Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Adjusted Gross Income (AGI) (10 points) In 2023, Nick made an annual salary of $68,000 and also opened up an IRA, to which he

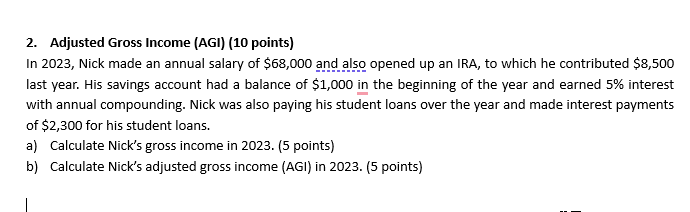

2. Adjusted Gross Income (AGI) (10 points) In 2023, Nick made an annual salary of $68,000 and also opened up an IRA, to which he contributed $8,500 last year. His savings account had a balance of $1,000 in the beginning of the year and earned 5% interest with annual compounding. Nick was also paying his student loans over the year and made interest payments of $2,300 for his student loans. a) Calculate Nick's gross income in 2023. (5 points) b) Calculate Nick's adjusted gross income (AGI) in 2023. (5 points)

2. Adjusted Gross Income (AGI) (10 points) In 2023, Nick made an annual salary of $68,000 and also opened up an IRA, to which he contributed $8,500 last year. His savings account had a balance of $1,000 in the beginning of the year and earned 5% interest with annual compounding. Nick was also paying his student loans over the year and made interest payments of $2,300 for his student loans. a) Calculate Nick's gross income in 2023. (5 points) b) Calculate Nick's adjusted gross income (AGI) in 2023. (5 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started