Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. a) The price of a non-dividend paying stock is $19 and a 6-month European call option with a strike of $20 is trading

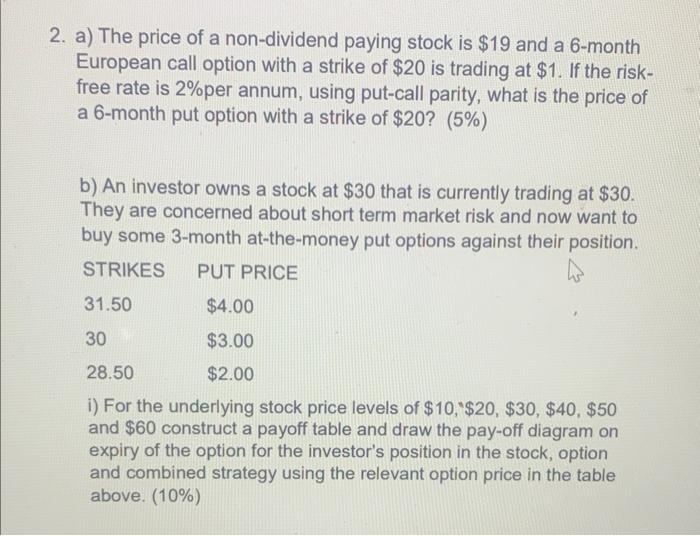

2. a) The price of a non-dividend paying stock is $19 and a 6-month European call option with a strike of $20 is trading at $1. If the risk- free rate is 2% per annum, using put-call parity, what is the price of a 6-month put option with a strike of $20? (5%) b) An investor owns a stock at $30 that is currently trading at $30. They are concerned about short term market risk and now want to buy some 3-month at-the-money put options against their position. PUT PRICE STRIKES 31.50 30 $4.00 $3.00 $2.00 28.50 i) For the underlying stock price levels of $10, $20, $30, $40, $50 and $60 construct a payoff table and draw the pay-off diagram on expiry of the option for the investor's position in the stock, option and combined strategy using the relevant option price in the table above. (10%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a PutCall Parity to Find Put Option Price We can use the putcall parity formula to find the price of the 6month put option with a strike of 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started