Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* 2 9 2 Agg @ the Trace Precedents Teace Dependents Remove Arrows ert -tion AutoSum Recently Financial Logical Text Date & Lookup & Math

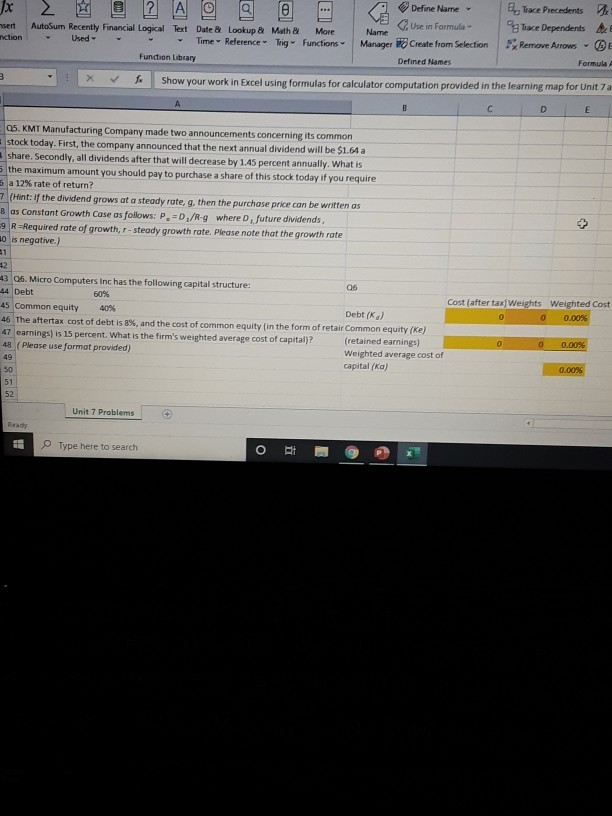

* 2 9 2 Agg @ the Trace Precedents Teace Dependents Remove Arrows ert -tion AutoSum Recently Financial Logical Text Date & Lookup & Math & Used- Time Reference in Function Library Define Name Use in Formula Name Manager Create from Selection Defined Names More functions Formula T X to show your work in Excel using formulas for calculator computation provided in the learning map for Unit 7 05. KMT Manufacturing Company made two announcements concerning its common stock today. First, the company announced that the next annual dividend will be $1.61 a share. Secondly, all dividends after that will decrease by 1.45 percent annually. What is the maximum amount you should pay to purchase a share of this stock today if you require a 12% rate of return? (Hint: if the dividend grows at a steady rate, g, then the purchase price can be written as as Constant Growth Case as follows: P.-D/R-9 where future dividends, R=Required rate of growth, r - steady growth rate. Please note that the growth rate is negative.) 13 06. Micro Computers Inc has the following capital structure: 14 Debt 60% Cost (after tax Weights Weighted Cost 45 Common equity 40% 0 0 0.00% 46 The aftertax cost of debt is 8%, and the cost of common equity in the form of retair Common equity (Ke) 47 earnings) is 15 percent. What is the firm's weighted average cost of capital)? (retained earnings) 0 0 0.00% 48 (Please use format provided) Weighted average cost of capital (ka) 51 52 Unit 7 Problems Ready Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started