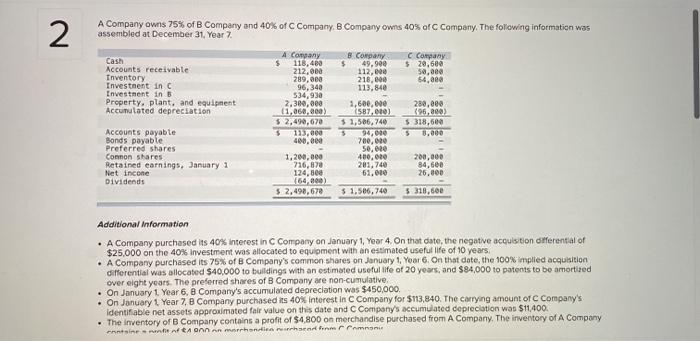

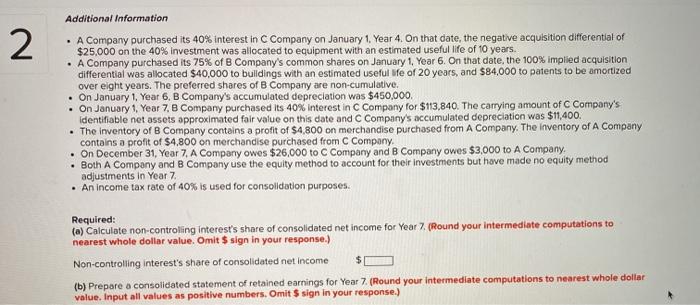

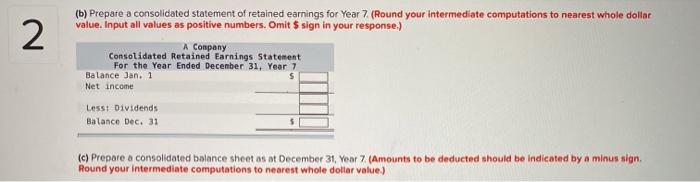

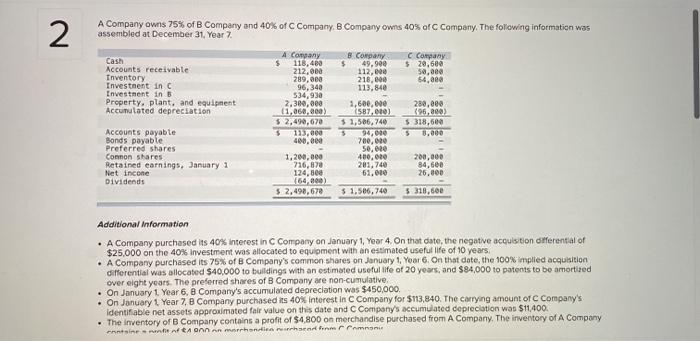

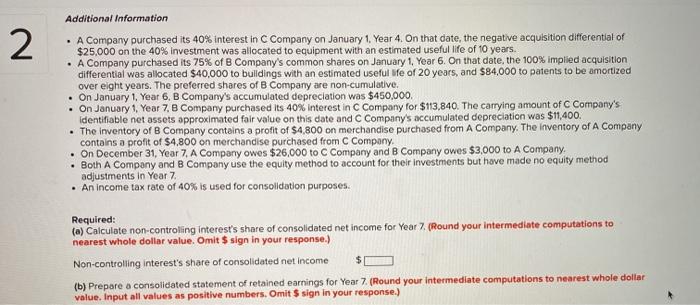

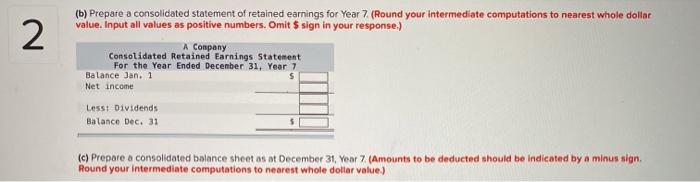

2 A Company owns 75% of B Company and 40% of Company B Company owns 40% of Company. The following information was assembled at December 31, Year 7 49.940 Company $ 29,600 50.000 54,000 Cash Accounts receivable Inventory Investment in Investment in B Property, plant, and equipment Accumulated depreciation A Company $ 116.480 212.000 289,000 96,340 534,930 2.300.000 (1,068.600) $ 2,490,670 $ 135,000 400.000 1.200.000 716,870 124,500 (64.600) $ 2,498,670 B. Company $ 112,000 218,600 113,840 1,600,000 2587, 010) $1,586,740 5 94,000 700,000 50.020 400,020 283,740 61,010 280,000 96,00) $ 318,600 Accounts payable Bonds payable Preferred Shares Connon shares Retained earnings, January 1 Net Income Dividends 200,000 84,600 26.000 $ 1.506,740 3 318,600 Additional Information A Company purchased its 40% Interest in C Company on January 1, Year 4. On that date, the negative acquisition differential of $25,000 on the 40% Investment was allocated to equipment with an estimated useful life of 10 years A Company purchased its 75% of B Company's common shares on January 1, Yoar 6. On that date, the 100% implied acquisition differential was allocated $40,000 to buildings with an estimated useful life of 20 years, and $84,000 to patents to be amortired over eight years. The preferred shares of Company are non-cumulative, On January 1 Year 6. B Company's accumulated depreciation was $450,000 On January 1 Year 7. B Company purchased its 40% Interest in C Company for $113,840. The carrying amount of Company's Identifiable net assets approximated fair value on this date and Company's accumulated depreciation was $11400 The inventory of B Company contains a profit of $4.800 on merchandise purchased from A Company. The inventory of A Company enntinnen tonna marchandisermoni Additional Information 2 A Company purchased its 40% interest in C Company on January 1. Year 4. On that date, the negative acquisition differential of $25,000 on the 40% Investment was allocated to equipment with an estimated useful life of 10 years. A Company purchased its 75% of B Company's common shares on January 1, Year 6. On that date, the 100% implied acquisition differential was allocated $40,000 to buildings with an estimated useful life of 20 years, and $84,000 to patents to be amortized over eight years. The preferred shares of B Company are non-cumulative. On January 1, Year 6. B Company's accumulated depreciation was $450,000. . On January 1, Year 7. B Company purchased its 40% Interest in c Company for $113,840. The carrying amount of Company's Identifiable net assets approximated fair value on this date and c Company's accumulated depreciation was $11,400. The inventory of Company contains a profit of $4,800 on merchandise purchased from