Question

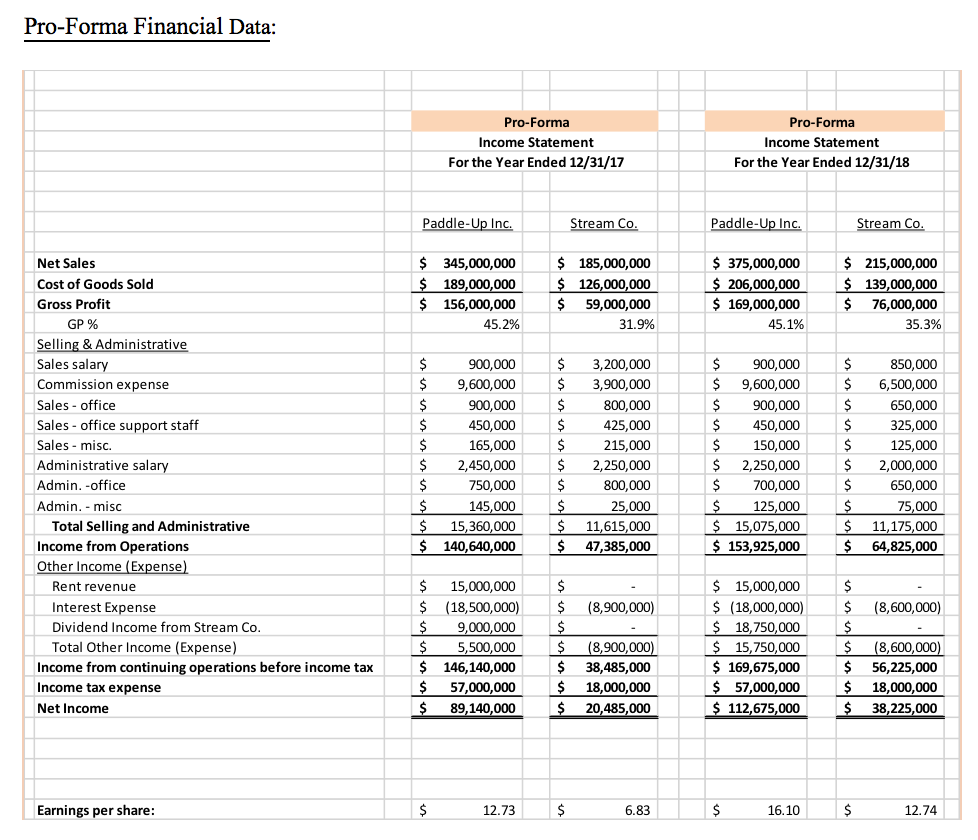

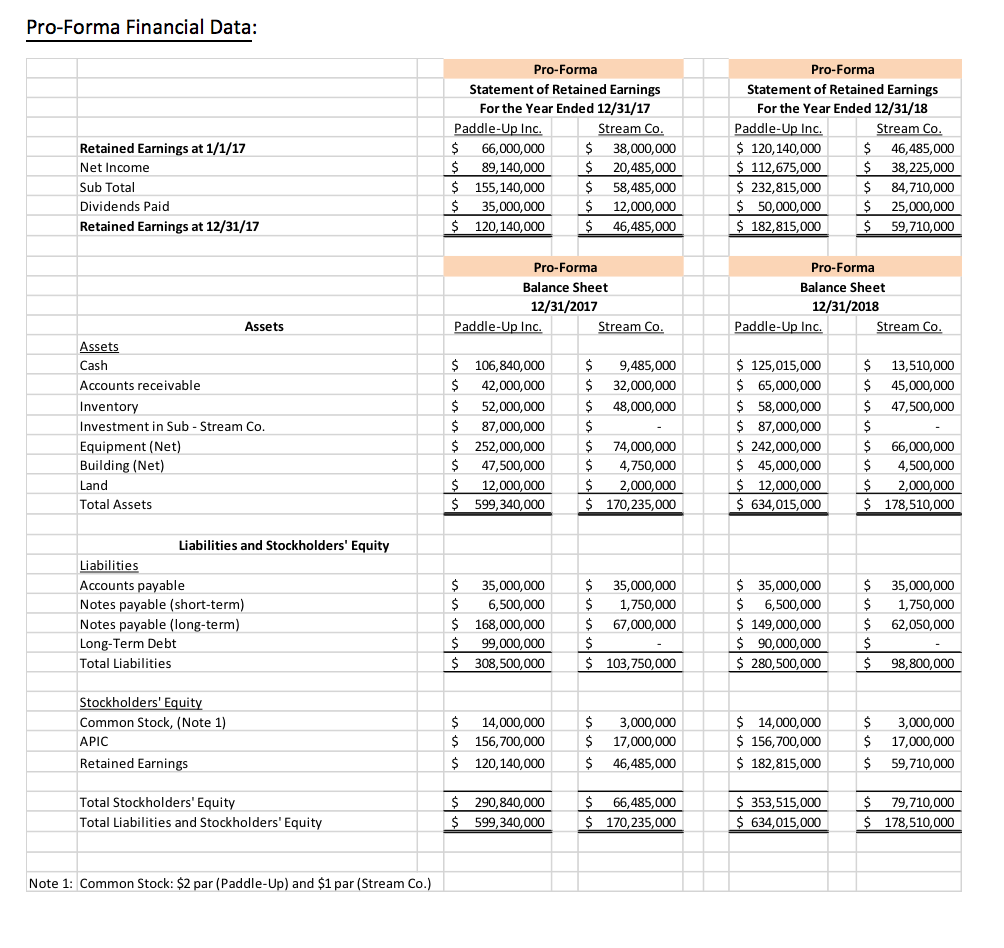

2. Analysis of the consolidated financial statements as of 12/31/17 and 12/31/18. Include in the analysis why there is an additional workpaper entry (reciprocity) when

2. Analysis of the consolidated financial statements as of 12/31/17 and 12/31/18. Include in the analysis why there is an additional workpaper entry (reciprocity) when completing the 12/31/18 consolidation workpaper and not in the 12/31/17 consolidation workpaper.

