Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. An Insurance Company uses 40% of its premium income for overhead (OH) salaries, rent, commissions, profit, etc..). Premium income not used for claims

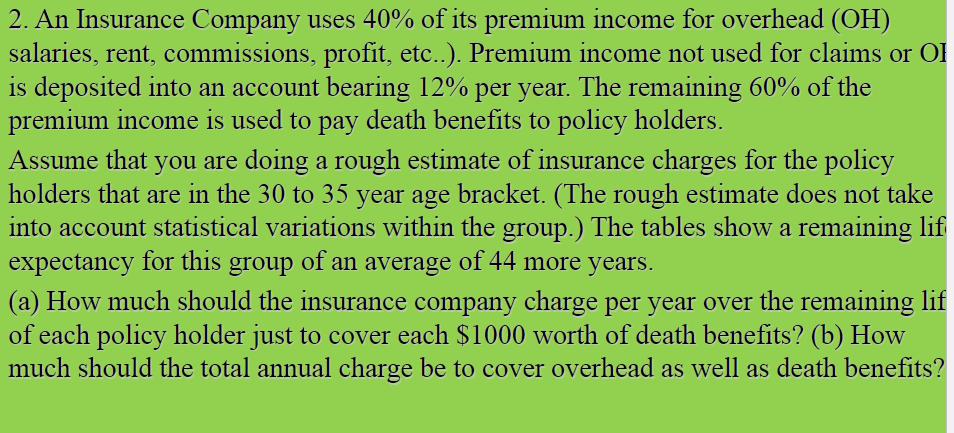

2. An Insurance Company uses 40% of its premium income for overhead (OH) salaries, rent, commissions, profit, etc..). Premium income not used for claims or OI is deposited into an account bearing 12% per year. The remaining 60% of the premium income is used to pay death benefits to policy holders. Assume that you are doing a rough estimate of insurance charges for the policy holders that are in the 30 to 35 year age bracket. (The rough estimate does not take into account statistical variations within the group.) The tables show a remaining lif expectancy for this group of an average of 44 more years. (a) How much should the insurance company charge per year over the remaining lif of each policy holder just to cover each $1000 worth of death benefits? (b) How much should the total annual charge be to cover overhead as well as death benefits?

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a If we assume that the insurance company pays out the 1000 death benefit at the end of the 44year p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started