Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ahmed Manufacturing LLC manufactures Product Q. In the previous month of September 2020, the company budgeted to manufacture and sell 3,300 Product Q at

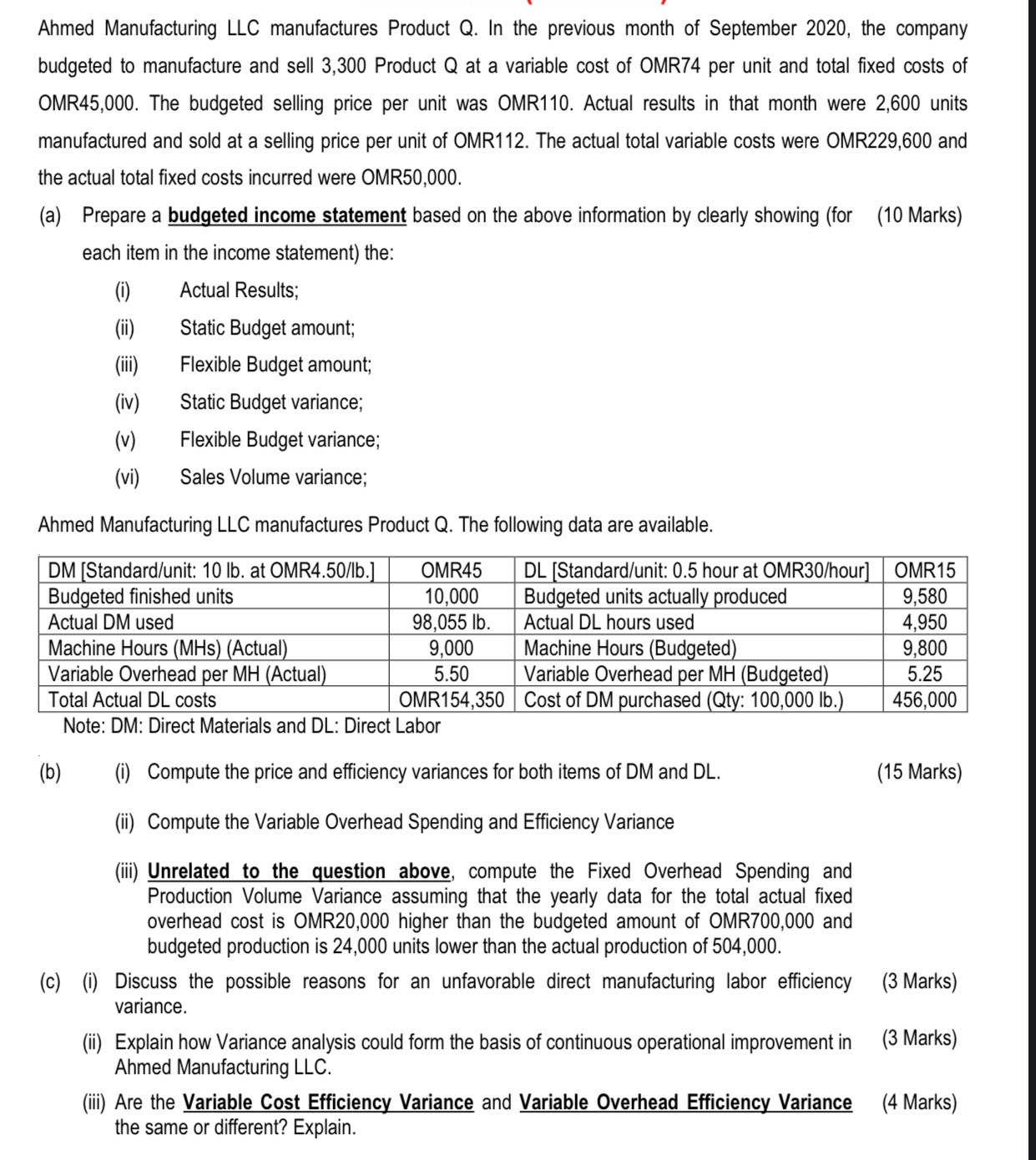

Ahmed Manufacturing LLC manufactures Product Q. In the previous month of September 2020, the company budgeted to manufacture and sell 3,300 Product Q at a variable cost of OMR74 per unit and total fixed costs of OMR45,000. The budgeted selling price per unit was OMR110. Actual results in that month were 2,600 units manufactured and sold at a selling price per unit of OMR112. The actual total variable costs were OMR229,600 and the actual total fixed costs incurred were OMR50,000. (a) Prepare a budgeted income statement based on the above information by clearly showing (for (10 Marks) each item in the income statement) the: (i) Actual Results; (ii) Static Budget amount; Flexible Budget amount; (iv) Static Budget variance; (v) Flexible Budget variance; (vi) Sales Volume variance; Ahmed Manufacturing LLC manufactures Product Q. The following data are available. DM [Standard/unit: 10 lb. at OMR4.50/lb.] OMR45 Budgeted finished units 10,000 DL [Standard/unit: 0.5 hour at OMR30/hour] Budgeted units actually produced OMR15 9,580 Actual DM used 98,055 lb. Actual DL hours used 4,950 Machine Hours (MHS) (Actual) Variable Overhead per MH (Actual) 9,000 5.50 Machine Hours (Budgeted) 9,800 Total Actual DL costs OMR154,350 Variable Overhead per MH (Budgeted) Cost of DM purchased (Qty: 100,000 lb.) 5.25 456,000 Note: DM: Direct Materials and DL: Direct Labor (b) (i) Compute the price and efficiency variances for both items of DM and DL. (15 Marks) (ii) Compute the Variable Overhead Spending and Efficiency Variance (iii) Unrelated to the question above, compute the Fixed Overhead Spending and Production Volume Variance assuming that the yearly data for the total actual fixed overhead cost is OMR20,000 higher than the budgeted amount of OMR700,000 and budgeted production is 24,000 units lower than the actual production of 504,000. (3 Marks) (c) (i) Discuss the possible reasons for an unfavorable direct manufacturing labor efficiency variance. (ii) Explain how Variance analysis could form the basis of continuous operational improvement in Ahmed Manufacturing LLC. (3 Marks) (iii) Are the Variable Cost Efficiency Variance and Variable Overhead Efficiency Variance the same or different? Explain. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ahmed Manufacturing LLC Variance Analysis a Budgeted Income Statement Item Actual Results Static Budget Amount Flexible Budget Variance Sales Volume V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started