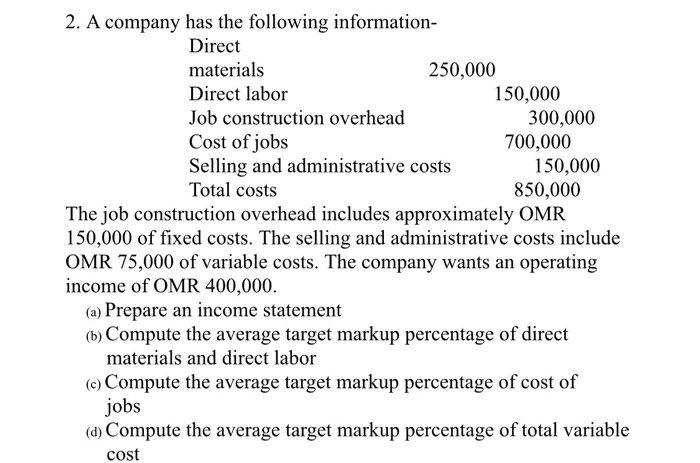

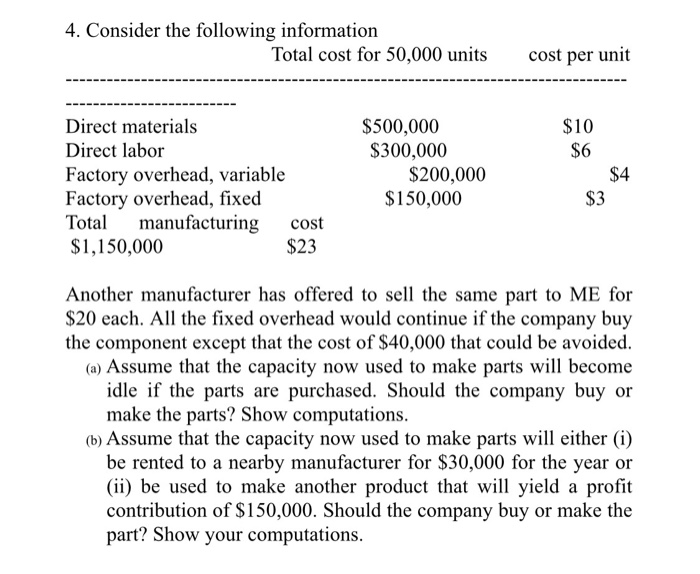

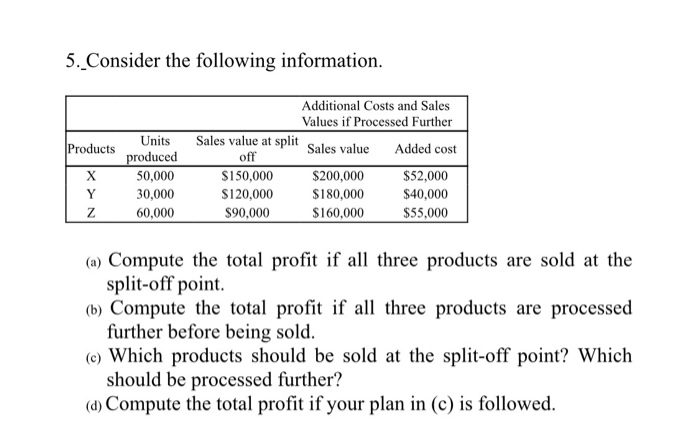

2. A company has the following information- Direct materials 250,000 Direct labor 150,000 Job construction overhead 300,000 Cost of jobs 700,000 Selling and administrative costs 150,000 Total costs 850,000 The job construction overhead includes approximately OMR 150,000 of fixed costs. The selling and administrative costs include OMR 75,000 of variable costs. The company wants an operating income of OMR 400,000. (a) Prepare an income statement (b) Compute the average target markup percentage of direct materials and direct labor (c) Compute the average target markup percentage of cost of jobs (a) Compute the average target markup percentage of total variable cost 4. Consider the following information Total cost for 50,000 units cost per unit $10 $6 Direct materials Direct labor Factory overhead, variable Factory overhead, fixed Total manufacturing cost $1,150,000 $23 $500,000 $300,000 $200,000 $150,000 $4 $3 Another manufacturer has offered to sell the same part to ME for $20 each. All the fixed overhead would continue if the company buy the component except that the cost of $40,000 that could be avoided. (a) Assume that the capacity now used to make parts will become idle if the parts are purchased. Should the company buy or make the parts? Show computations. (b) Assume that the capacity now used to make parts will either (i) be rented to a nearby manufacturer for $30,000 for the year or (ii) be used to make another product that will yield a profit contribution of $150,000. Should the company buy or make the part? Show your computations. 5. Consider the following information. Sales value at split Sales value Products Units produced 50,000 30,000 60,000 X Y Z Additional Costs and Sales Values if Processed Further Added cost $200,000 $52,000 $180,000 $40,000 $160,000 $55,000 off $150,000 $120,000 $90,000 (a) Compute the total profit if all three products are sold at the split-off point (b) Compute the total profit if all three products are processed further before being sold. (c) Which products should be sold at the split-off point? Which should be processed further? (a) Compute the total profit if your plan in (c) is followed. 2. A company has the following information- Direct materials 250,000 Direct labor 150,000 Job construction overhead 300,000 Cost of jobs 700,000 Selling and administrative costs 150,000 Total costs 850,000 The job construction overhead includes approximately OMR 150,000 of fixed costs. The selling and administrative costs include OMR 75,000 of variable costs. The company wants an operating income of OMR 400,000. (a) Prepare an income statement (b) Compute the average target markup percentage of direct materials and direct labor (c) Compute the average target markup percentage of cost of jobs (a) Compute the average target markup percentage of total variable cost 4. Consider the following information Total cost for 50,000 units cost per unit $10 $6 Direct materials Direct labor Factory overhead, variable Factory overhead, fixed Total manufacturing cost $1,150,000 $23 $500,000 $300,000 $200,000 $150,000 $4 $3 Another manufacturer has offered to sell the same part to ME for $20 each. All the fixed overhead would continue if the company buy the component except that the cost of $40,000 that could be avoided. (a) Assume that the capacity now used to make parts will become idle if the parts are purchased. Should the company buy or make the parts? Show computations. (b) Assume that the capacity now used to make parts will either (i) be rented to a nearby manufacturer for $30,000 for the year or (ii) be used to make another product that will yield a profit contribution of $150,000. Should the company buy or make the part? Show your computations. 5. Consider the following information. Sales value at split Sales value Products Units produced 50,000 30,000 60,000 X Y Z Additional Costs and Sales Values if Processed Further Added cost $200,000 $52,000 $180,000 $40,000 $160,000 $55,000 off $150,000 $120,000 $90,000 (a) Compute the total profit if all three products are sold at the split-off point (b) Compute the total profit if all three products are processed further before being sold. (c) Which products should be sold at the split-off point? Which should be processed further? (a) Compute the total profit if your plan in (c) is followed