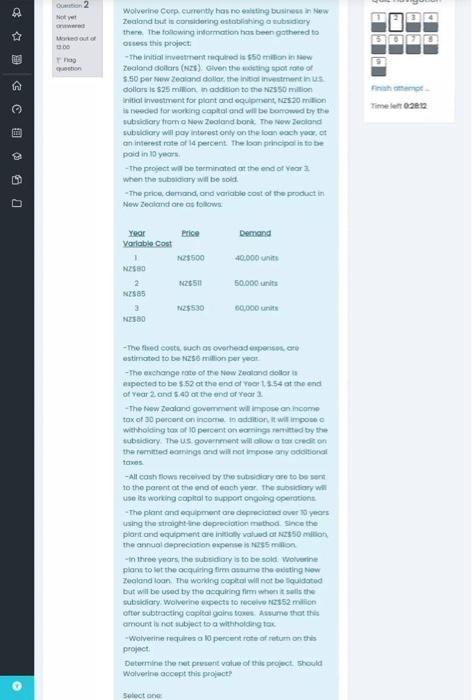

2 A Note os nog Wolverine Corp currently has no eating business in New Zealond but is considering establishing a subsidiary there. The following information has been gathered to Ossess this project -The initial investment required is 550 milioni Zealand dollar (NZS) Given the citing spot one of 5.50 per ww Zealand dollar, the initiativement in dollars is 525 million. In addition to me Nzs50 million Initiat investment for plant and equipment, NES20 milion is needed for working capital and will be borrowed by the subsidiary from Now Zealand bonit. The New Zealand subeldiary will pay interest only on the loan och yoor et an interest rate of 4 percent The loon piincipis to be pold in 10 years The project will be terminated at the end of year when the subsidiary will be sold - The price demand and variable cost of the product in New Zealand are as follow mo Timelet 2012 CC ILE Demand 40.000 units Year Price Variable cost 1 2500 N2580 2 N2650 N585 N2$530 N2580 50,000 units 60,000 units -The fled costs, such as overhead expenses are estimated to be a million per year - The exchange rate of the New Zealand door expected to be 552 at the end of yoor 3.54 of the end of Year 2 and 5.40 at the end of year The New Zealand government will impose an income tox of 30 percent on income to action. It will importa withholding tax of 10 percent on coming reitted by the subsidiary. The us government will allow to credit on the remitted earing and will not impose any additional tones -All cash flows received by the subsidiary or to be at to the parent at the end of each year. The subsidiary use its working capital to support ongoing operations The plant and equipment are depreciated over 15 years using the straight-line depreciation method. Since the plant and equipment are initially valued at $50 min the annual depreciation expenses 5 million in three years, the subsidiary is to be sold Wolverine plans to let the acquiring firstume the ting Now Zealand loan. The word capital will not be squidated but will be used by the acquiring firm when sollte subsidiary Wolverine gets to receive 1552 min ofter subtracting capital gainstore. Assume that this amount is not subject to a withholding to Wolverine requires a 10 percent of return on this project Determine the present value of this project. Should Wolverine accept this project Select one 2 A Note os nog Wolverine Corp currently has no eating business in New Zealond but is considering establishing a subsidiary there. The following information has been gathered to Ossess this project -The initial investment required is 550 milioni Zealand dollar (NZS) Given the citing spot one of 5.50 per ww Zealand dollar, the initiativement in dollars is 525 million. In addition to me Nzs50 million Initiat investment for plant and equipment, NES20 milion is needed for working capital and will be borrowed by the subsidiary from Now Zealand bonit. The New Zealand subeldiary will pay interest only on the loan och yoor et an interest rate of 4 percent The loon piincipis to be pold in 10 years The project will be terminated at the end of year when the subsidiary will be sold - The price demand and variable cost of the product in New Zealand are as follow mo Timelet 2012 CC ILE Demand 40.000 units Year Price Variable cost 1 2500 N2580 2 N2650 N585 N2$530 N2580 50,000 units 60,000 units -The fled costs, such as overhead expenses are estimated to be a million per year - The exchange rate of the New Zealand door expected to be 552 at the end of yoor 3.54 of the end of Year 2 and 5.40 at the end of year The New Zealand government will impose an income tox of 30 percent on income to action. It will importa withholding tax of 10 percent on coming reitted by the subsidiary. The us government will allow to credit on the remitted earing and will not impose any additional tones -All cash flows received by the subsidiary or to be at to the parent at the end of each year. The subsidiary use its working capital to support ongoing operations The plant and equipment are depreciated over 15 years using the straight-line depreciation method. Since the plant and equipment are initially valued at $50 min the annual depreciation expenses 5 million in three years, the subsidiary is to be sold Wolverine plans to let the acquiring firstume the ting Now Zealand loan. The word capital will not be squidated but will be used by the acquiring firm when sollte subsidiary Wolverine gets to receive 1552 min ofter subtracting capital gainstore. Assume that this amount is not subject to a withholding to Wolverine requires a 10 percent of return on this project Determine the present value of this project. Should Wolverine accept this project Select one