Answered step by step

Verified Expert Solution

Question

1 Approved Answer

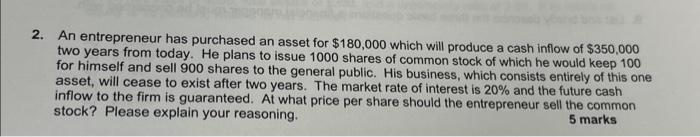

2. An entrepreneur has purchased an asset for $180,000 which will produce a cash inflow of $350,000 two years from today. He plans to issue

2. An entrepreneur has purchased an asset for $180,000 which will produce a cash inflow of $350,000 two years from today. He plans to issue 1000 shares of common stock of which he would keep 100 for himself and sell 900 shares to the general public. His business, which consists entirely of this one asset, will cease to exist after two years. The market rate of interest is 20% and the future cash inflow to the firm is guaranteed. At what price per share should the entrepreneur sell the common stock? Please explain your reasoning. 5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started