Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are an assistant to a portfolio manager who manages a portfolio with a market value of $5 million as at 1 January

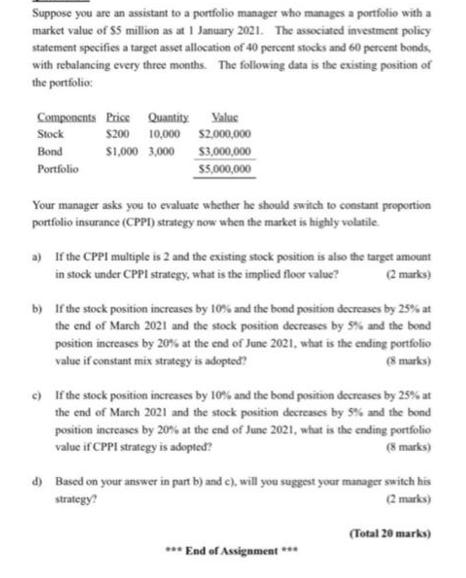

Suppose you are an assistant to a portfolio manager who manages a portfolio with a market value of $5 million as at 1 January 2021. The associated investment policy statement specifies a target asset allocation of 40 percent stocks and 60 percent bonds, with rebalancing every three months. The following data is the existing position of the portfolio: Components Price Quantity Valuc $200 10,000 $2,000,000 $1,000 3,000 Stock Bond Portfolio $3,000,000 $5,000,000 Your manager asks you to evaluate whether he should switch to constant proportion portfolio insurance (CPPI) strategy now when the market is highly volatile a) If the CPPI multiple is 2 and the existing stock position is also the target amount in stock under CPPI strategy, what is the implied floor value? (2 marks) b) If the stock position increases by 10% and the bond position decreases by 25% at the end of March 2021 and the stock position decreases by 5% and the bond position increases by 20% at the end of June 2021, what is the ending portfolio value if constant mix strategy is adopted? (8 marks) c) If the stock position increases by 10% and the bond position decreases by 25% at the end of March 2021 and the stock position decreases by 5% and the bond position increases by 20% at the end of June 2021, what is the ending portfolio value if CPPI strategy is adopted? (8 marks) d) Based on your answer in part b) and c), will you suggest your manager switch his strategy? (2 marks) *** End of Assignment *** (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image contains a text question which is a finance problem It is about evaluating whether to switch to a constant proportion portfolio insurance CPPI strategy for a portfolio manager who manages a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started