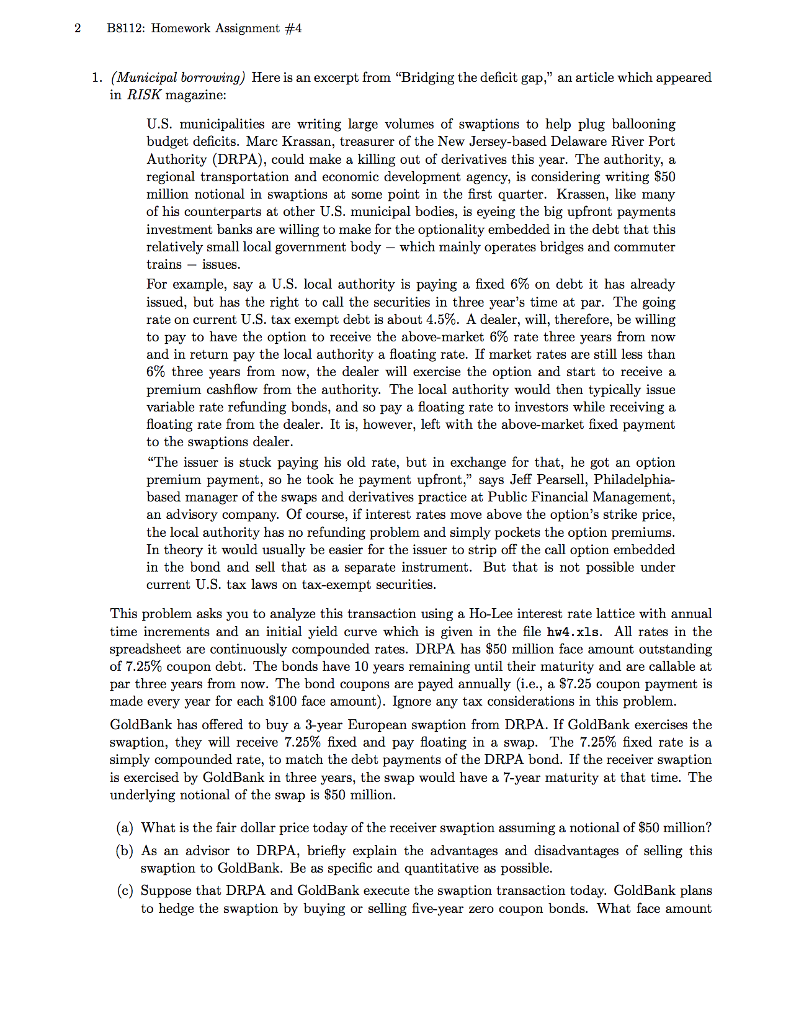

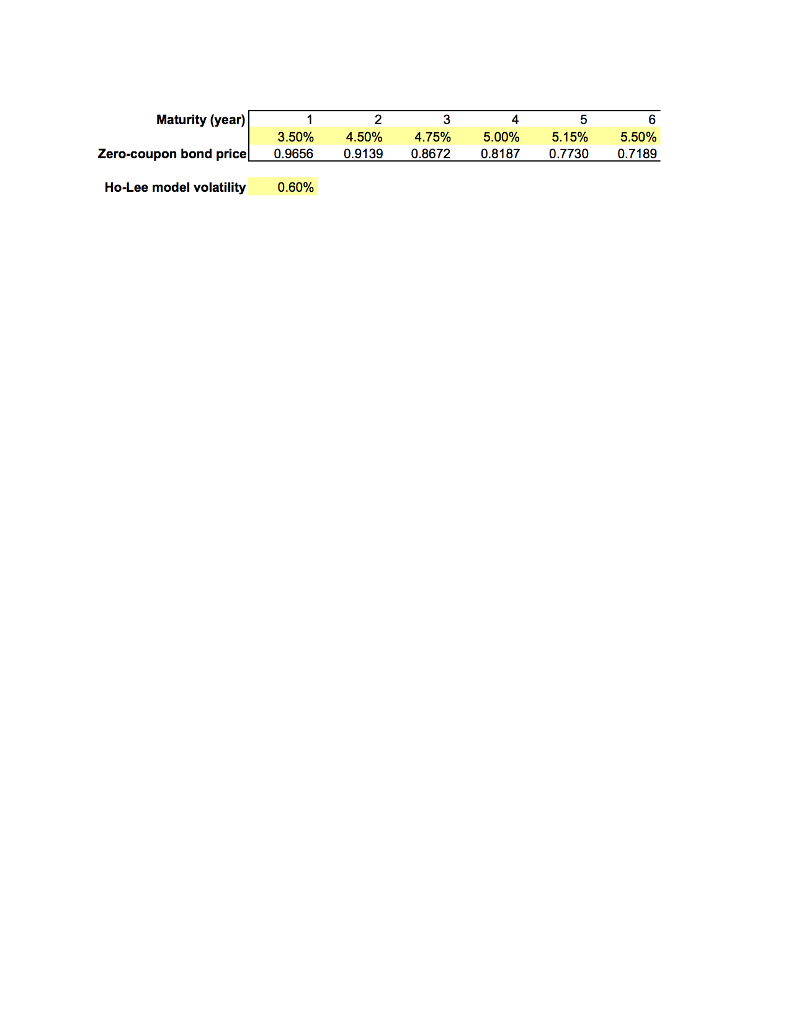

2 B8112. Homework Assignment #4 1. (Municipal borrowing) Here is an excerpt from "Bridging the deficit gap," an article which appeared in RISK magazine: U.S. municipalities are writing large volumes of swaptions to help plug ballooning budget deficits. Marc Krassan, treasurer of the New Jersey-based Delaware River Port Authority (DRPA), could make a killing out of derivatives this year. The authority, a regional transportation and economic development agency, is considering writing S50 million notional in swaptions at some point in the first quarter. Krassen, like of his counterparts at other U.S. municipal bodies, is eyeing the big upfront payments investment banks are willing to make for the optionality embedded in the debt that this relatively small local government body - which mainly operates bridges and commuter trains1Ssues. For example, say a U.S. local authority is paying a fixed 6% on debt it has already issued, but has the right to call the securities in three year's time at par. The going rate on current U.S. tax exempt debt is about 4.5%. A dealer, will, therefore, be willing to pay to have the option to receive the above-market 6% rate three years from now and in return pay the local authority a floating rate. If market rates are still less than 6% three years from now, the dealer will exercise the option and start to receive a premium cashflow from the authority. The local authority would then typically issue variable rate refunding bonds, and so pay a floating rate to investors while receiving a floating rate from the dealer. It is, however, left with the above-market fixed to the swaptions dealer "The issuer is stuck paying his old rate, but in exchange for that, he got an option premium payment, so he took he payment upfront," says Jeff Pearsell, Philadelphia- based manager of the swaps and derivatives practice at Public Financial Management, an advisory company. Of course, if interest rates move above the option's strike price the local authority has no refunding problem and simply