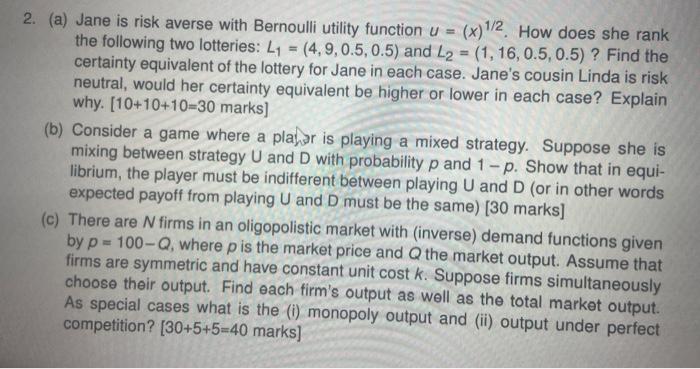

2. (a) Jane is risk averse with Bernoulli utility function u = (x)1/2 How does she rank the following two lotteries: L1 = (4.9.0.5, 0.5) and L2 = (1,16, 0.5, 0.5) ? Find the certainty equivalent of the lottery for Jane in each case. Jane's cousin Linda is risk neutral, would her certainty equivalent be higher or lower in each case? Explain why. [10+10+10=30 marks] (b) Consider a game where a player is playing a mixed strategy. Suppose she is mixing between strategy U and D with probability p and 1 - p. Show that in equi- librium, the player must be indifferent between playing U and D (or in other words expected payoff from playing U and D must be the same) (30 marks] (c) There are N firms in an oligopolistic market with (inverse) demand functions given by p = 100-Q, where p is the market price and Q the market output. Assume that firms are symmetric and have constant unit cost k. Suppose firms simultaneously choose their output. Find each firm's output as well as the total market output. As special cases what is the (0) monopoly output and (ii) output under perfect competition? (30+5+5=40 marks] 2. (a) Jane is risk averse with Bernoulli utility function u = (x)1/2 How does she rank the following two lotteries: L1 = (4.9.0.5, 0.5) and L2 = (1,16, 0.5, 0.5) ? Find the certainty equivalent of the lottery for Jane in each case. Jane's cousin Linda is risk neutral, would her certainty equivalent be higher or lower in each case? Explain why. [10+10+10=30 marks] (b) Consider a game where a player is playing a mixed strategy. Suppose she is mixing between strategy U and D with probability p and 1 - p. Show that in equi- librium, the player must be indifferent between playing U and D (or in other words expected payoff from playing U and D must be the same) (30 marks] (c) There are N firms in an oligopolistic market with (inverse) demand functions given by p = 100-Q, where p is the market price and Q the market output. Assume that firms are symmetric and have constant unit cost k. Suppose firms simultaneously choose their output. Find each firm's output as well as the total market output. As special cases what is the (0) monopoly output and (ii) output under perfect competition? (30+5+5=40 marks]