Answered step by step

Verified Expert Solution

Question

1 Approved Answer

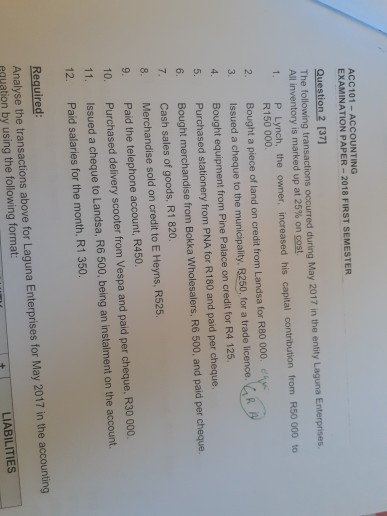

2. ACC101 - ACCOUNTING EXAMINATION PAPER - 2018 FIRST SEMESTER Question 2 [37] The following transactions occurred during May 2017 in the entity Laguna Enterprises

2. ACC101 - ACCOUNTING EXAMINATION PAPER - 2018 FIRST SEMESTER Question 2 [37] The following transactions occurred during May 2017 in the entity Laguna Enterprises All inventory is marked up at 25% on cost. 1. P Lynch, the owner, increased his capital contribution from R50 000 to R150 000 Bought a piece of land on credit from Landsa for RBO 000. 3. Issued a cheque to the municipality, R250, for a trade licence. Bought equipment from Pine Palace on credit for R4 125 Purchased stationery from PNA for R180 and paid per cheque. Bought merchandise from Bokka Wholesalers, RO 500, and paid per cheque Cash sales of goods, R1 820. 8. Merchandise sold on credit to E Heyns, R525. 9. Paid the telephone account, R450. 10. Purchased delivery scooter from Vespa and paid per cheque, R30 000 11. Issued a cheque to Landsa, R6 500, being an instalment on the account 12. Paid salaries for the month, R1 350. Required: Analyse the transactions above for Laguna Enterprises for May 2017 in the accounting quation by using the following format: LIABILITIES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started