Answered step by step

Verified Expert Solution

Question

1 Approved Answer

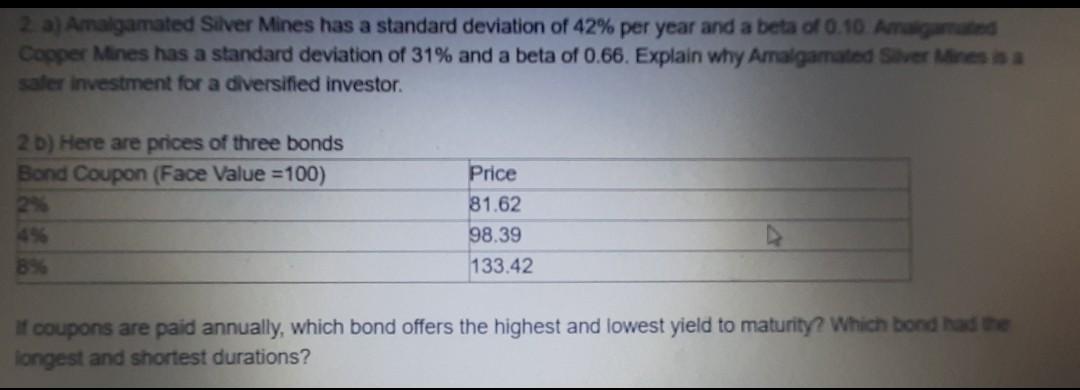

2. a) Amalgamated Silver Mines has a standard deviation of 42% per year and a beta of 0.10 Amage Copper Mines has a standard deviation

2. a) Amalgamated Silver Mines has a standard deviation of 42% per year and a beta of 0.10 Amage Copper Mines has a standard deviation of 31% and a beta of 0.66. Explain why Amalgamated Sverines saler investment for a diversified investor. 2D) Here are prices of three bonds Bond Coupon (Face Value =100) Price 81.62 98.39 133.42 If coupons are paid annually, which bond offers the highest and lowest yield to maturity? Which bond had the longest and shortest durations? 2. a) Amalgamated Silver Mines has a standard deviation of 42% per year and a beta of 0.10 Amage Copper Mines has a standard deviation of 31% and a beta of 0.66. Explain why Amalgamated Sverines saler investment for a diversified investor. 2D) Here are prices of three bonds Bond Coupon (Face Value =100) Price 81.62 98.39 133.42 If coupons are paid annually, which bond offers the highest and lowest yield to maturity? Which bond had the longest and shortest durations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started