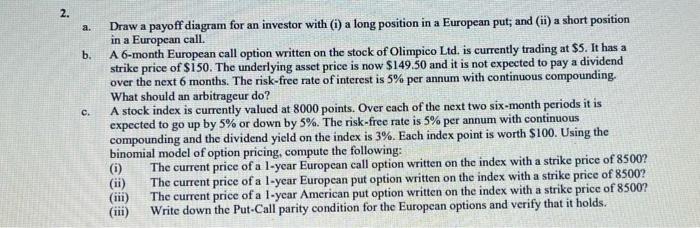

2. a. b. c. Draw a payoff diagram for an investor with (i) a long position in a European put; and (ii) a short position in a European call A 6-month European call option written on the stock of Olimpico Ltd. is currently trading at $5. It has a strike price of $150. The underlying asset price is now $149.50 and it is not expected to pay a dividend over the next 6 months. The risk-free rate of interest is 5% per annum with continuous compounding. What should an arbitrageur do? A stock index is currently valued at 8000 points. Over each of the next two six-month periods it is expected to go up by 5% or down by 5%. The risk-free rate is 5% per annum with continuous compounding and the dividend yield on the index is 3%. Each index point is worth $100. Using the binomial model of option pricing, compute the following: () The current price of a l-year European call option written on the index with a strike price of 8500? (ii) The current price of a 1-year European put option written on the index with a strike price of 8500? (iii) The current price of a 1-year American put option written on the index with a strike price of 8500? (iii) Write down the Put-Call parity condition for the European options and verify that it holds. 2. a. b. c. Draw a payoff diagram for an investor with (i) a long position in a European put; and (ii) a short position in a European call A 6-month European call option written on the stock of Olimpico Ltd. is currently trading at $5. It has a strike price of $150. The underlying asset price is now $149.50 and it is not expected to pay a dividend over the next 6 months. The risk-free rate of interest is 5% per annum with continuous compounding. What should an arbitrageur do? A stock index is currently valued at 8000 points. Over each of the next two six-month periods it is expected to go up by 5% or down by 5%. The risk-free rate is 5% per annum with continuous compounding and the dividend yield on the index is 3%. Each index point is worth $100. Using the binomial model of option pricing, compute the following: () The current price of a l-year European call option written on the index with a strike price of 8500? (ii) The current price of a 1-year European put option written on the index with a strike price of 8500? (iii) The current price of a 1-year American put option written on the index with a strike price of 8500? (iii) Write down the Put-Call parity condition for the European options and verify that it holds