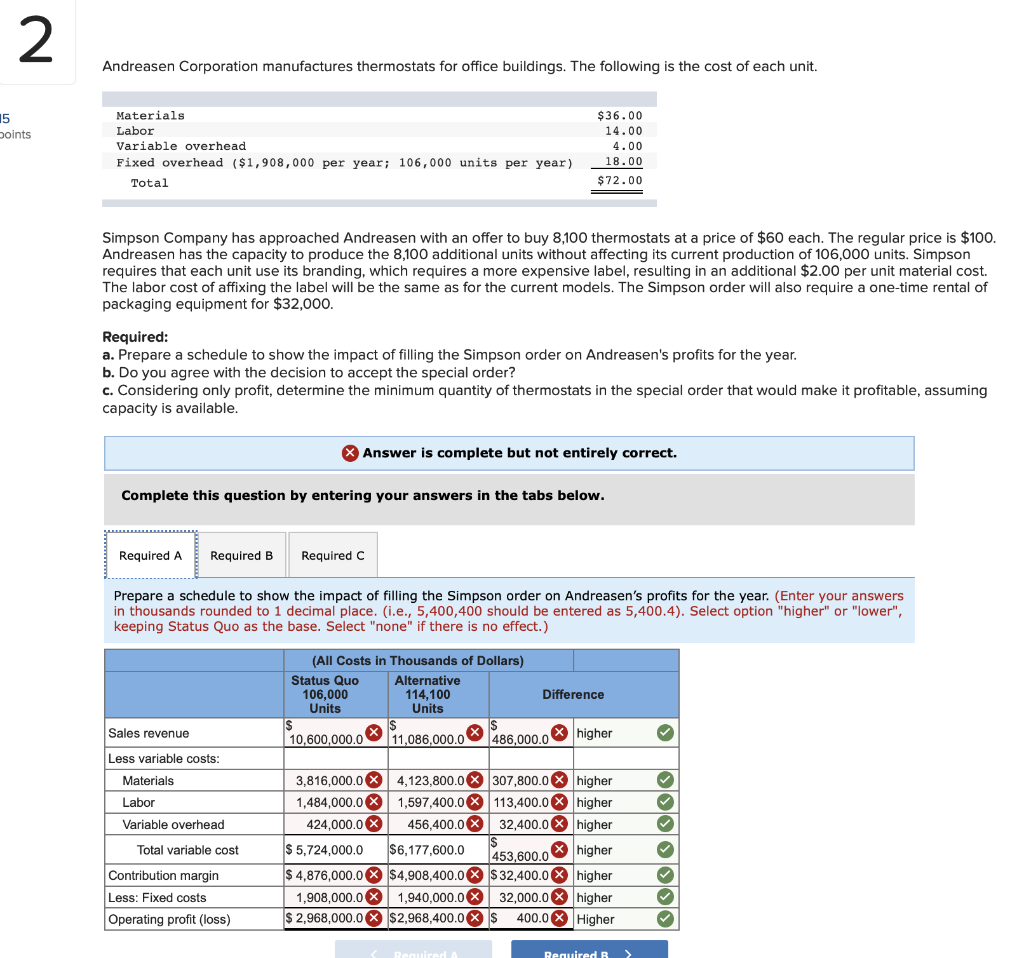

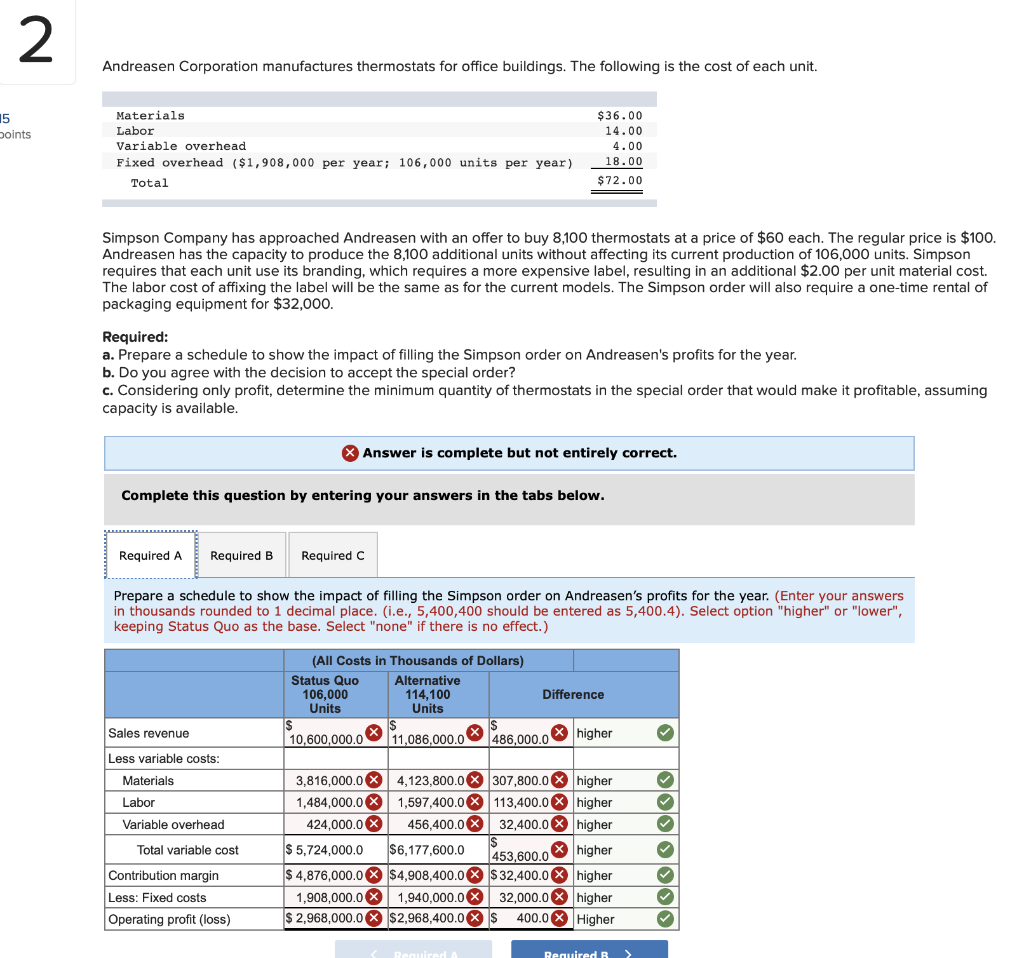

2 Andreasen Corporation manufactures thermostats for office buildings. The following is the cost of each unit. 15 points Materials Labor Variable overhead Fixed overhead ($1,908,000 per year; 106,000 units per year) Total $36.00 14.00 4.00 18.00 $72.00 Simpson Company has approached Andreasen with an offer to buy 8,100 thermostats at a price of $60 each. The regular price is $100. Andreasen has the capacity to produce the 8,100 additional units without affecting its current production of 106,000 units. Simpson requires that each unit use its branding, which requires a more expensive label, resulting in an additional $2.00 per unit material cost. The labor cost of affixing the label will be the same as for the current models. The Simpson order will also require a one-time rental of packaging equipment for $32,000. Required: a. Prepare a schedule to show the impact of filling the Simpson order on Andreasen's profits for the year. b. Do you agree with the decision to accept the special order? c. Considering only profit, determine the minimum quantity of thermostats in the special order that would make it profitable, assuming capacity is available. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare a schedule to show the impact of filling the Simpson order on Andreasen's profits for the year. (Enter your answers in thousands rounded to 1 decimal place. (i.e., 5,400,400 should be entered as 5,400.4). Select option "higher" or "lower", keeping Status Quo as the base. Select "none" if there is no effect.) (All Costs in Thousands of Dollars) Status Quo Alternative 106,000 114,100 Units Units Difference Sales revenue 10,600,000.0 11,086,000.0 486,000.0 higher Less variable costs: Materials Labor Variable overhead 3,816,000.0 4,123,800.0 307,800.0 X higher 1,484,000.0 X 1,597,400.0 X 113,400.0 % higher 424,000.0 X 456,400.0 % 32,400.0 % higher $ 5,724,000.0 $6,177,600.0 453,600.0 X higher $ 4,876,000.0 X $4,908,400.0 X $ 32,400.0 % higher 1,908,000.0 X 1,940,000.0 % 32,000.0 % higher $ 2,968,000.0X $2,968,400.0% $ 400.0 % Higher Ollol Total variable cost Contribution margin Less: Fixed costs Operating profit (loss) Required B