Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. A magazine printer is considering taking on a new weekly publication. The company's financial officer has researched and determined costs and a committee

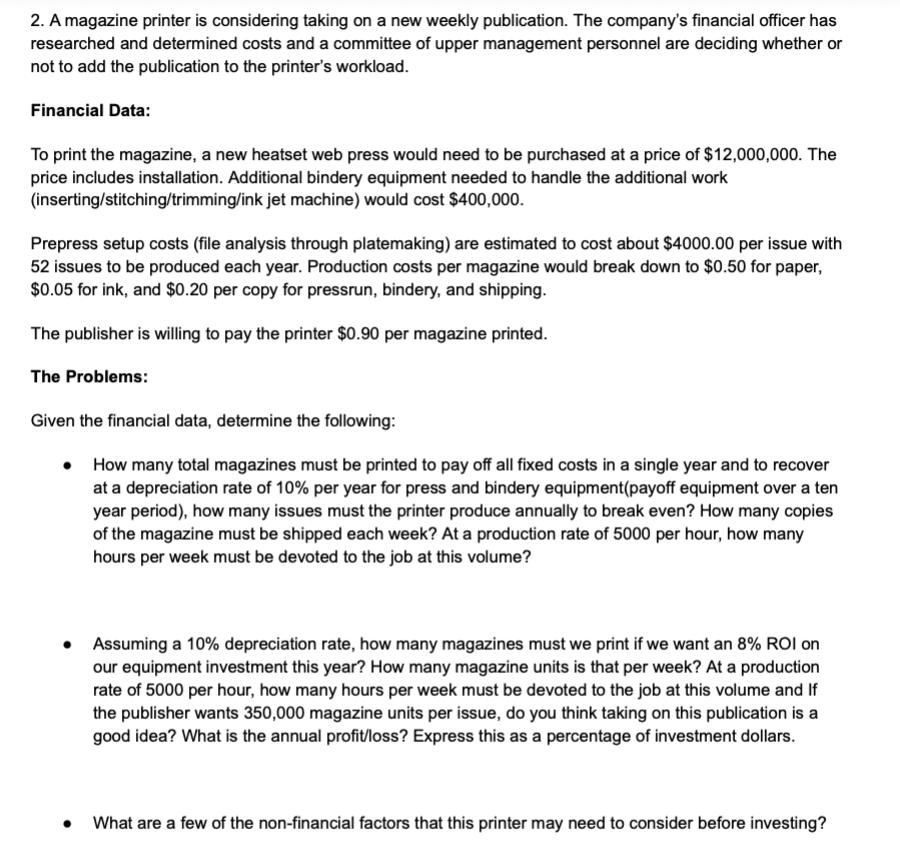

2. A magazine printer is considering taking on a new weekly publication. The company's financial officer has researched and determined costs and a committee of upper management personnel are deciding whether or not to add the publication to the printer's workload. Financial Data: To print the magazine, a new heatset web press would need to be purchased at a price of $12,000,000. The price includes installation. Additional bindery equipment needed to handle the additional work (inserting/stitching/trimming/ink jet machine) would cost $400,000. Prepress setup costs (file analysis through platemaking) are estimated to cost about $4000.00 per issue with 52 issues to be produced each year. Production costs per magazine would break down to $0.50 for paper, $0.05 for ink, and $0.20 per copy for pressrun, bindery, and shipping. The publisher is willing to pay the printer $0.90 per magazine printed. The Problems: Given the financial data, determine the following: How many total magazines must be printed to pay off all fixed costs in a single year and to recover at a depreciation rate of 10% per year for press and bindery equipment(payoff equipment over a ten year period), how many issues must the printer produce annually to break even? How many copies of the magazine must be shipped each week? At a production rate of 5000 per hour, how many hours per week must be devoted to the job at this volume? Assuming a 10% depreciation rate, how many magazines must we print if we want an 8% ROI on our equipment investment this year? How many magazine units is that per week? At a production rate of 5000 per hour, how many hours per week must be devoted to the job at this volume and If the publisher wants 350,000 magazine units per issue, do you think taking on this publication is a good idea? What is the annual profit/loss? Express this as a percentage of investment dollars. What are a few of the non-financial factors that this printer may need to consider before investing?

Step by Step Solution

★★★★★

3.57 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Requirment1 Fixed Costs 10 Depreciation on 12400000 Pre press setup cost 400052 Total Fixed Cost Var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started