Question

2) Analysis of company performance (35 marks) Wally is impressed by the quality of your analysis. He needs some additional help this time with evaluating

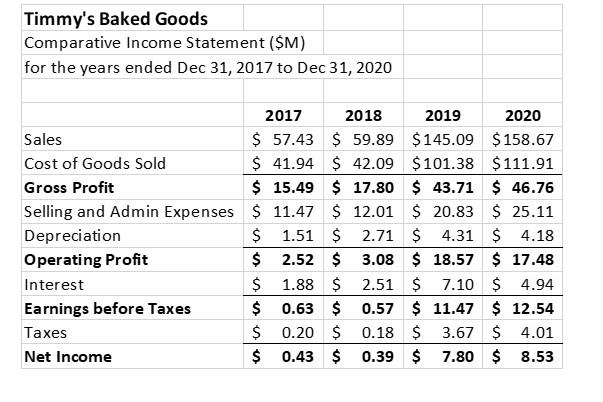

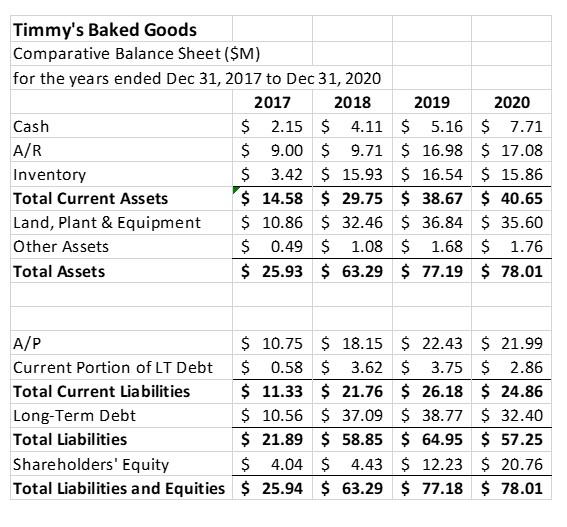

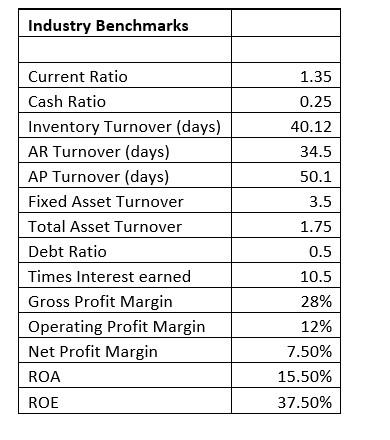

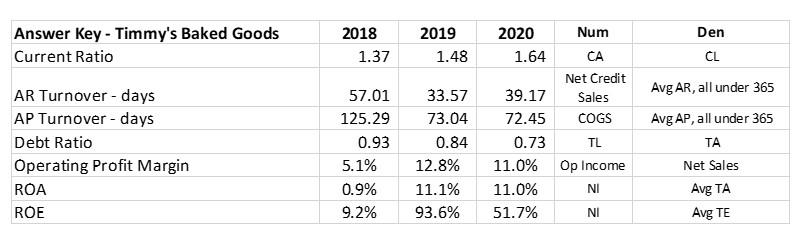

2) Analysis of company performance (35 marks) Wally is impressed by the quality of your analysis. He needs some additional help this time with evaluating how one of his companys - Timmys Baked Goods (TBG) - is performing. TBG is a chain of bakeries operating across Canada. Wally has asked you to perform some financial statement analysis. He asks that you look at how the company has performed relative to history and industry benchmarks. He wants you to calculate the following ratios for each of 2018, 2019 and 2020, using the data he provides below. Be sure to comment on what you think the results mean. He has also included industry information that you can use in your analysis. Note that for the ROA and ROE, you should use the average total assets and the average total equity in your calculations. For turnover ratios, please also use the average. (e.g., for Accounts Receivable Turnover, take Credit Sales / Average Accounts Receivable for the year).

1. Current ratio

2. Account Receivable turnover days: all sales are credit sales

3. Accounts Payable turnover days

4. Debt ratio 5. Operating Profit margin

6. Return on Assets

7. Return on Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started