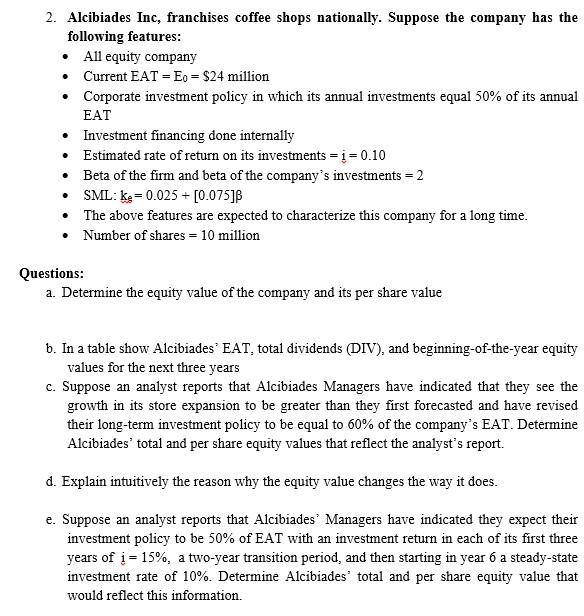

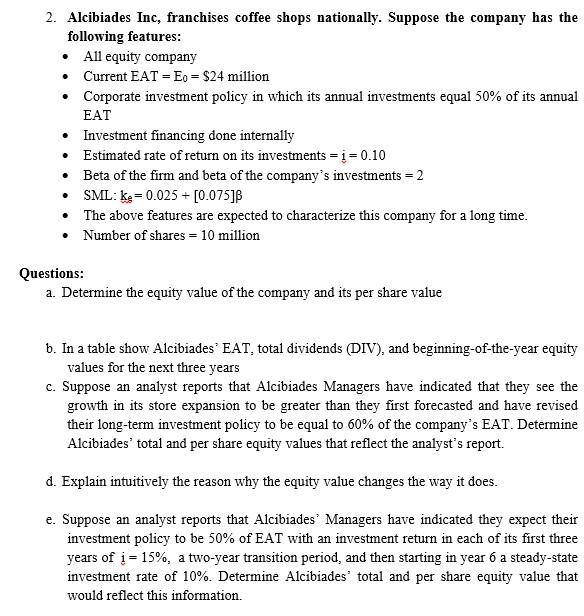

2. Alcibiades Inc, franchises coffee shops nationally. Suppose the company has the following features: All equity company Current EAT = Eo = $24 million Corporate investment policy in which its annual investments equal 50% of its annual EAT Investment financing done internally Estimated rate of return on its investments = i = 0.10 Beta of the firm and beta of the company's investments = 2 SML: K9 = 0.025 + [0.075]B The above features are expected to characterize this company for a long time. Number of shares = 10 million Questions: a. Determine the equity value of the company and its per share value b. In a table show Alcibiades' EAT, total dividends (DIV), and beginning-of-the-year equity values for the next three years c. Suppose an analyst reports that Alcibiades Managers have indicated that they see the growth in its store expansion to be greater than they first forecasted and have revised their long-term investment policy to be equal to 60% of the company's EAT. Determine Alcibiades' total and per share equity values that reflect the analyst's report. d. Explain intuitively the reason why the equity value changes the way it does. e. Suppose an analyst reports that Alcibiades Managers have indicated they expect their investment policy to be 50% of EAT with an investment return in each of its first three years of = 15%, a two-year transition period, and then starting in year 6 a steady-state investment rate of 10%. Determine Alcibiades' total and per share equity value that would reflect this information. 2. Alcibiades Inc, franchises coffee shops nationally. Suppose the company has the following features: All equity company Current EAT = Eo = $24 million Corporate investment policy in which its annual investments equal 50% of its annual EAT Investment financing done internally Estimated rate of return on its investments = i = 0.10 Beta of the firm and beta of the company's investments = 2 SML: K9 = 0.025 + [0.075]B The above features are expected to characterize this company for a long time. Number of shares = 10 million Questions: a. Determine the equity value of the company and its per share value b. In a table show Alcibiades' EAT, total dividends (DIV), and beginning-of-the-year equity values for the next three years c. Suppose an analyst reports that Alcibiades Managers have indicated that they see the growth in its store expansion to be greater than they first forecasted and have revised their long-term investment policy to be equal to 60% of the company's EAT. Determine Alcibiades' total and per share equity values that reflect the analyst's report. d. Explain intuitively the reason why the equity value changes the way it does. e. Suppose an analyst reports that Alcibiades Managers have indicated they expect their investment policy to be 50% of EAT with an investment return in each of its first three years of = 15%, a two-year transition period, and then starting in year 6 a steady-state investment rate of 10%. Determine Alcibiades' total and per share equity value that would reflect this information