Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (a) A 30-year loan of RM N is made to an individual in order to purchase a house, where N is the your

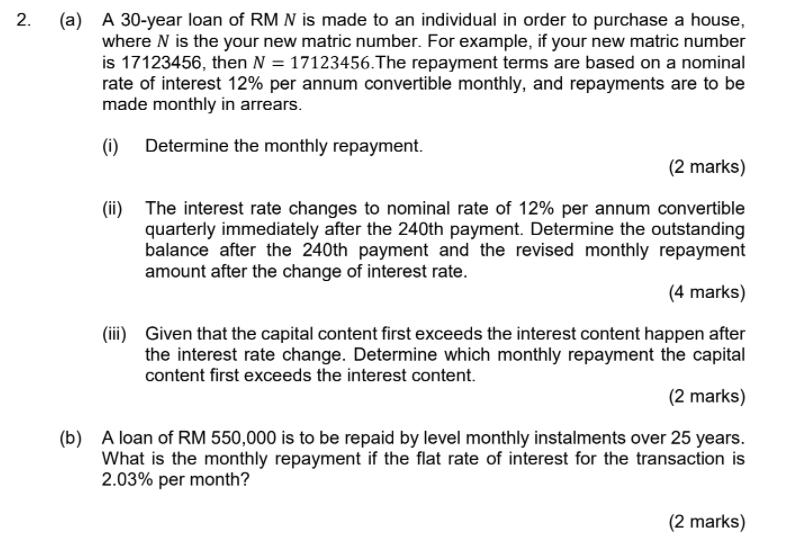

2. (a) A 30-year loan of RM N is made to an individual in order to purchase a house, where N is the your new matric number. For example, if your new matric number is 17123456, then N=17123456. The repayment terms are based on a nominal rate of interest 12% per annum convertible monthly, and repayments are to be made monthly in arrears. (i) Determine the monthly repayment. (2 marks) (ii) The interest rate changes to nominal rate of 12% per annum convertible quarterly immediately after the 240th payment. Determine the outstanding balance after the 240th payment and the revised monthly repayment amount after the change of interest rate. (4 marks) (iii) Given that the capital content first exceeds the interest content happen after the interest rate change. Determine which monthly repayment the capital content first exceeds the interest content. (2 marks) (b) A loan of RM 550,000 is to be repaid by level monthly instalments over 25 years. What is the monthly repayment if the flat rate of interest for the transaction is 2.03% per month? (2 marks)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i Deter mine the monthly repayment 2 marks ANS WER The monthly repayment for a 30 year loan of RM N at a nominal rate of interest 12 per ann um conver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started