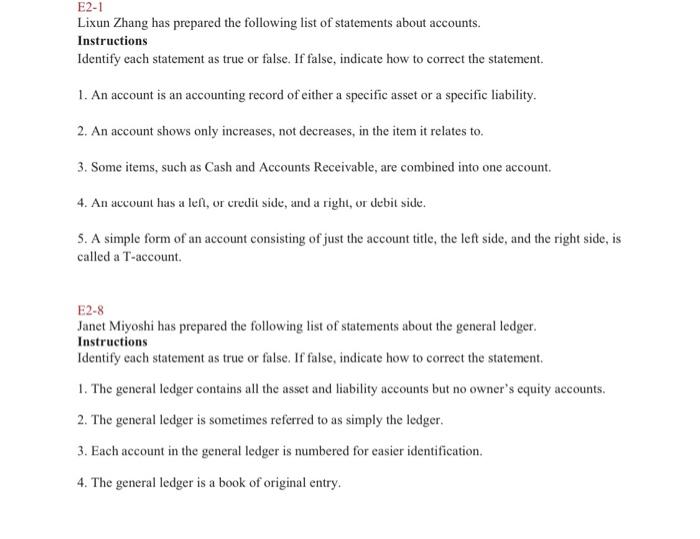

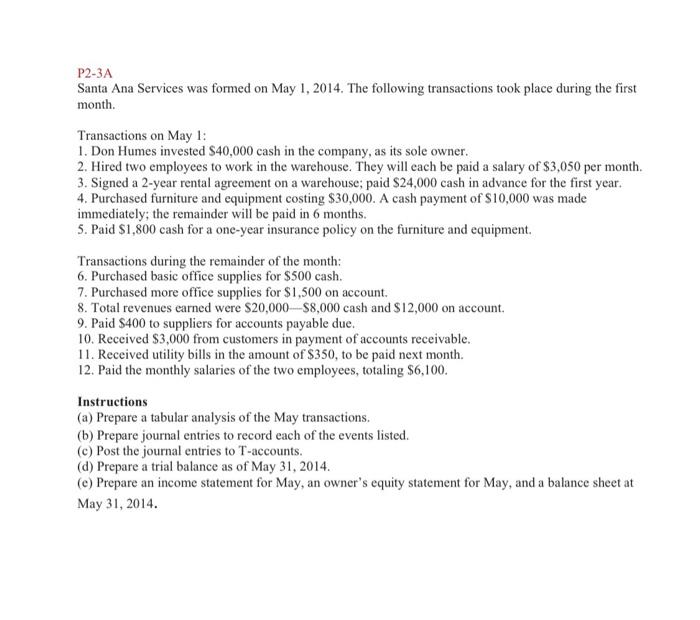

2. An account shows only increases, not decreases, in the item it relates to. 3. Some items, such as Cash and Accounts Receivable, are combined into one account. 4. An account has a lef, or credit side, and a right, or debit side. 5. A simple form of an account consisting of just the account title, the left side, and the right side, is called a T-account. E2-8 Janet Miyoshi has prepared the following list of statements about the general ledger. Instructions Identify each statement as true or false. If false, indicate how to correct the statement. 1. The general ledger contains all the asset and liability accounts but no owner's equity accounts. 2. The general ledger is sometimes referred to as simply the ledger. 3. Each account in the general ledger is numbered for easier identification. 4. The general ledger is a book of original entry. P2-3A Santa Ana Services was formed on May 1, 2014. The following transactions took place during the first month. Transactions on May 1: 1. Don Humes invested $40,000 cash in the company, as its sole owner. 2. Hired two employees to work in the warehouse. They will each be paid a salary of $3,050 per month. 3. Signed a 2-year rental agreement on a warehouse; paid $24,000 cash in advance for the first year. 4. Purchased furniture and equipment costing $30,000. A cash payment of $10,000 was made immediately; the remainder will be paid in 6 months. 5. Paid $1,800 cash for a one-year insurance policy on the furniture and equipment. Transactions during the remainder of the month: 6. Purchased basic office supplies for $500 cash. 7. Purchased more office supplies for $1,500 on account. 8. Total revenues earned were $20,000$8,000 cash and $12,000 on account. 9. Paid $400 to suppliers for accounts payable due. 10. Received $3,000 from customers in payment of accounts receivable. 11. Received utility bills in the amount of $350, to be paid next month. 12. Paid the monthly salaries of the two employees, totaling $6,100. Instructions (a) Prepare a tabular analysis of the May transactions. (b) Prepare journal entries to record each of the events listed. (c) Post the journal entries to T-accounts. (d) Prepare a trial balance as of May 31, 2014. (e) Prepare an income statement for May, an owner's equity statement for May, and a balance sheet at May 31, 2014