Answered step by step

Verified Expert Solution

Question

1 Approved Answer

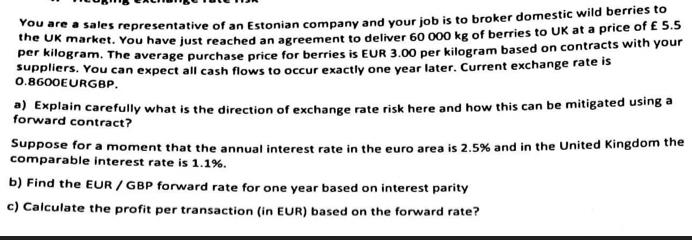

You are a sales representative of an Estonian company and your job is to broker domestic wild berries to the UK market. You have

You are a sales representative of an Estonian company and your job is to broker domestic wild berries to the UK market. You have just reached an agreement to deliver 60 000 kg of berries to UK at a price of 5.5 per kilogram. The average purchase price for berries is EUR 3.00 per kilogram based on contracts with your suppliers. You can expect all cash flows to occur exactly one year later. Current exchange rate is 0.8600EURGBP. a) Explain carefully what is the direction of exchange rate risk here and how this can be mitigated using a forward contract? Suppose for a moment that the annual interest rate in the euro area is 2.5% and in the United Kingdom the comparable interest rate is 1.1%. b) Find the EUR/GBP forward rate for one year based on interest parity c) Calculate the profit per transaction (in EUR) based on the forward rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a The direction of exchange rate risk in this scenario is that the Estonian company is sellin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started