2. assume that the credit sales for 2011 are $1,260,000 and that the weighted average percentage calculated...

3. do you believe this estimate of bad debt expense is resonable?

4. how would you estimate 2011 bad debt expense if losses from uncollectible accounts for 2010 were $30,000? what other action would management consider?

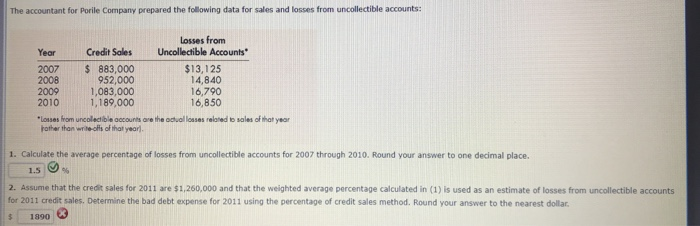

The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts: Losses from Year Credit Soles Uncollectible Accounts 2007 $ 883,000 $13,125 2008 952,000 14,840 2009 1,083,000 16,790 2010 1,189,000 16,850 losses from uncoladible course the colossos reload to sales of that year bother than writects of that year. 1. Calculate the average percentage of losses from uncollectible accounts for 2007 through 2010. Round your answer to one decimal place. 2. Assume that the credit sales for 2011 are $1,260,000 and that the weighted average percentage calculated in (1) is used as an estimate of losses from uncollectible accounts for 2011 credit sales. Determine the bad debt expense for 2011 using the percentage of credit sales method. Round your answer to the nearest dollar $ 1890 3. Conceptual Connection: Do you believe this estimate of bad debt expense is reasonable? The input in the box below will not be graded, but may be reviewed and considered by your instructor blank 4. Conceptual Connection: How would you estimate 2011 bad debt expense If losses from uncollectible accounts for 2010 were $30,000? What other action would management considera The input in the box below will not be graded, but may be reviewed and considered by your instructor The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts: Losses from Year Credit Soles Uncollectible Accounts 2007 $ 883,000 $13,125 2008 952,000 14,840 2009 1,083,000 16,790 2010 1,189,000 16,850 losses from uncoladible course the colossos reload to sales of that year bother than writects of that year. 1. Calculate the average percentage of losses from uncollectible accounts for 2007 through 2010. Round your answer to one decimal place. 2. Assume that the credit sales for 2011 are $1,260,000 and that the weighted average percentage calculated in (1) is used as an estimate of losses from uncollectible accounts for 2011 credit sales. Determine the bad debt expense for 2011 using the percentage of credit sales method. Round your answer to the nearest dollar $ 1890 3. Conceptual Connection: Do you believe this estimate of bad debt expense is reasonable? The input in the box below will not be graded, but may be reviewed and considered by your instructor blank 4. Conceptual Connection: How would you estimate 2011 bad debt expense If losses from uncollectible accounts for 2010 were $30,000? What other action would management considera The input in the box below will not be graded, but may be reviewed and considered by your instructor