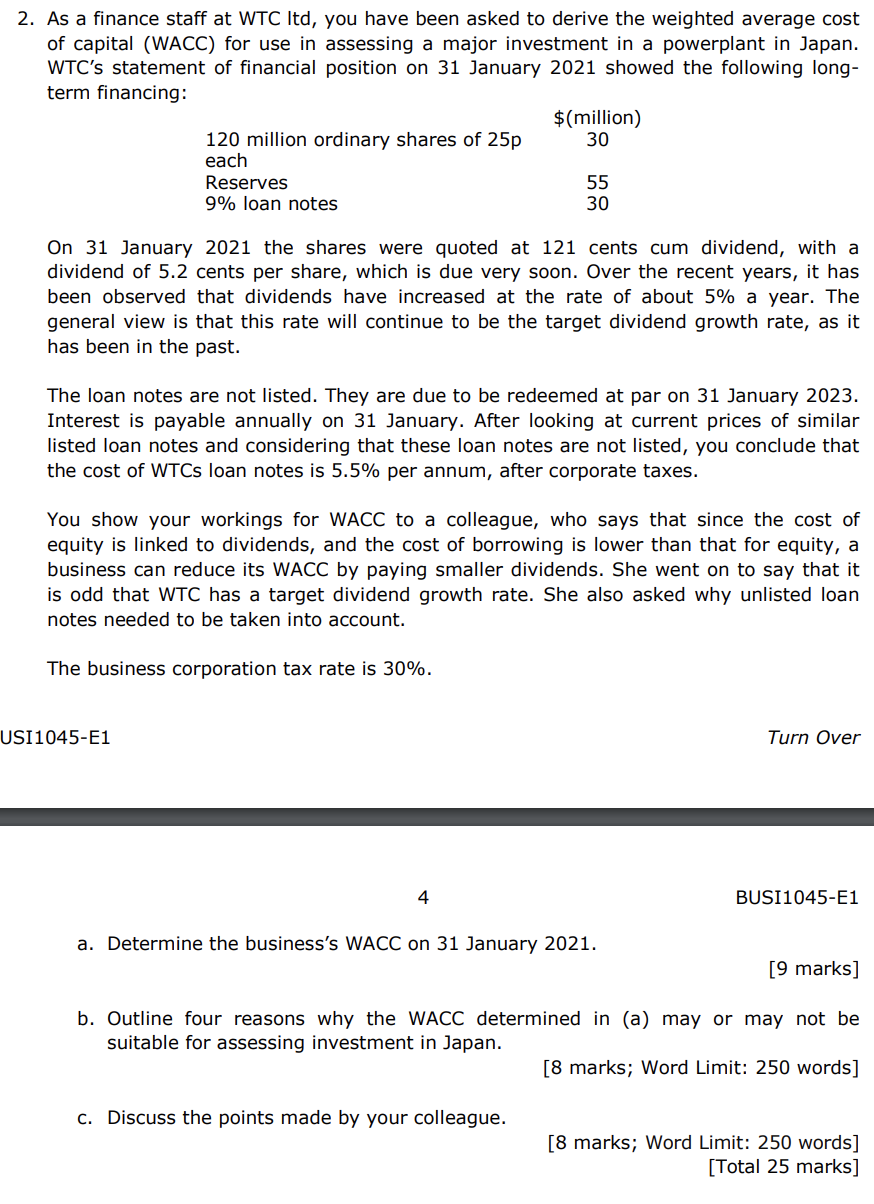

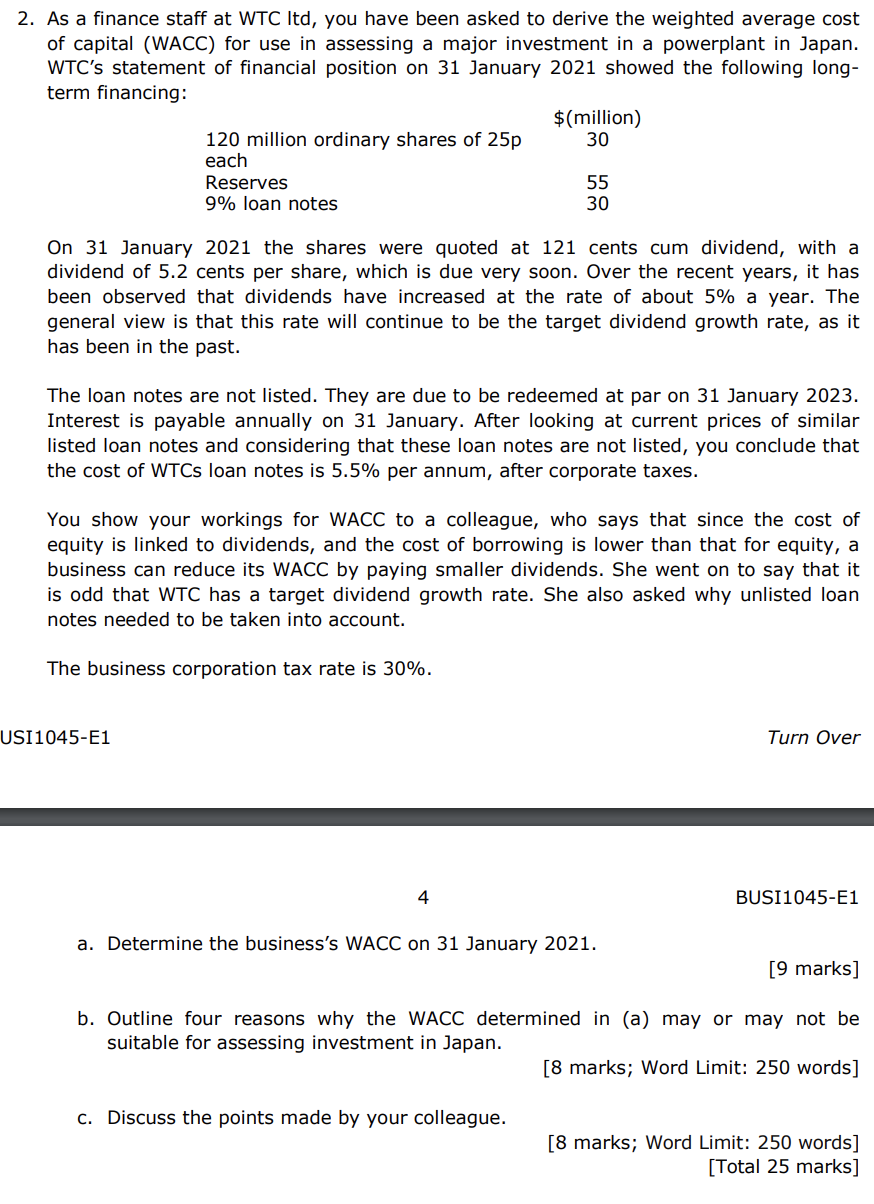

2. As a finance staff at WTC Itd, you have been asked to derive the weighted average cost of capital (WACC) for use in assessing a major investment in a powerplant in Japan. WTC's statement of financial position on 31 January 2021 showed the following long- term financing: $(million) 120 million ordinary shares of 25p 30 each Reserves 55 9% loan notes 30 On 31 January 2021 the shares were quoted at 121 cents cum dividend, with a dividend of 5.2 cents per share, which is due very soon. Over the recent years, it has been observed that dividends have increased at the rate of about 5% a year. The general view is that this rate will continue to be the target dividend growth rate, as it has been in the past. The loan notes are not listed. They are due to be redeemed at par on 31 January 2023. Interest is payable annually on 31 January. After looking at current prices of similar listed loan notes and considering that these loan notes are not listed, you conclude that the cost of WTCs loan notes is 5.5% per annum, after corporate taxes. You show your workings for WACC to a colleague, who says that since the cost of equity is linked to dividends, and the cost of borrowing is lower than that for equity, a business can reduce its WACC by paying smaller dividends. She went on to say that it is odd that WTC has a target dividend growth rate. She also asked why unlisted loan notes needed to be taken into account. The business corporation tax rate is 30%. USI1045-E1 Turn Over 4 BUSI1045-E1 a. Determine the business's WACC on 31 January 2021. [9 marks] b. Outline four reasons why the WACC determined in (a) may or may not be suitable for assessing investment in Japan. [8 marks; Word Limit: 250 words] c. Discuss the points made by your colleague. [8 