Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) An investment is expected to generate $150,000 of cashflow for each of the next four years. Using a 6% discount rate (interest rate)

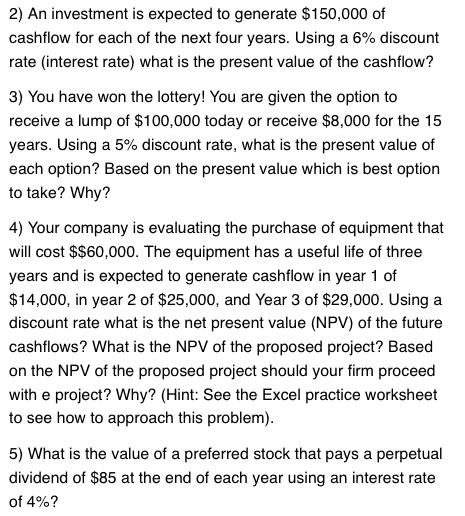

2) An investment is expected to generate $150,000 of cashflow for each of the next four years. Using a 6% discount rate (interest rate) what is the present value of the cashflow? 3) You have won the lottery! You are given the option to receive a lump of $100,000 today or receive $8,000 for the 15 years. Using a 5% discount rate, what is the present value of each option? Based on the present value which is best option to take? Why? 4) Your company is evaluating the purchase of equipment that will cost $$60,000. The equipment has a useful life of three years and is expected to generate cashflow in year 1 of $14,000, in year 2 of $25,000, and Year 3 of $29,000. Using a discount rate what is the net present value (NPV) of the future cashflows? What is the NPV of the proposed project? Based on the NPV of the proposed project should your firm proceed with e project? Why? (Hint: See the Excel practice worksheet to see how to approach this problem). 5) What is the value of a preferred stock that pays a perpetual dividend of $85 at the end of each year using an interest rate of 4%?

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Answer 2 To calculate the present value of the cashflow we can use the formula for the present value of an annuity PV CF1rn Where PV is the present va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started