Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Applying Assignment Question 2, EM2-24 (similar to) Part 2 of 6 Jackson Foundry uses a predetermined overhead allocation rate to allocate overhead to

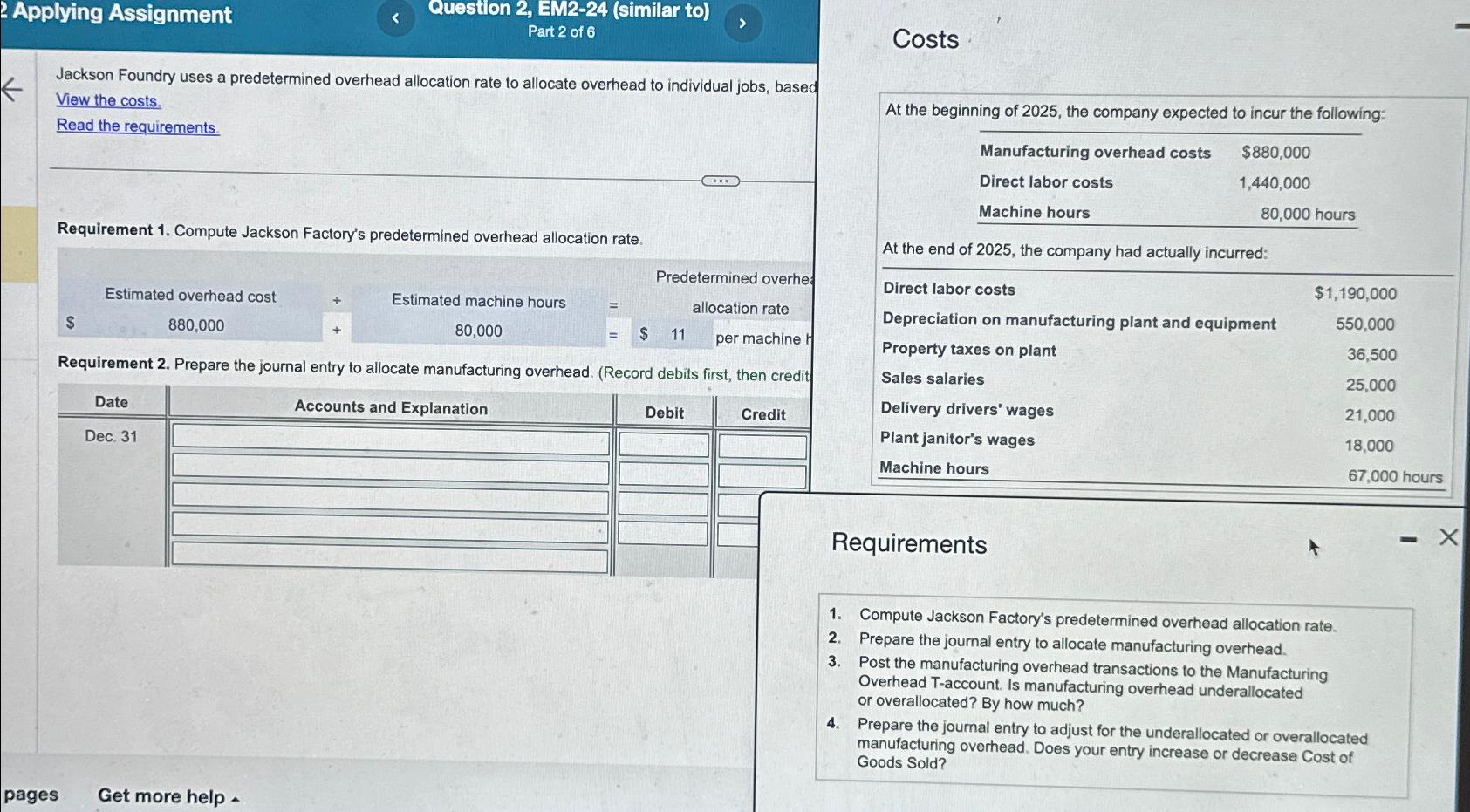

2 Applying Assignment Question 2, EM2-24 (similar to) Part 2 of 6 Jackson Foundry uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based View the costs. Read the requirements. Costs At the beginning of 2025, the company expected to incur the following: Manufacturing overhead costs Requirement 1. Compute Jackson Factory's predetermined overhead allocation rate. Direct labor costs Machine hours $880,000 1,440,000 80,000 hours At the end of 2025, the company had actually incurred: $ Estimated overhead cost 880,000 Predetermined overhe Direct labor costs Estimated machine hours 80,000 = allocation rate =1 $ 11 per machine h Depreciation on manufacturing plant and equipment Property taxes on plant Sales salaries Accounts and Explanation Debit Credit Delivery drivers' wages Requirement 2. Prepare the journal entry to allocate manufacturing overhead. (Record debits first, then credit Date Dec. 31 Plant janitor's wages Machine hours pages Get more help Requirements 1. 2. 3. 4. $1,190,000 550,000 36,500 25,000 21,000 18,000 67,000 hours Compute Jackson Factory's predetermined overhead allocation rate. Prepare the journal entry to allocate manufacturing overhead. Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Is manufacturing overhead underallocated or overallocated? By how much? Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Does your entry increase or decrease Cost of Goods Sold?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started