Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) A firm faces two alternative investment projects A and B and wants to choose one of them. The relevant information for these projects is

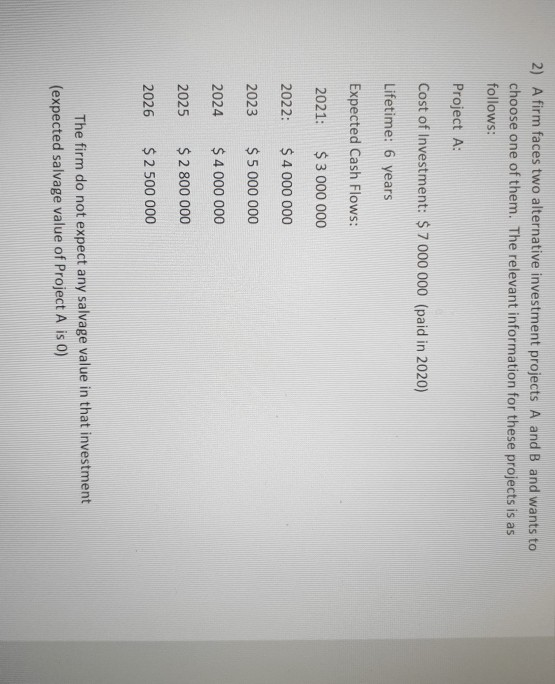

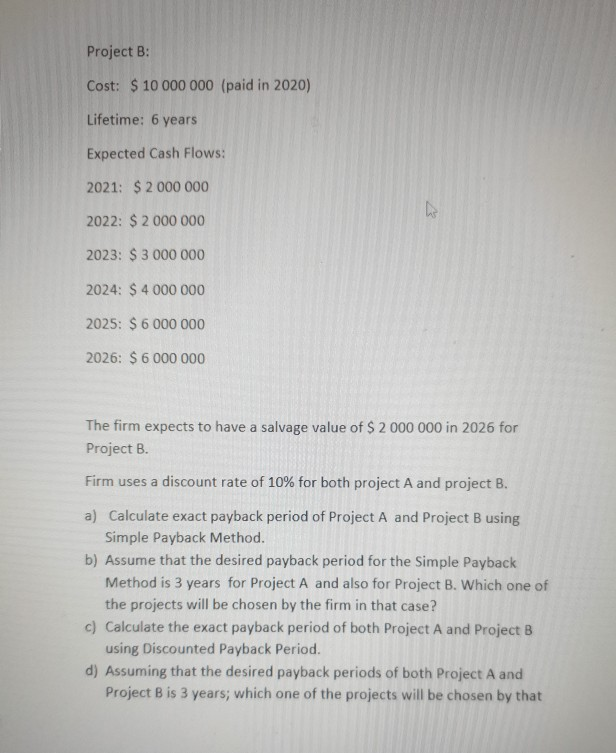

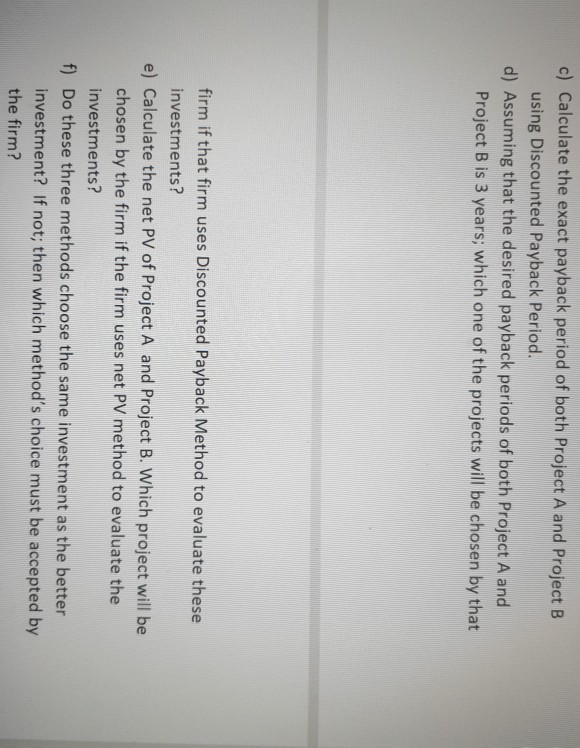

2) A firm faces two alternative investment projects A and B and wants to choose one of them. The relevant information for these projects is as follows: Project A: Cost of Investment: $ 7 000 000 (paid in 2020) Lifetime: 6 years Expected Cash Flows: 2021: $ 3 000 000 2022: $ 4 000 000 2023 $ 5 000 000 2024 $ 4 000 000 2025 $ 2 800 000 2026 $ 2 500 000 The firm do not expect any salvage value in that investment (expected salvage value of Project A is 0) Project B: Cost: $ 10 000 000 (paid in 2020) Lifetime: 6 years Expected Cash Flows: 2021: $ 2 000 000 2022: $ 2 000 000 2023: $ 3 000 000 2024: $ 4 000 000 2025: $ 6 000 000 2026: $ 6 000 000 The firm expects to have a salvage value of $ 2 000 000 in 2026 for Project B. Firm uses a discount rate of 10% for both project A and project B. a) Calculate exact payback period of Project A and Project B using Simple Payback Method. b) Assume that the desired payback period for the Simple Payback Method is 3 years for Project A and also for Project B. Which one of the projects will be chosen by the firm in that case? c) Calculate the exact payback period of both Project A and Project B using Discounted Payback Period. d) Assuming that the desired payback periods of both Project A and Project Bis 3 years, which one of the projects will be chosen by that c) Calculate the exact payback period of both Project A and Project B using Discounted Payback Period. d) Assuming that the desired payback periods of both Project A and Project B is 3 years; which one of the projects will be chosen by that firm if that firm uses Discounted Payback Method to evaluate these investments? e) Calculate the net PV of Project A and Project B. Which project will be chosen by the firm if the firm uses net PV method to evaluate the investments? f) Do these three methods choose the same investment as the better investment? If not; then which method's choice must be accepted by the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started