A Company. The inventory of A Company . On December 31, Year 7. A Company owes $26,000 to c Company and B Company owes $3,000 to A Company. Both A Company and B Company use the equity method to account for their investments but have made no equity method . An income tax rate of 40% is used for consolidation purposes. Required: (a) Calculate non-controlling interest's share of consolidated net income for Year 7. (Round your intermediate computations to nearest whole dollar value. Omit $ sign in your response.) Non-controlling interest's share of consolidated net income (b) Prepare a consolidated statement of retained earnings for Year 7. (Round your intermediate computations to nearest whole dollar value. Input all values as positive numbers. Omit $ sign in your response.) 2 (6) Prepare a consolidated statement of retained earnings for Year 7 (Round your intermediate computations to nearest whole dollar value. Input all values as positive numbers. Omit $ sign in your response.) A Company Consolidated Retained Earnings Statement For the Year Ended December 31, Year 7 Balance Jan. 1 $ Net income Less: Dividends Balance Dec. 31 (c) Prepare a consolidated balance sheet as at December 31, Year 7 (Amounts to be deducted should be indicated by a minus sign. Round your intermediate computations to nearest whole dollar value) 2 (c) Prepare a consolidated balance sheet as at December 31, Year 7. (Amounts to be deducted should be indicated by a minus sign. Round your intermediate computations to nearest whole dollar value.) A Company Consolidated Balance Sheet December 31, Year 7 Assets Liabilities and Equity 2 A Company owns 75% of B Company and 40% of Company B Company owns 40% of Company. The following information was assembled at December 31, Year 7 49.940 Company $ 29,600 50.000 54,000 Cash Accounts receivable Inventory Investment in Investment in B Property, plant, and equipment Accumulated depreciation A Company $ 116.480 212.000 289,000 96,340 534,930 2.300.000 (1,068.600) $ 2,490,670 $ 135,000 400.000 1.200.000 716,870 124,500 (64.600) $ 2,498,670 B. Company $ 112,000 218,600 113,840 1,600,000 2587, 010) $1,586,740 5 94,000 700,000 50.020 400,020 283,740 61,010 280,000 96,00) $ 318,600 Accounts payable Bonds payable Preferred Shares Connon shares Retained earnings, January 1 Net Income Dividends 200,000 84,600 26.000 $ 1.506,740 3 318,600 Additional Information A Company purchased its 40% Interest in C Company on January 1, Year 4. On that date, the negative acquisition differential of $25,000 on the 40% Investment was allocated to equipment with an estimated useful life of 10 years A Company purchased its 75% of B Company's common shares on January 1, Yoar 6. On that date, the 100% implied acquisition differential was allocated $40,000 to buildings with an estimated useful life of 20 years, and $84,000 to patents to be amortired over eight years. The preferred shares of Company are non-cumulative, On January 1 Year 6. B Company's accumulated