Solution

Question

1 Approved Answer

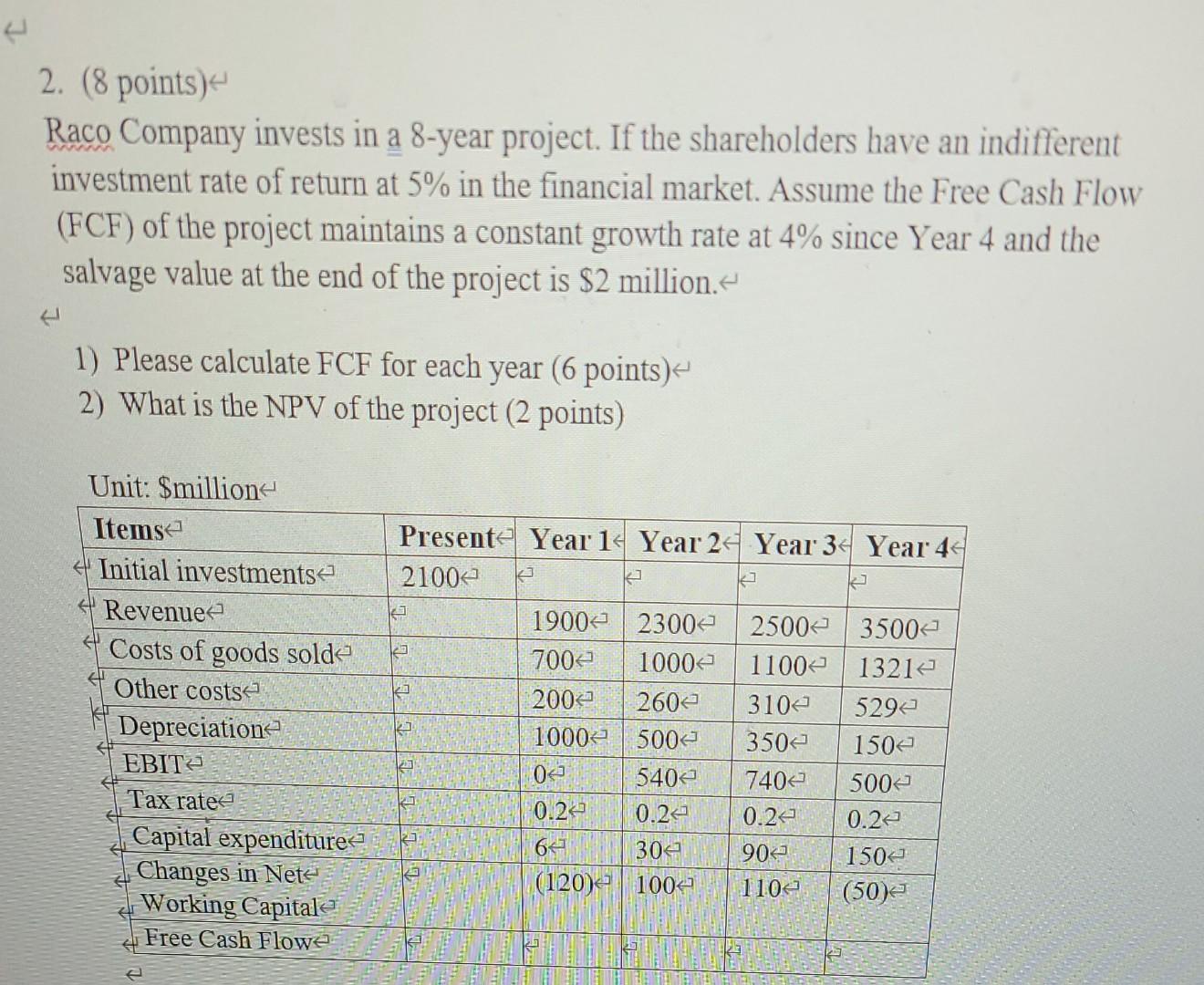

2. (8 points) Raco Company invests in a 8-year project. If the shareholders have an indifferent investment rate of return at 5% in the financial

2. (8 points) Raco Company invests in a 8-year project. If the shareholders have an indifferent investment rate of return at 5% in the financial market. Assume the Free Cash Flow (FCF) of the project maintains a constant growth rate at 4% since Year 4 and the salvage value at the end of the project is $2 million. 1) Please calculate FCF for each year (6 points) 2) What is the NPV of the project (2 points) a le ka Unit: $million Itemse Initial investments Revenuee Costs of goods solde Other costs Depreciatione EBITO Tax ratee Capital expenditure- Changes in Nets Working Capitale Free Cash Flow Present Year 14 Year 2 Year 34 Year 44 2100 19000 23002 25000 35002 7002 10002 11002 13212 2004 2602 3102 5292 10002 500 350 1502 04 5402 7404 5002 0.22 0.24 0.24 0.22 60 302 904 1504 (120)2 1004 1104 (50) 12 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started