Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. a. State how to make a valid application for spreading back a contract gratuity. b. Mr Leung joined a construction company as an engineer

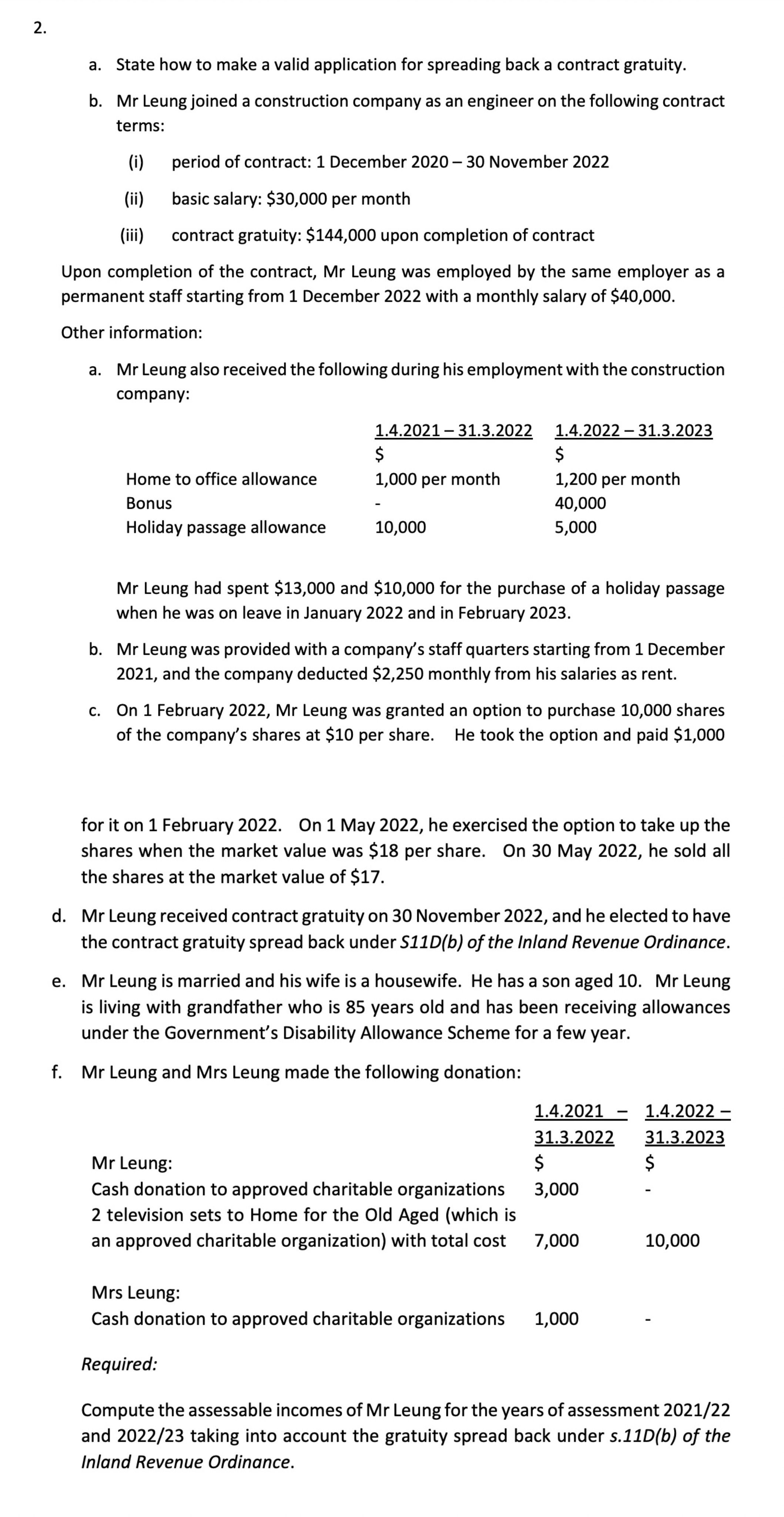

2. a. State how to make a valid application for spreading back a contract gratuity. b. Mr Leung joined a construction company as an engineer on the following contract terms: (i) period of contract: 1 December 2020-30 November 2022 (ii) basic salary: $30,000 per month (iii) contract gratuity: $144,000 upon completion of contract Upon completion of the contract, Mr Leung was employed by the same employer as a permanent staff starting from 1 December 2022 with a monthly salary of $40,000. Other information: a. Mr Leung also received the following during his employment with the construction company: Mr Leung had spent $13,000 and $10,000 for the purchase of a holiday passage when he was on leave in January 2022 and in February 2023. b. Mr Leung was provided with a company's staff quarters starting from 1 December 2021, and the company deducted $2,250 monthly from his salaries as rent. c. On 1 February 2022, Mr Leung was granted an option to purchase 10,000 shares of the company's shares at $10 per share. He took the option and paid $1,000 for it on 1 February 2022. On 1 May 2022, he exercised the option to take up the shares when the market value was $18 per share. On 30 May 2022, he sold all the shares at the market value of $17. d. Mr Leung received contract gratuity on 30 November 2022 , and he elected to have the contract gratuity spread back under S11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: Required: Compute the assessable incomes of Mr Leung for the years of assessment 2021/22 and 2022/23 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance

2. a. State how to make a valid application for spreading back a contract gratuity. b. Mr Leung joined a construction company as an engineer on the following contract terms: (i) period of contract: 1 December 2020-30 November 2022 (ii) basic salary: $30,000 per month (iii) contract gratuity: $144,000 upon completion of contract Upon completion of the contract, Mr Leung was employed by the same employer as a permanent staff starting from 1 December 2022 with a monthly salary of $40,000. Other information: a. Mr Leung also received the following during his employment with the construction company: Mr Leung had spent $13,000 and $10,000 for the purchase of a holiday passage when he was on leave in January 2022 and in February 2023. b. Mr Leung was provided with a company's staff quarters starting from 1 December 2021, and the company deducted $2,250 monthly from his salaries as rent. c. On 1 February 2022, Mr Leung was granted an option to purchase 10,000 shares of the company's shares at $10 per share. He took the option and paid $1,000 for it on 1 February 2022. On 1 May 2022, he exercised the option to take up the shares when the market value was $18 per share. On 30 May 2022, he sold all the shares at the market value of $17. d. Mr Leung received contract gratuity on 30 November 2022 , and he elected to have the contract gratuity spread back under S11D(b) of the Inland Revenue Ordinance. e. Mr Leung is married and his wife is a housewife. He has a son aged 10. Mr Leung is living with grandfather who is 85 years old and has been receiving allowances under the Government's Disability Allowance Scheme for a few year. f. Mr Leung and Mrs Leung made the following donation: Required: Compute the assessable incomes of Mr Leung for the years of assessment 2021/22 and 2022/23 taking into account the gratuity spread back under s.11D(b) of the Inland Revenue Ordinance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started