marks; Word Limit: 250 words] [Total 25 marks] 2. As a finance staff at WTC Itd, you have been asked to derive the weighted average cost of capital (WACC) for use in assessing a major investment in a powerplant in Japan. WTC's statement of financial position on 31 January 2021 showed the following long- term financing: $(million) 120 million ordinary shares of 25p 30 each Reserves 55 9% loan notes 30 On 31 January 2021 the shares were quoted at 121 cents cum dividend, with a dividend of 5.2 cents per share, which is due very soon. Over the recent years, it has been observed that dividends have increased at the rate of about 5% a year. The general view is that this rate will continue to be the target dividend growth rate, as it has been in the past. The loan notes are not listed. They are due to be redeemed at par on 31 January 2023. Interest is payable annually on 31 January. After looking at current prices of similar listed loan notes and considering that these loan notes are not listed, you conclude that the cost of WTCs loan notes is 5.5% per annum, after corporate taxes. You show your workings for WACC to a colleague, who says that since the cost of equity is linked to dividends, and the cost of borrowing is lower than that for equity, a business can reduce its WACC by paying smaller dividends. She went on to say that it is odd that WTC has a target dividend growth rate. She also asked why unlisted loan notes needed to be taken into account. The business corporation tax rate is 30%. USI1045-E1 Turn Over 4 BUSI1045-E1 a. Determine the business's WACC on 31 January 2021. [9 marks] b. Outline four reasons why the WACC determined in (a) may or may not be suitable for assessing investment in Japan. [8 marks; Word Limit: 250 words] c. Discuss the points made by your colleague. [8 marks; Word Limit: 250 words] [Total 25 marks]