depreciation was $450,000 On January 1 Year 7. B Company purchased its 40% Interest in C Company for $113,840. The carrying amount of Company's Identifiable net assets approximated fair value on this date and Company's accumulated depreciation was $11400 The inventory of B Company contains a profit of $4.800 on merchandise purchased from A Company. The inventory of A Company enntinnen tonna marchandisermoni Additional Information 2 A Company purchased its 40% interest in C Company on January 1. Year 4. On that date, the negative acquisition differential of $25,000 on the 40% Investment was allocated to equipment with an estimated useful life of 10 years. A Company purchased its 75% of B Company's common shares on January 1, Year 6. On that date, the 100% implied acquisition differential was allocated $40,000 to buildings with an estimated useful life of 20 years, and $84,000 to patents to be amortized over eight years. The preferred shares of B Company are non-cumulative. On January 1, Year 6. B Company's accumulated depreciation was $450,000. . On January 1, Year 7. B Company purchased its 40% Interest in c Company for $113,840. The carrying amount of Company's Identifiable net assets approximated fair value on this date and c Company's accumulated depreciation was $11,400. The inventory of Company contains a profit of $4,800 on merchandise purchased from A Company. The inventory of A Company . On December 31, Year 7. A Company owes $26,000 to c Company and B Company owes $3,000 to A Company. Both A Company and B Company use the equity method to account for their investments but have made no equity method . An income tax rate of 40% is used for consolidation purposes. Required: (a) Calculate non-controlling interest's share of consolidated net income for Year 7. (Round your intermediate computations to nearest whole dollar value. Omit $ sign in your response.) Non-controlling interest's share of consolidated net income (b) Prepare a consolidated statement of retained earnings for Year 7. (Round your intermediate computations to nearest whole dollar value. Input all values as positive numbers. Omit $ sign in your response.) 2 (6) Prepare a consolidated statement of retained earnings for Year 7 (Round your intermediate computations to nearest whole dollar value. Input all values as positive numbers. Omit $ sign in your response.) A Company Consolidated Retained Earnings Statement For the Year Ended December 31, Year 7 Balance Jan. 1 $ Net income Less: Dividends Balance Dec. 31 (c) Prepare a consolidated balance sheet as at December 31, Year 7 (Amounts to be deducted should be indicated by a minus sign. Round your intermediate computations to nearest whole dollar value) 2 (c) Prepare a consolidated balance sheet as at December 31, Year 7. (Amounts to be deducted should be indicated by a minus sign. Round your intermediate computations to nearest whole dollar value.) A Company Consolidated Balance Sheet December 31, Year 7 Assets Liabilities and Equity