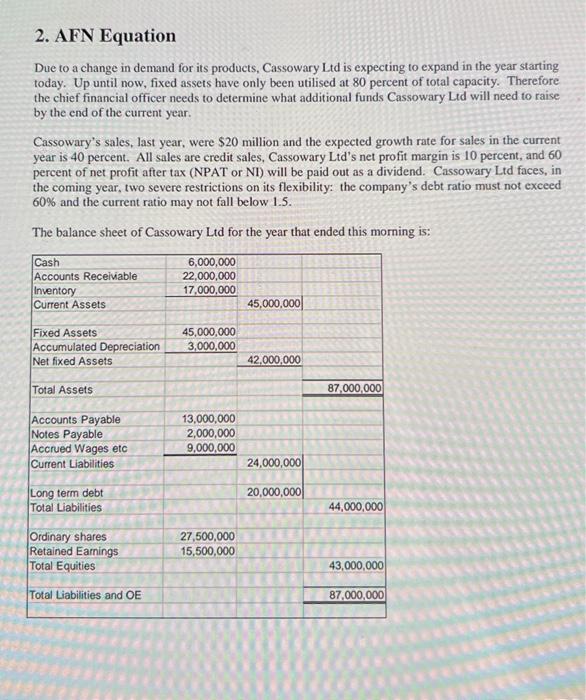

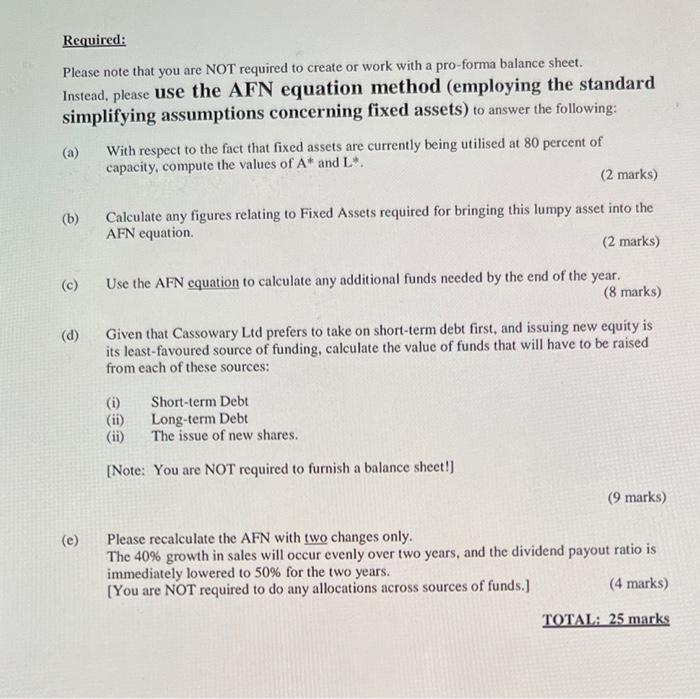

2. AFN Equation Due to a change in demand for its products, Cassowary Ltd is expecting to expand in the year starting today. Up until now, fixed assets have only been utilised at 80 percent of total capacity. Therefore the chief financial officer needs to determine what additional funds Cassowary Lid will need to raise by the end of the current year. Cassowary's sales, last year, were \\( \\$ 20 \\) million and the expected growth rate for sales in the current year is 40 percent. All sales are credit sales, Cassowary Ltd's net profit margin is 10 percent, and 60 percent of net profit after tax (NPAT or NI) will be paid out as a dividend. Cassowary Ltd faces, in the coming year, two severe restrictions on its flexibility: the company's debt ratio must not exceed \60 and the current ratio may not fall below 1.5 . The balance sheet of Cassowary Ltd for the year that ended this morning is: Required: Please note that you are NOT required to create or work with a pro-forma balance sheet. Instead, please use the AFN equation method (employing the standard simplifying assumptions concerning fixed assets) to answer the following: (a) With respect to the fact that fixed assets are currently being utilised at 80 percent of capacity, compute the values of \\( \\mathrm{A}^{*} \\) and \\( \\mathrm{L}^{*} \\). (2 marks) (b) Calculate any figures relating to Fixed Assets required for bringing this lumpy asset into the AFN equation. (2 marks) (c) Use the AFN equation to calculate any additional funds needed by the end of the year. (8 marks) (d) Given that Cassowary Ltd prefers to take on short-term debt first, and issuing new equity is its least-favoured source of funding, calculate the value of funds that will have to be raised from each of these sources: (i) Short-term Debt (ii) Long-term Debt (ii) The issue of new shares. [Note: You are NOT required to furnish a balance sheet!] (9 marks) (e) Please recalculate the AFN with two changes only. The \40 growth in sales will occur evenly over two years, and the dividend payout ratio is immediately lowered to \50 for the two years. [You are NOT required to do any allocations across sources of funds.] (4 marks) TOTAL: 25 marks