Answered step by step

Verified Expert Solution

Question

1 Approved Answer

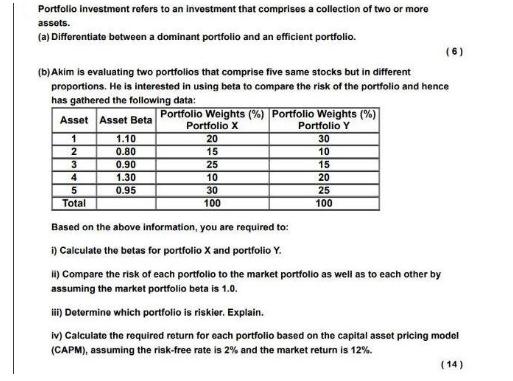

Portfolio investment refers to an investment that comprises a collection of two or more assets. (a) Differentiate between a dominant portfolio and an efficient

Portfolio investment refers to an investment that comprises a collection of two or more assets. (a) Differentiate between a dominant portfolio and an efficient portfolio. (b) Akim is evaluating two portfolios that comprise five same stocks but in different proportions. He is interested in using beta to compare the risk of the portfolio and hence has gathered the following data: Asset Asset Beta Portfolio Weights (%) Portfolio Weights (%) Portfolio X Portfolio Y 1 2 3 4 5 Total 1.10 0.80 0.90 1.30 0.95 20 15 25 10 30 100 30 10 (6) 15 20 25 100 Based on the above information, you are required to: i) Calculate the betas for portfolio X and portfolio Y. II) Compare the risk of each portfolio to the market portfolio as well as to each other by assuming the market portfolio beta is 1.0. iii) Determine which portfolio is riskier. Explain. iv) Calculate the required return for each portfolio based on the capital asset pricing model (CAPM), assuming the risk-free rate is 2% and the market return is 12%. (14)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears youve provided an image with a question that requires a stepbystep explanation regarding portfolio investment Lets tackle each of the point...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started