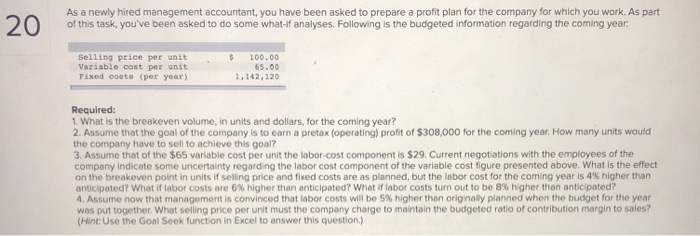

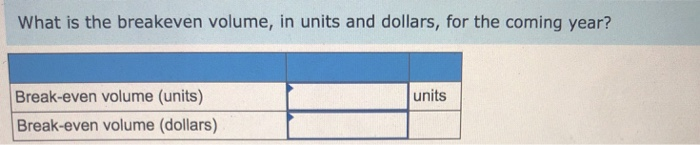

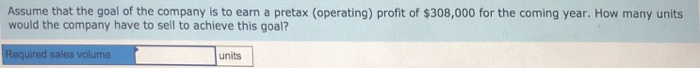

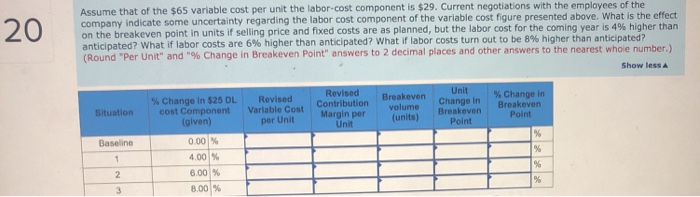

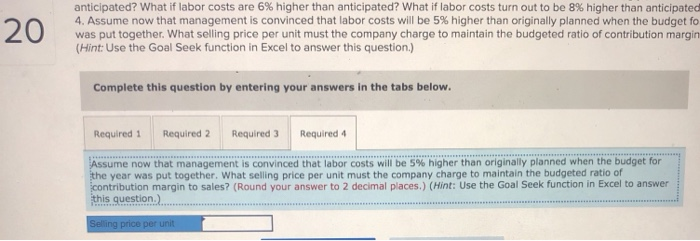

2 As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, you've been asked to do some what-f analyses. Following is the budgeted information regarding the coming year Selling price per unit . Variable cost per unit Fixed costs (per year) 100.00 65.00 1,142,120 Required: 1. What is the breakeven volume, in units and dollars, for the coming year? 2. Assume that the goal of the company is to earn a pretax (operating) profit of $308,000 for the coming year. How many units would the company have to sell to achieve this goal? 3. Assume that of the $65 variable cost per unit the labor-cost component is $29. Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven port in units if selling price and fixed costs are as planned, but the labor cost for the coming year is 4% higher than anticipated? what if labor costs are 6% higher than anticipated? what if labor costs turn out to be 8% higher than anticipated? 4 Assume now that management is convinced that labor costs will be 5% higher than orignasy planned when the budget for the year was put together. What selling price per unit must the company charge to maintain the budgeted ratio of contribution margin to sales? (Hint: Use the Goal Seek function in Excel to answer this question) What is the breakeven volume, in units and dollars, for the coming year? Break-even volume (units) Break-even volume (dollars) units Assume that the goal of the company is to earn a pretax (operating) profit of $308,000 for the coming year. How many units would the company have to sell to achieve this goal? equired sales volume units Assume that of the $65 variable cost per unit the labor-cost component is $29. Current negotiations with the emplayees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is 4% higher than anticipated? What if labor costs are 6% higher than anticipated? What if labor costs turn out to be 8% higher than anti pat (Round . What is the effect "Per Unit" and "% Change in Breakeven Point" answers to 2 decimal places and other answers tothe nearest whoe number. Show less Change in $25 DL Revised cost Component Variable Cost Contribution Contribution volume Breakeven Margin per (units) Situation Point per Unit Margin per volume Change in % Change in Point (given) Unit 0.001% 4.001% 6.001% 8.001% Baseline 20 anticipated? What if labor costs are 6% higher than anticipated? what if labor costs turn out to be 8% higher than anticipated 4. Assume now that management is convinced that labor costs will be 5% higher than originally planned when the budget fo was put together. What selling price per unit must the company charge to maintain the budgeted ratio of contribution margin (Hint: Use the Goal Seek function in Excel to answer this question.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required umen thatanagement is convinced that laborosts ill be 5% higher than originally planned when the budget for year was put together, What selling price per unit must the company charge to maintain the budgeted ratio of tribution margin to sales? (Round your answer to 2 decimal places.) (Hint: Use the Goal Seek function in Excel to answer . . this question)