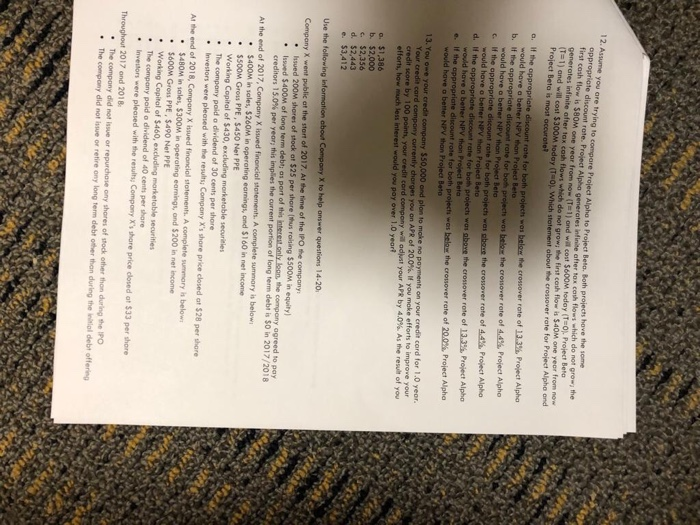

2. Assume you are tr compare Project Alpho to Project Beta. Both projects hove the some discount rote. Project Alpha generates infinike after tox cash flows which dlo not grow the 0M one year from no (T 1) ond wil cost $600M today (T-o). Project Beta first cash flow is $8 Penerates infinite ofter tax cash flows which do not grow; the first cosh flow is $40M one year from now t about the crossover rate for Project Alpho and T-1) and will cost $300M soday (T hich s oieen ,os belos me crossover rate o, las Project Alpho projects wos below the crossover rate of 44%, Project Alpho rate of 44% Project Alpho rote of 13,3% Project Alpho projechs wos belox the cromover rate of 20.0% Project Alpha e discount rate for both would have a better b b. If the approp would have a better If the appropriate discount would have o d. If the would have a better on your credit card for 1.0 yeor d compony currently charges you an APR of 200%. If you make efforts to improve credit score by 100 points, your credit cord c compony wa odist your APR by 40%. As me result of you efforts, how much less interest would you pay over 1.0 year o. $1,386 b. $2,000 c. $2,356 d. $2,443 e. $3,412 Issued $400M of long term debt; as port of this inter y lean, the company agreed to pay creditors l 5.0% per year; this implies the current portion of long term debe is SO in 201 7/2018 S400M in sales, $260M in operating earnings, ond $160 in net income .$500M Gross PPE, $450 Net PPE Working Copital of $430, excluding morketoble securiaie Investors were pleased with the results; Company X's share price closed at $28 per share $4BOM in sales, $300M in operating earnings, and $200 in net income . The company poid o dividend of 30 cents per shore At the end of 2018, Company X issued financial stotements. A complete summary is below $600M Gross PPE, $490 Net PP .Working Copital of $460, excluding marketable securities - The paid o dividend of 40 cents per shore investors were pleased with the results, Compony X's share price closed at $33 per shore Throughout 2017 and 2018 . The compony did not issue or repurchase ony shores of stock other thon during the PO The compony did not issue or retire ony long term debt other than during the leitial debt offering