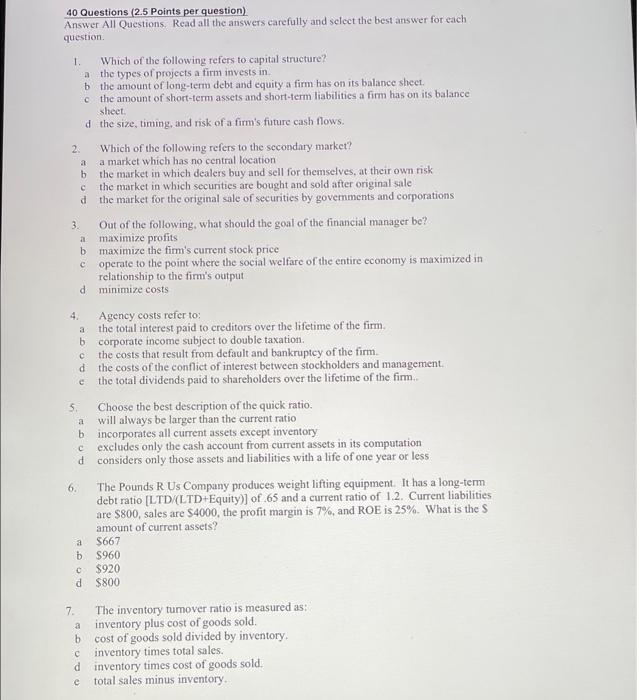

2. a b il b C 40 Questions (2.5 Points per question) Answer All Questions. Read all the answers carefully and select the best answer for each question 1. Which of the following refers to capital structure? a the types of projects a firm invests in the amount of long-term debt and equity a firm has on its balance sheet c the amount of short-term assets and short-term liabilities a firm has on its balance sheet d the size, timing, and risk of a firm's future cash flows. Which of the following refers to the sccondary market? a market which has no central location the market in which dealers buy and sell for themselves, at their own risk the market in which securities are bought and sold after original sale d the market for the original sale of securities by governments and corporations 3 Out of the following what should the goal of the financial manager be? maximize profits maximize the firm's current stock price operate to the point where the social welfare of the entire economy is maximized in relationship to the firm's output d minimize costs 4. Agency costs refer to a the total interest paid to creditors over the lifetime of the firm, b corporate income subject to double taxation the costs that result from default and bankruptcy of the firm. d the costs of the conflict of interest between stockholders and management the total dividends paid to shareholders over the lifetime of the fimm 5. Choose the best description of the quick ratio. will always be larger than the current ratio b incorporates all current assets except inventory c excludes only the cash account from current assets in its computation d considers only those assets and liabilities with a life of one year or less 6. The Pounds R Us Company produces weight lifting equipment. It has a long-term debt ratio [LTD (LTD+Equity)] of 65 and a current ratio of 1.2. Current liabilities are $800, sales are $4000, the profit margin is 7%, and ROE is 25%. What is the S amount of current assets? S667 b $960 $920 d $800 c C a a C 7 The inventory tumover ratio is measured as: inventory plus cost of goods sold. b cost of goods sold divided by inventory. inventory times total sales. d inventory times cost of goods sold. total sales minus inventory. e