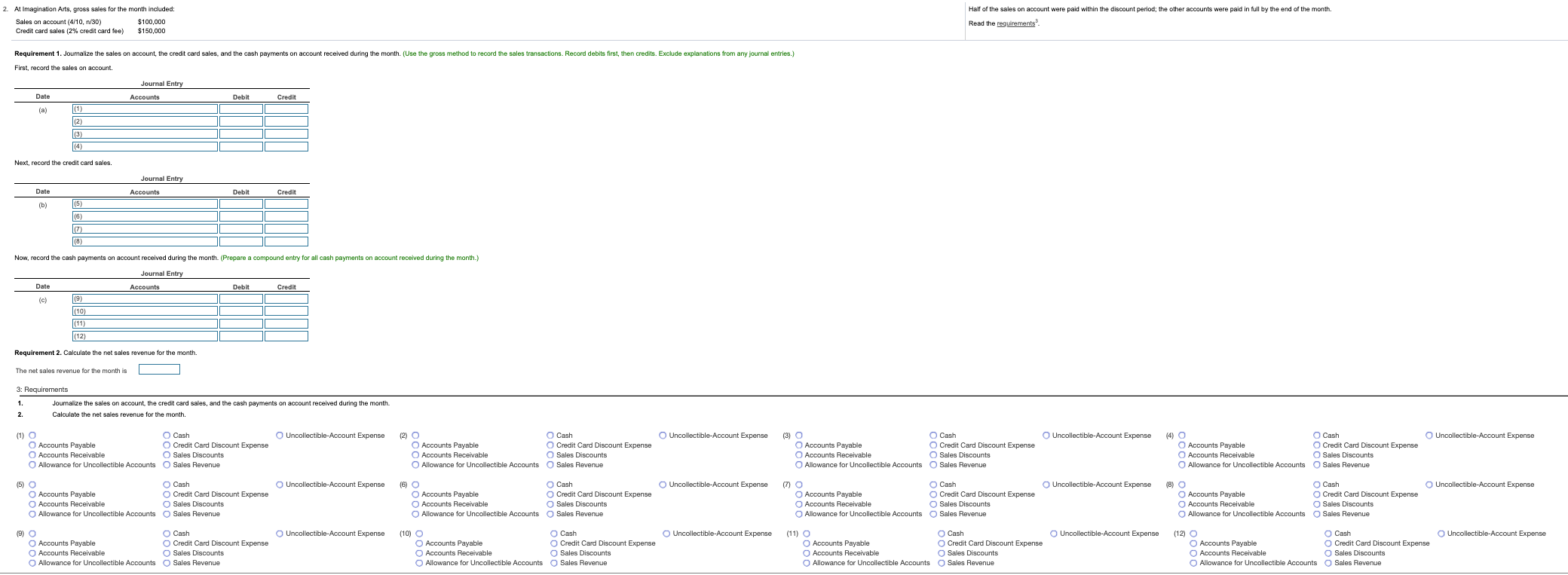

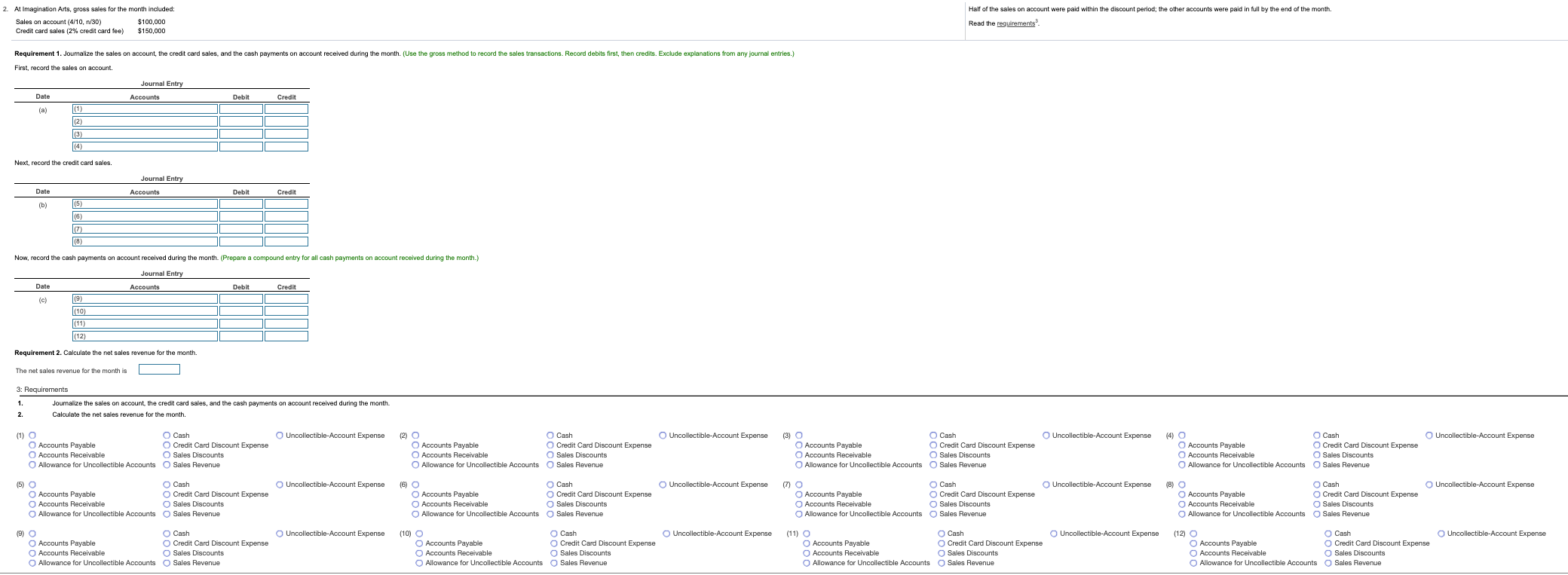

2. At Imagination Arts, gross sales for the month included: Sales on account (4/10, 1/30) $100,000 Credit card sales (2% credit card fee) $150,000 Half of the sales on account were paid within the discount period; the other accounts were paid in full by the end of the month. Read the requirements Requirement 1. Journalize the sales on account the credit card sales, and the cash payments on account received during the month. (Use the gross method to record the sales transactions. Record debits first, then credits. Exclude explanations from any journal entries.) First, record the sales on account. Journal Entry Accounts Date Debit Credit (a) 111 (2) (3) (4) 1 Next, record the credit card sales. Journal Entry Date Accounts Debit Credit (b) 115) 116 (7) (8) Now, record the cash payments on account received during the month (Prepare a compound entry for all cash payments on account received during month.) Journal Entry Date Accounts Debit Credit (c) 19) (10) (11) (12) 1 Requirement 2. Calculate the net sales revenue for the month. The net sales revenue for the month is 3: Requirements 1. Journalize the sales on account, the credit card sales, and the cash payments on account received during the month. 2. Calculate the net sales revenue for the month. Uncollectible-Account Expense Uncollectible-Account Expense (3) Uncollectible-Account Expense (4) Uncollectible-Account Expense (1) O O Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue (2) O Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts O Cash Credit Card Discount Expense Sales Discounts O Sales Revenue Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue Uncollectible-Account Expense Uncollectible-Account Expense (7) Uncollectible-Account Expense Uncollectible-Account Expense 5) O Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts O Cash Credit Card Discount Expense Sales Discounts Sales Revenue (6) O Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts Cash Credit Card Discount Expense Sales Discounts Sales Revenue Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts Cash Credit Card Discount Expense Sales Discounts Sales Revenue (8) O Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue (9) Uncollectible-Account Expense (10) Uncollectible-Account Expense Uncollectible-Account Expense (12) Uncollectible-Account Expense Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts O Cash Credit Card Discount Expense Sales Discounts Sales Revenue Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue (11) O Accounts Payable Accounts Receivable Allowance for Uncollectible Accounts Cash Credit Card Discount Expense Sales Discounts Sales Revenue Cash Accounts Payable Credit Card Discount Expense Accounts Receivable Sales Discounts Allowance for Uncollectible Accounts Sales Revenue