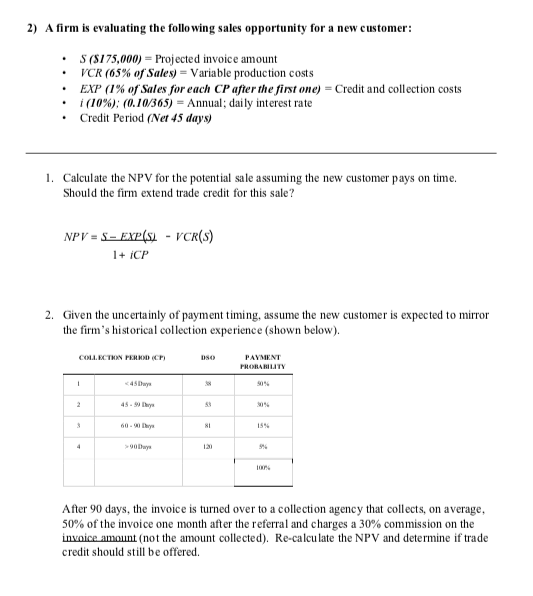

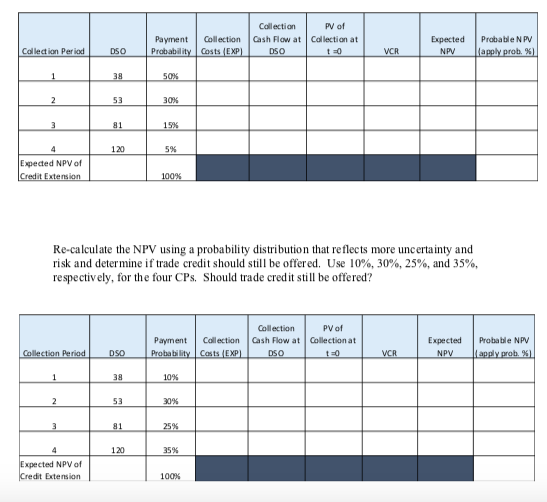

2) A firm is evaluating the following sales opportunity for a new customer: S($175,000) = Projected invoice amount VCR (65% of Sales) = Variable production costs EXP (1% of Sales for each CP after the first one) = Credit and collection costs . (10%), (0.10/365) = Annual; daily interest rate Credit Period (Net 45 days) 1. Calculate the NPV for the potential sale assuming the new customer pays on time. Should the firm extend trade credit for this sale? NPV = S - EXP- VCR(s) 1+ iCP 2. Given the uncertainly of payment timing, assume the new customer is expected to mirror the firm's historical collection experience (shown below). COLLECTION PERIOD (CP) DSO PAYMENT PRORABILITY 1 5 NI 15% 9% After 90 days, the invoice is turned over to a collection agency that collects, on average, 50% of the invoice one month after the referral and charges a 30% commission on the invoice amount (not the amount collected). Re-calculate the NPV and determine if trade credit should still be offered. Collection PV of Cash Flow at Collection at DSO Payment Collection Probability costs (EXP) Expected NPV Probable NPV apply prob. %) Collection Period DSO VCR 1 38 50x 2 53 30% 3 81 15% 4 120 5% Expected NPV of Credit Extension 100% Re-calculate the NPV using a probability distribution that reflects more uncertainty and risk and determine if trade credit should still be offered. Use 10%, 30%, 25%, and 35%, respectively, for the four CPs. Should trade credit still be offered? Payment Collection Probability Costs EXP] Collection PV of Cash Flow at Collection at DSO Expected NPV Probabile NPV apply prob. %] Collection Period DSO VCR 1 38 10% 2 53 30% 3 81 25% 120 35% Expected NPV of Credit Extension 100% 2) A firm is evaluating the following sales opportunity for a new customer: S($175,000) = Projected invoice amount VCR (65% of Sales) = Variable production costs EXP (1% of Sales for each CP after the first one) = Credit and collection costs . (10%), (0.10/365) = Annual; daily interest rate Credit Period (Net 45 days) 1. Calculate the NPV for the potential sale assuming the new customer pays on time. Should the firm extend trade credit for this sale? NPV = S - EXP- VCR(s) 1+ iCP 2. Given the uncertainly of payment timing, assume the new customer is expected to mirror the firm's historical collection experience (shown below). COLLECTION PERIOD (CP) DSO PAYMENT PRORABILITY 1 5 NI 15% 9% After 90 days, the invoice is turned over to a collection agency that collects, on average, 50% of the invoice one month after the referral and charges a 30% commission on the invoice amount (not the amount collected). Re-calculate the NPV and determine if trade credit should still be offered. Collection PV of Cash Flow at Collection at DSO Payment Collection Probability costs (EXP) Expected NPV Probable NPV apply prob. %) Collection Period DSO VCR 1 38 50x 2 53 30% 3 81 15% 4 120 5% Expected NPV of Credit Extension 100% Re-calculate the NPV using a probability distribution that reflects more uncertainty and risk and determine if trade credit should still be offered. Use 10%, 30%, 25%, and 35%, respectively, for the four CPs. Should trade credit still be offered? Payment Collection Probability Costs EXP] Collection PV of Cash Flow at Collection at DSO Expected NPV Probabile NPV apply prob. %] Collection Period DSO VCR 1 38 10% 2 53 30% 3 81 25% 120 35% Expected NPV of Credit Extension 100%