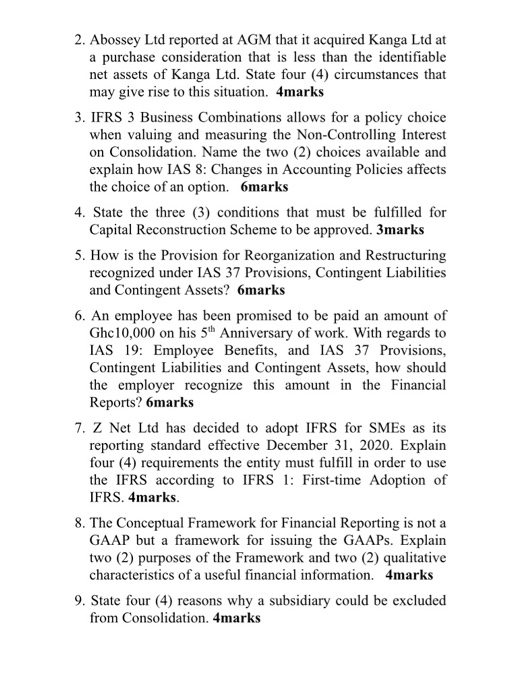

2. Abossey Ltd reported at AGM that it acquired Kanga Ltd at a purchase consideration that is less than the identifiable net assets of Kanga Ltd. State four (4) circumstances that may give rise to this situation. 4marks 3. IFRS 3 Business Combinations allows for a policy choice when valuing and measuring the Non-Controlling Interest on Consolidation. Name the two (2) choices available and explain how IAS 8: Changes in Accounting Policies affects the choice of an option. 6marks 4. State the three (3) conditions that must be fulfilled for Capital Reconstruction Scheme to be approved. 3marks 5. How is the Provision for Reorganization and Restructuring recognized under IAS 37 Provisions, Contingent Liabilities and Contingent Assets? 6marks 6. An employee has been promised to be paid an amount of Ghc10,000 on his 5th Anniversary of work. With regards to IAS 19: Employee Benefits, and IAS 37 Provisions, Contingent Liabilities and Contingent Assets, how should the employer recognize this amount in the Financial Reports? 6marks 7. Z Net Ltd has decided to adopt IFRS for SMEs as its reporting standard effective December 31, 2020. Explain four (4) requirements the entity must fulfill in order to use the IFRS according to IFRS 1: First-time Adoption of IFRS. 4marks. 8. The Conceptual Framework for Financial Reporting is not a GAAP but a framework for issuing the GAAPs. Explain two (2) purposes of the Framework and two (2) qualitative characteristics of a useful financial information. 4marks 9. State four (4) reasons why a subsidiary could be excluded from Consolidation. 4marks 2. Abossey Ltd reported at AGM that it acquired Kanga Ltd at a purchase consideration that is less than the identifiable net assets of Kanga Ltd. State four (4) circumstances that may give rise to this situation. 4marks 3. IFRS 3 Business Combinations allows for a policy choice when valuing and measuring the Non-Controlling Interest on Consolidation. Name the two (2) choices available and explain how IAS 8: Changes in Accounting Policies affects the choice of an option. 6marks 4. State the three (3) conditions that must be fulfilled for Capital Reconstruction Scheme to be approved. 3marks 5. How is the Provision for Reorganization and Restructuring recognized under IAS 37 Provisions, Contingent Liabilities and Contingent Assets? 6marks 6. An employee has been promised to be paid an amount of Ghc10,000 on his 5th Anniversary of work. With regards to IAS 19: Employee Benefits, and IAS 37 Provisions, Contingent Liabilities and Contingent Assets, how should the employer recognize this amount in the Financial Reports? 6marks 7. Z Net Ltd has decided to adopt IFRS for SMEs as its reporting standard effective December 31, 2020. Explain four (4) requirements the entity must fulfill in order to use the IFRS according to IFRS 1: First-time Adoption of IFRS. 4marks. 8. The Conceptual Framework for Financial Reporting is not a GAAP but a framework for issuing the GAAPs. Explain two (2) purposes of the Framework and two (2) qualitative characteristics of a useful financial information. 4marks 9. State four (4) reasons why a subsidiary could be excluded from Consolidation. 4marks