Question

2. (a) If you feel that Stock price can go up to $3,000 or can go down to $1,800, but you aren't sure about the

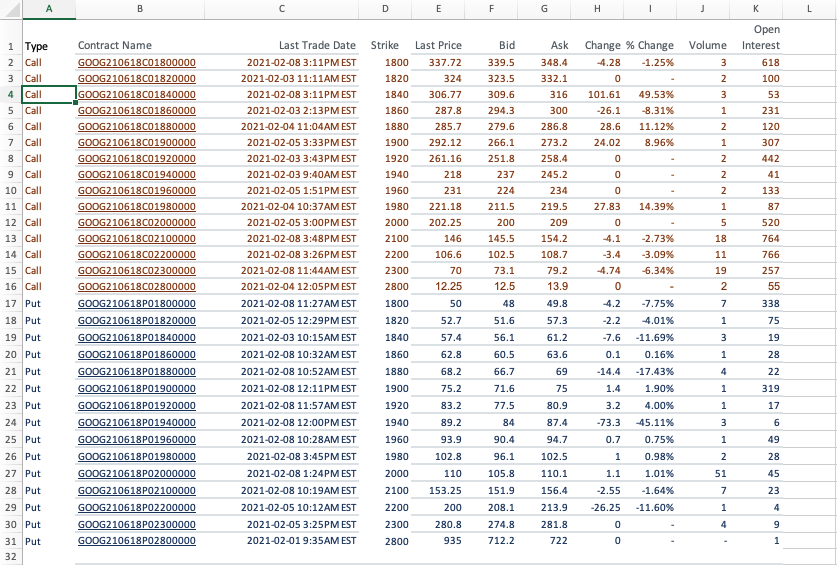

2. (a) If you feel that Stock price can go up to $3,000 or can go down to $1,800, but you aren't sure about the direction, what strategy would be more appropriate when you choose options with strike price of 2,100. Explain. Calculate the payoff and profit of the strategy. [5+2+2=8 marks] (b) At what stock price(s) your profit would be zero in the above case? [5 marks] (c) If you expect stock price is more likely to go up to $3,000, what strategy would better serve you? Explain. Calculate payoff and profit of the strategy. [4+2+2=8 marks] (d) Calculate the range of stock prices beyond which your profit would be positive if you follow the strategy in (c)? [6 marks]

