Answered step by step

Verified Expert Solution

Question

1 Approved Answer

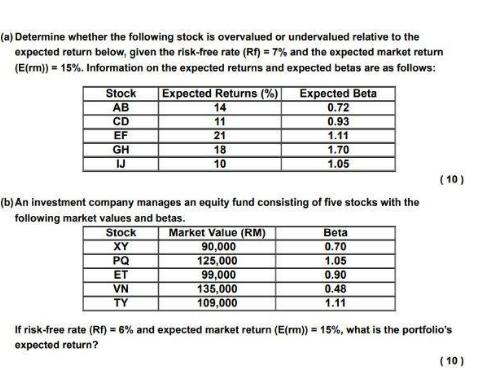

(a) Determine whether the following stock is overvalued or undervalued relative to the expected return below, given the risk-free rate (Rf) = 7% and

(a) Determine whether the following stock is overvalued or undervalued relative to the expected return below, given the risk-free rate (Rf) = 7% and the expected market return (E(rm)) = 15%. Information on the expected returns and expected betas are as follows: Stock AB CD EF GH IJ Expected Returns (%) 14 11 21 18 10 Expected Beta 0.72 0.93 1.11 Market Value (RM) 90,000 125,000 99,000 135,000 109,000 1.70 1.05 (b) An investment company manages an equity fund consisting of five stocks with the following market values and betas. Stock XY PQ ET VN TY Beta 0.70 1.05 0.90 0.48 1.11 (10) If risk-free rate (Rf) = 6% and expected market return (E(rm)) = 15%, what is the portfolio's expected return? (10)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether a stock is overvalued or undervalued we calculate its required retu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started