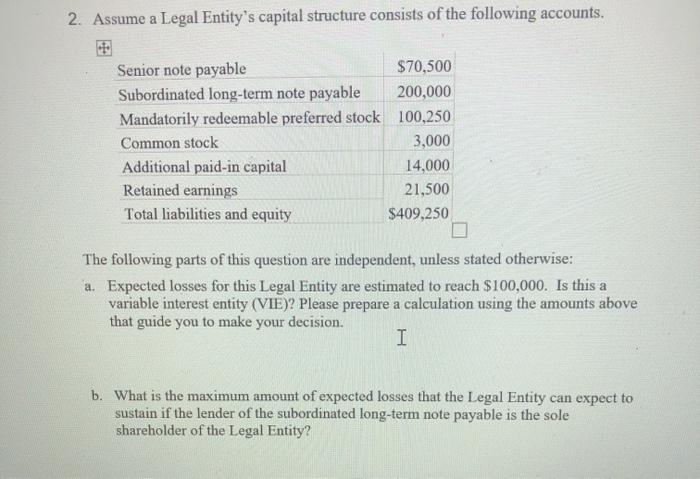

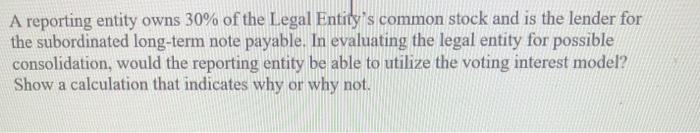

2. Assume a Legal Entity's capital structure consists of the following accounts. Senior note payable $70,500 Subordinated long-term note payable 200,000 Mandatorily redeemable preferred stock 100,250 Common stock 3,000 Additional paid-in capital 14,000 Retained earnings 21,500 Total liabilities and equity $409,250 The following parts of this question are independent, unless stated otherwise: a. Expected losses for this Legal Entity are estimated to reach $100,000. Is this a variable interest entity (VIE)? Please prepare a calculation using the amounts above that guide you to make your decision. I b. What is the maximum amount of expected losses that the Legal Entity can expect to sustain if the lender of the subordinated long-term note payable is the sole shareholder of the Legal Entity? A reporting entity owns 30% of the Legal Entity is common stock and is the lender for the subordinated long-term note payable. In evaluating the legal entity for possible consolidation, would the reporting entity be able to utilize the voting interest model? Show a calculation that indicates why or why not. 2. Assume a Legal Entity's capital structure consists of the following accounts. Senior note payable $70,500 Subordinated long-term note payable 200,000 Mandatorily redeemable preferred stock 100,250 Common stock 3,000 Additional paid-in capital 14,000 Retained earnings 21,500 Total liabilities and equity $409,250 The following parts of this question are independent, unless stated otherwise: a. Expected losses for this Legal Entity are estimated to reach $100,000. Is this a variable interest entity (VIE)? Please prepare a calculation using the amounts above that guide you to make your decision. I b. What is the maximum amount of expected losses that the Legal Entity can expect to sustain if the lender of the subordinated long-term note payable is the sole shareholder of the Legal Entity? A reporting entity owns 30% of the Legal Entity is common stock and is the lender for the subordinated long-term note payable. In evaluating the legal entity for possible consolidation, would the reporting entity be able to utilize the voting interest model? Show a calculation that indicates why or why not