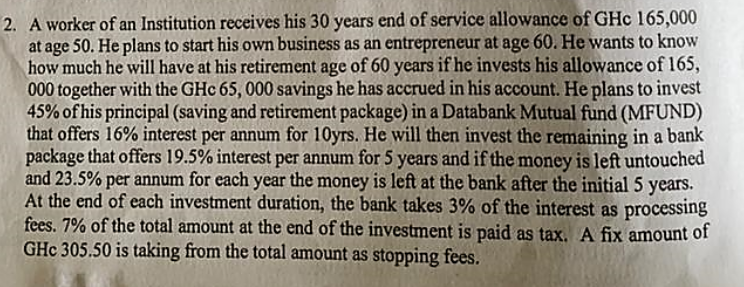

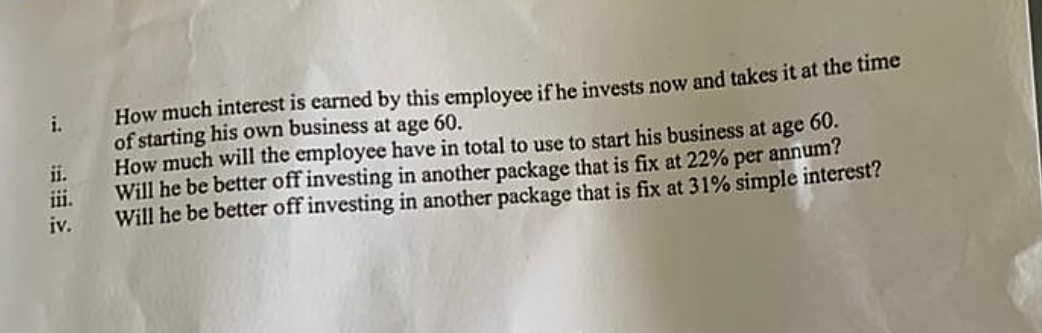

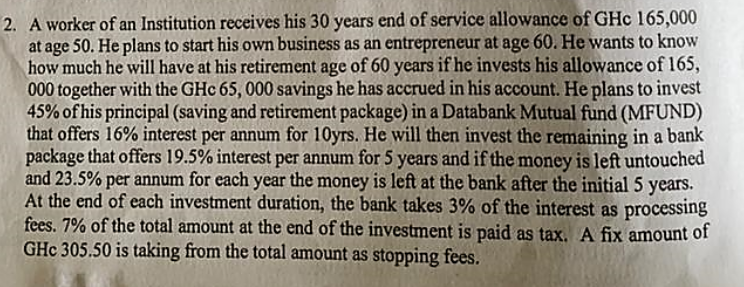

2. A worker of an Institution receives his 30 years end of service allowance of GHc 165,000 at age 50. He plans to start his own business as an entrepreneur at age 60. He wants to know how much he will have at his retirement age of 60 years if he invests his allowance of 165, 000 together with the GHc 65,000 savings he has accrued in his account. He plans to invest 45% of his principal (saving and retirement package) in a Databank Mutual fund (MFUND that offers 16% interest per annum for 10yrs. He will then invest the remaining in a bank package that offers 19.5% interest per annum for 5 years and if the money is left untouched and 23.5% per annum for each year the money is left at the bank after the initial 5 years. At the end of each investment duration, the bank takes 3% of the interest as processing fees. 7% of the total amount at the end of the investment is paid as tax. A fix amount of GHc 305.50 is taking from the total amount as stopping fees. i. ii. iii. iv. How much interest is earned by this employee if he invests now and takes it at the time of starting his own business at age 60. How much will the employee have in total to use to start his business at age 60. Will he be better off investing in another package that is fix at 22% per annum? Will he be better off investing in another package that is fix at 31% simple interest? 2. A worker of an Institution receives his 30 years end of service allowance of GHc 165,000 at age 50. He plans to start his own business as an entrepreneur at age 60. He wants to know how much he will have at his retirement age of 60 years if he invests his allowance of 165, 000 together with the GHc 65,000 savings he has accrued in his account. He plans to invest 45% of his principal (saving and retirement package) in a Databank Mutual fund (MFUND that offers 16% interest per annum for 10yrs. He will then invest the remaining in a bank package that offers 19.5% interest per annum for 5 years and if the money is left untouched and 23.5% per annum for each year the money is left at the bank after the initial 5 years. At the end of each investment duration, the bank takes 3% of the interest as processing fees. 7% of the total amount at the end of the investment is paid as tax. A fix amount of GHc 305.50 is taking from the total amount as stopping fees. i. ii. iii. iv. How much interest is earned by this employee if he invests now and takes it at the time of starting his own business at age 60. How much will the employee have in total to use to start his business at age 60. Will he be better off investing in another package that is fix at 22% per annum? Will he be better off investing in another package that is fix at 31% simple interest