A E F G I Ask Volume 348.4 3 2 3 Bid 339.5 323.5 309.6 294.3 279.6 266.1 251.8 237 Change % Change -4.28 -1.25% 0 101.61 49.53% -26.1 -8.31% 28.6 11.12% 24.02 8.96% 0 1 2 1 2 0 2 224 0 1 Type 2 Call 3 Call 4 Call 5 Call 6 Call 7 Call 8 Call 9 Call 10 Call 11 Call 12 Call 13 Call 14 Call 15 Call 16 Call 17 Put 18 Put 19 Put 20 Put 21 Put 22 Put 2 1 Open Interest 618 100 53 231 120 307 442 41 133 87 520 764 766 257 55 338 75 14.39% 332.1 316 300 286.8 273.2 258.4 245.2 234 219.5 209 154.2 108.7 79.2 13.9 49.8 57.3 27.83 0 Contract Name GOOG210618001800000 GOOG210618001820000 GOOG210618001840000 GOOG210618001860000 GOOG210618001880000 GOOG210618001900000 GOOG210618C01920000 GOOG210618C01940000 GOOG210618C01960000 GOOG210618C01980000 GOOG210618C02000000 GOOG210618002100000 GOOG210618002200000 GOOG210618002300000 GOOG210618002800000 GOOG210618P01800000 GOOG210618P01820000 GOOG210618P01840000 GOOG210618P01860000 GOOG210618P01880000 GOOG210618P01900000 GOOG210618P01920000 GOOG210618P01940000 GOOG210618P01960000 GOOG210618P01980000 GOOG210618P02000000 GOOG210618P02100000 GOOG210618P02200000 GOOG210618P02300000 GOOG210618P02800000 5 18 11 -2.73% -3.09% -6.34% Last Trade Date 2021-02-08 3:11PM EST 2021-02-03 11:11AM EST 2021-02-08 3:11PM EST 2021-02-03 2:13PM EST 2021-02-04 11:04AM EST 2021-02-05 3:33PM EST 2021-02-03 3:43PM EST 2021-02-03 9:40AM EST 2021-02-05 1:51PM EST 2021-02-04 10:37AM EST 2021-02-05 3:00PM EST 2021-02-08 3:48PM EST 2021-02-08 3:26PM EST 2021-02-08 11:44AM EST 2021-02-04 12:05PM EST 2021-02-08 11:27AM EST 2021-02-05 12:29PM EST 2021-02-03 10:15AM EST 2021-02-08 10:32AM EST 2021-02-08 10:52AM EST 2021-02-08 12:11PM EST 2021-02-08 11:57AM EST 2021-02-08 12:00PM EST 2021-02-08 10:28AM EST 2021-02-08 3:45PM EST 2021-02-08 1:24PM EST 2021-02-08 10:19AM EST 2021-02-05 10:12 AM EST 2021-02-05 3:25PM EST 2021-02-019:35AM EST Strike Last Price 1800 337.72 1820 324 1840 306.77 1860 287.8 1880 285.7 1900 292.12 1920 261.16 1940 218 1960 231 1980 221.18 2000 202.25 2100 146 2200 106.6 2300 70 2800 12.25 1800 50 1820 52.7 1840 57.4 1860 62.8 1880 68.2 1900 75.2 1920 83.2 1940 89.2 1960 93.9 1980 102.8 2000 110 2100 153.25 2200 200 2300 280.8 2800 935 211.5 200 145.5 102.5 73.1 12.5 48 51.6 19 2 -4.1 -3.4 -4.74 0 -4.2 -2.2 -7.6 7 1 3 19 61.2 63.6 -7.75% 4.01% -11.69% 0.16% -17.4396 1.90% 0.1 1 69 56.1 60.5 66.7 71.6 77.5 84 4 28 22 319 -14.4 1.4 3.2 75 1 1 17 3 6 80.9 87.4 94.7 102.5 110.1 -73.3 0.7 1 1 49 28 4.00% 45.11% 0.75% 0.98% 1.01% -1.64% -11.60% 2 1.1 51 23 Put 24 Put 25 Put 26 Put 27 Put 28 Put 29 Put 30 Put 31 Put 32 45 90.4 96.1 105.8 151.9 208.1 274.8 712.2 156.4 7 23 -2.55 -26.25 213.9 1 4 4 9 281.8 722 0 0 1 A E F G I Ask Volume 348.4 3 2 3 Bid 339.5 323.5 309.6 294.3 279.6 266.1 251.8 237 Change % Change -4.28 -1.25% 0 101.61 49.53% -26.1 -8.31% 28.6 11.12% 24.02 8.96% 0 1 2 1 2 0 2 224 0 1 Type 2 Call 3 Call 4 Call 5 Call 6 Call 7 Call 8 Call 9 Call 10 Call 11 Call 12 Call 13 Call 14 Call 15 Call 16 Call 17 Put 18 Put 19 Put 20 Put 21 Put 22 Put 2 1 Open Interest 618 100 53 231 120 307 442 41 133 87 520 764 766 257 55 338 75 14.39% 332.1 316 300 286.8 273.2 258.4 245.2 234 219.5 209 154.2 108.7 79.2 13.9 49.8 57.3 27.83 0 Contract Name GOOG210618001800000 GOOG210618001820000 GOOG210618001840000 GOOG210618001860000 GOOG210618001880000 GOOG210618001900000 GOOG210618C01920000 GOOG210618C01940000 GOOG210618C01960000 GOOG210618C01980000 GOOG210618C02000000 GOOG210618002100000 GOOG210618002200000 GOOG210618002300000 GOOG210618002800000 GOOG210618P01800000 GOOG210618P01820000 GOOG210618P01840000 GOOG210618P01860000 GOOG210618P01880000 GOOG210618P01900000 GOOG210618P01920000 GOOG210618P01940000 GOOG210618P01960000 GOOG210618P01980000 GOOG210618P02000000 GOOG210618P02100000 GOOG210618P02200000 GOOG210618P02300000 GOOG210618P02800000 5 18 11 -2.73% -3.09% -6.34% Last Trade Date 2021-02-08 3:11PM EST 2021-02-03 11:11AM EST 2021-02-08 3:11PM EST 2021-02-03 2:13PM EST 2021-02-04 11:04AM EST 2021-02-05 3:33PM EST 2021-02-03 3:43PM EST 2021-02-03 9:40AM EST 2021-02-05 1:51PM EST 2021-02-04 10:37AM EST 2021-02-05 3:00PM EST 2021-02-08 3:48PM EST 2021-02-08 3:26PM EST 2021-02-08 11:44AM EST 2021-02-04 12:05PM EST 2021-02-08 11:27AM EST 2021-02-05 12:29PM EST 2021-02-03 10:15AM EST 2021-02-08 10:32AM EST 2021-02-08 10:52AM EST 2021-02-08 12:11PM EST 2021-02-08 11:57AM EST 2021-02-08 12:00PM EST 2021-02-08 10:28AM EST 2021-02-08 3:45PM EST 2021-02-08 1:24PM EST 2021-02-08 10:19AM EST 2021-02-05 10:12 AM EST 2021-02-05 3:25PM EST 2021-02-019:35AM EST Strike Last Price 1800 337.72 1820 324 1840 306.77 1860 287.8 1880 285.7 1900 292.12 1920 261.16 1940 218 1960 231 1980 221.18 2000 202.25 2100 146 2200 106.6 2300 70 2800 12.25 1800 50 1820 52.7 1840 57.4 1860 62.8 1880 68.2 1900 75.2 1920 83.2 1940 89.2 1960 93.9 1980 102.8 2000 110 2100 153.25 2200 200 2300 280.8 2800 935 211.5 200 145.5 102.5 73.1 12.5 48 51.6 19 2 -4.1 -3.4 -4.74 0 -4.2 -2.2 -7.6 7 1 3 19 61.2 63.6 -7.75% 4.01% -11.69% 0.16% -17.4396 1.90% 0.1 1 69 56.1 60.5 66.7 71.6 77.5 84 4 28 22 319 -14.4 1.4 3.2 75 1 1 17 3 6 80.9 87.4 94.7 102.5 110.1 -73.3 0.7 1 1 49 28 4.00% 45.11% 0.75% 0.98% 1.01% -1.64% -11.60% 2 1.1 51 23 Put 24 Put 25 Put 26 Put 27 Put 28 Put 29 Put 30 Put 31 Put 32 45 90.4 96.1 105.8 151.9 208.1 274.8 712.2 156.4 7 23 -2.55 -26.25 213.9 1 4 4 9 281.8 722 0 0 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started