2 and 3 please

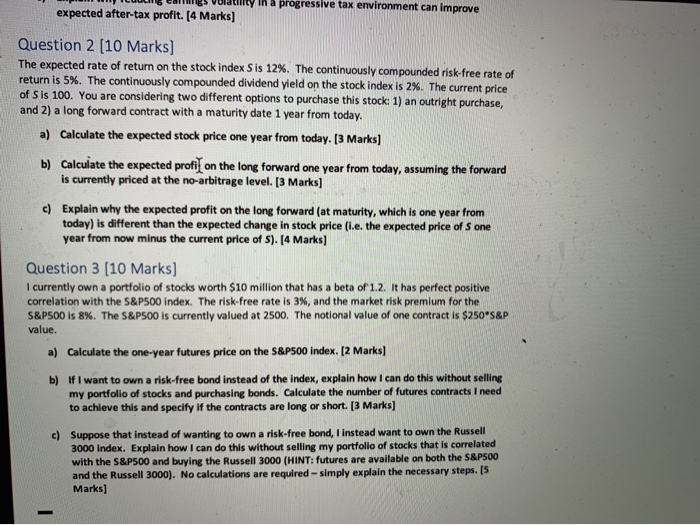

l lug earings volatility in a progressive tax environment can improve expected after-tax profit. [4 Marks] Question 2 [10 Marks) The expected rate of return on the stock index Sis 12%. The continuously compounded risk-free rate of return is 5%. The continuously compounded dividend yield on the stock index is 2%. The current price of Sis 100. You are considering two different options to purchase this stock: 1) an outright purchase, and 2) a long forward contract with a maturity date 1 year from today. a) Calculate the expected stock price one year from today. (3 Marks) b) Calculate the expected profil on the long forward one year from today, assuming the forward is currently priced at the no-arbitrage level. [3 Marks) c) Explain why the expected profit on the long forward (at maturity, which is one year from today) is different than the expected change in stock price (.e. the expected price of Sone year from now minus the current price of s). [4 Marks) Question 3 [10 Marks) I currently own a portfolio of stocks worth $10 million that has a beta of 1.2. It has perfect positive correlation with the S&P500 index. The risk-free rate is 3%, and the market risk premium for the S&P500 is 8%. The S&P500 is currently valued at 2500. The notional value of one contract is $250*S&P value. a) Calculate the one-year futures price on the S&P500 index. [2 Marks) b) If I want to own a risk-free bond instead of the index, explain how I can do this without selling my portfolio of stocks and purchasing bonds. Calculate the number of futures contracts I need to achieve this and specify if the contracts are long or short. [3 Marks c) Suppose that instead of wanting to own a risk-free bond, I instead want to own the Russell 3000 Index. Explain how I can do this without selling my portfolio of stocks that is correlated with the S&P500 and buying the Russell 3000 (HINT: futures are available on both the S&P500 and the Russell 3000). No calculations are required - simply explain the necessary steps. 15 Marks] l lug earings volatility in a progressive tax environment can improve expected after-tax profit. [4 Marks] Question 2 [10 Marks) The expected rate of return on the stock index Sis 12%. The continuously compounded risk-free rate of return is 5%. The continuously compounded dividend yield on the stock index is 2%. The current price of Sis 100. You are considering two different options to purchase this stock: 1) an outright purchase, and 2) a long forward contract with a maturity date 1 year from today. a) Calculate the expected stock price one year from today. (3 Marks) b) Calculate the expected profil on the long forward one year from today, assuming the forward is currently priced at the no-arbitrage level. [3 Marks) c) Explain why the expected profit on the long forward (at maturity, which is one year from today) is different than the expected change in stock price (.e. the expected price of Sone year from now minus the current price of s). [4 Marks) Question 3 [10 Marks) I currently own a portfolio of stocks worth $10 million that has a beta of 1.2. It has perfect positive correlation with the S&P500 index. The risk-free rate is 3%, and the market risk premium for the S&P500 is 8%. The S&P500 is currently valued at 2500. The notional value of one contract is $250*S&P value. a) Calculate the one-year futures price on the S&P500 index. [2 Marks) b) If I want to own a risk-free bond instead of the index, explain how I can do this without selling my portfolio of stocks and purchasing bonds. Calculate the number of futures contracts I need to achieve this and specify if the contracts are long or short. [3 Marks c) Suppose that instead of wanting to own a risk-free bond, I instead want to own the Russell 3000 Index. Explain how I can do this without selling my portfolio of stocks that is correlated with the S&P500 and buying the Russell 3000 (HINT: futures are available on both the S&P500 and the Russell 3000). No calculations are required - simply explain the necessary steps. 15 Marks]

2 and 3 please

2 and 3 please