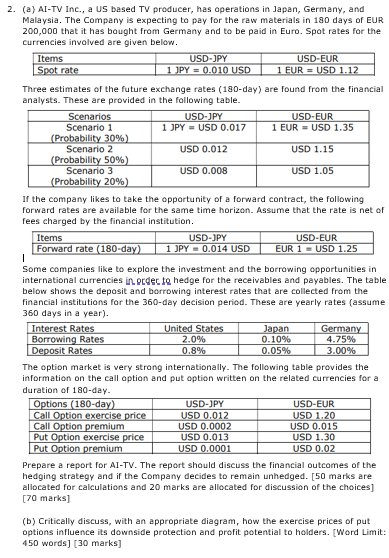

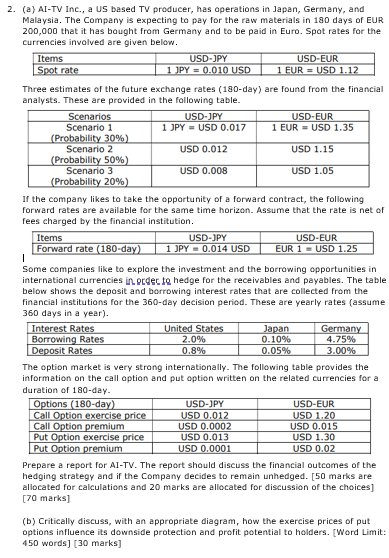

2. (a) AI-TV Inc., a US based TV producer, has operations in Japan, Germany, and Malaysia. The Company is expecting to pay for the raw materials in 180 days of EUR 200,000 that it has bought from Germany and to be paid in Euro. Spot rates for the Currencies involved are given below. Items USD-JPY USD-EUR Spot rate 1 JPY = 0.010 USD 1 EUR = USD 1.12 Three estimates of the future exchange rates (180-day) are found from the financial analysts. These are provided in the following table. Scenarios USD-JPY USD-EUR Scenario 1 1 JPY = USD 0.017 1 EUR = USD 1.35 (Probability 30%) Scenario 2 USD 0.012 USD 1.15 (Probability 50%) Scenario 3 USD 0.008 USD 1.05 (Probability 20% If the company likes to take the opportunity of a forward contract, the following forward rates are available for the same time horizon. Assume that the rate is net of fees charged by the financial institution. Items USDJPY USD-EUR Forward rate (180-day) 1 JPY - 0.014 USD EUR 1 = USD 1.25 | Some companies like to explore the investment and the borrowing opportunities in international currencies in order to hedge for the receivables and payables. The table below shows the depasit and borrowing interest rates that are collected from the financial institutions for the 360-day decision period. These are yearly rates (assume 360 days in a year). Interest Rates United States Japan Germany Borrowing Rates 2.0% 0.10% 4.75% Deposit Rates 0.8% 0.05% 3.00% The option market is very strong internationally. The following table provides the information on the call option and put option written on the related currencies for a duration of 180-day. Options (180-day) USDJPY USD-EUR Call Option exercise price USD 0.012 USD 1.20 Call Option premium USD 0.0002 USD 0.015 Option exercise price USD 0.013 USD 1.30 Put Option premium USD 0.0001 USD 0.02 Prepare a report for AI-TV. The report should discuss the financial outcomes of the hedging strategy and if the Company decides to remain unhedged. [50 marks are allocated for calculations and 20 marks are allocated for discussion of the choices] [70 marks] (b) Critically discuss, with an appropriate diagram, how the exercise prices of put options influence its downside protection and profit potential to holders. (Word Limit: 450 words] [30 marks] 2. (a) AI-TV Inc., a US based TV producer, has operations in Japan, Germany, and Malaysia. The Company is expecting to pay for the raw materials in 180 days of EUR 200,000 that it has bought from Germany and to be paid in Euro. Spot rates for the Currencies involved are given below. Items USD-JPY USD-EUR Spot rate 1 JPY = 0.010 USD 1 EUR = USD 1.12 Three estimates of the future exchange rates (180-day) are found from the financial analysts. These are provided in the following table. Scenarios USD-JPY USD-EUR Scenario 1 1 JPY = USD 0.017 1 EUR = USD 1.35 (Probability 30%) Scenario 2 USD 0.012 USD 1.15 (Probability 50%) Scenario 3 USD 0.008 USD 1.05 (Probability 20% If the company likes to take the opportunity of a forward contract, the following forward rates are available for the same time horizon. Assume that the rate is net of fees charged by the financial institution. Items USDJPY USD-EUR Forward rate (180-day) 1 JPY - 0.014 USD EUR 1 = USD 1.25 | Some companies like to explore the investment and the borrowing opportunities in international currencies in order to hedge for the receivables and payables. The table below shows the depasit and borrowing interest rates that are collected from the financial institutions for the 360-day decision period. These are yearly rates (assume 360 days in a year). Interest Rates United States Japan Germany Borrowing Rates 2.0% 0.10% 4.75% Deposit Rates 0.8% 0.05% 3.00% The option market is very strong internationally. The following table provides the information on the call option and put option written on the related currencies for a duration of 180-day. Options (180-day) USDJPY USD-EUR Call Option exercise price USD 0.012 USD 1.20 Call Option premium USD 0.0002 USD 0.015 Option exercise price USD 0.013 USD 1.30 Put Option premium USD 0.0001 USD 0.02 Prepare a report for AI-TV. The report should discuss the financial outcomes of the hedging strategy and if the Company decides to remain unhedged. [50 marks are allocated for calculations and 20 marks are allocated for discussion of the choices] [70 marks] (b) Critically discuss, with an appropriate diagram, how the exercise prices of put options influence its downside protection and profit potential to holders. (Word Limit: 450 words] [30 marks]