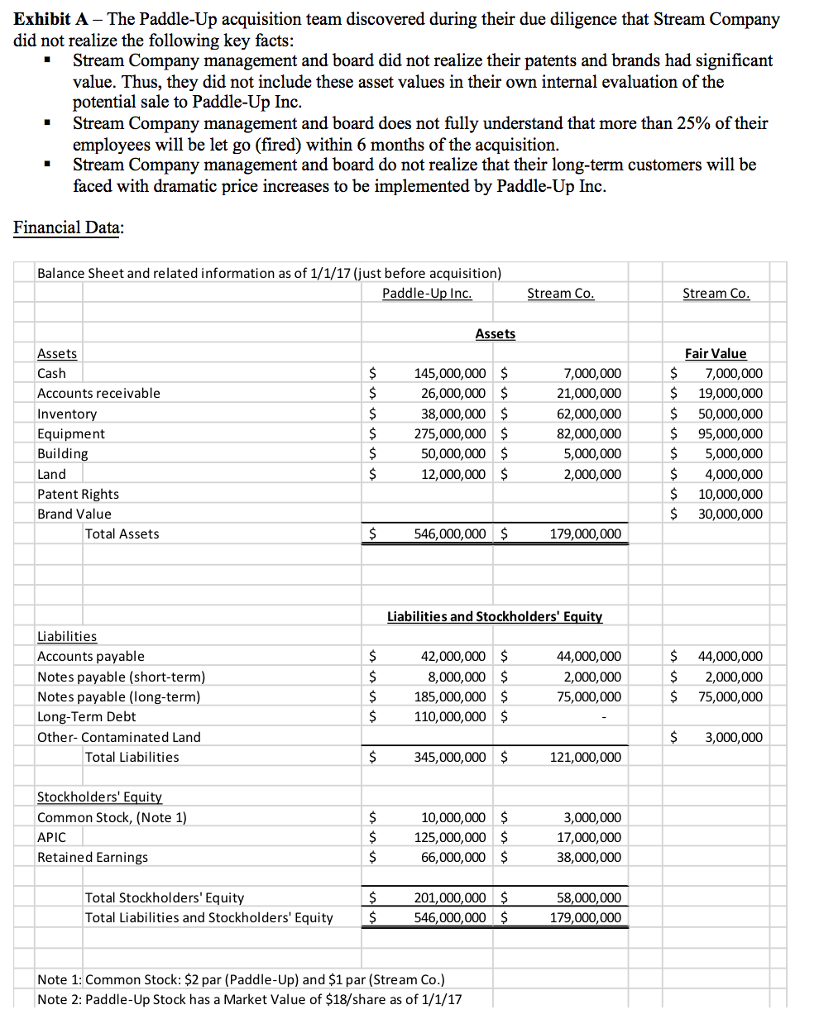

3. Recommendation in regards to several ethical questions included in a note received from the Paddle-Up Inc. acquisition team (Exhibit A). Consider whether the type of acquisition (asset or stock) impacts your evaluation.

4. Analysis whether the stock acquisition of Stream Company is a good financial and strategic decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started