pockets the option premiums In theory it would usually be easier for the issuer to strip off the call option embedded in the bond and sell that as a separate instrument. But that is not possible under current U.S. tax laws on tax-exempt securities. many payment This problem asks you to analyze this transaction using a Ho-Lee interest rate lattice with annual time increments and an initial yield curve which is given in the file hw4.xls. All rates in the spreadsheet are continuously compounded rates. DRPA has $50 million face amount outstanding of 7.25% coupon debt. The bonds have 10 years remaining until their rnaturity and are callable at par three years from now. The bond coupons are payed annually (i.e., a S7.25 coupon payment is made every year for each S100 face amount). Ignore any tax considerations in this problem. GoldBank has offered to buy a 3-year European swaption from DRPA. If GoldBank exercises the swaption, they will receive 7.25% fixed and pay floating in a swap. The 7.25% fixed rate is a simply compounded rate, to match the debt payments of the DRPA bond. If the receiver swaption is exercised by GoldBank in three years, the swap would have a 7-year maturity at that time. The underlying notional of the swap is 850 million. (a) What is the fair dollar price today of the receiver swaption assuming a notional of $50 million? (b) As an advisor to DRPA, briefly explain the advantages and disadvantages of selling this swaption to GoldBank. Be as specific and quantitative as possible. (c) Suppose that DRPA and GoldBank execute the swaption transaction today. GoldBank plans to hedge the swaption by buying or selling five-year zero coupon bonds. What face amount 2 B8112. Homework Assignment #4 1. (Municipal borrowing) Here is an excerpt from "Bridging the deficit gap," an article which appeared in RISK magazine: U.S. municipalities are writing large volumes of swaptions to help plug ballooning budget deficits. Marc Krassan, treasurer of the New Jersey-based Delaware River Port Authority (DRPA), could make a killing out of derivatives this year. The authority, a regional transportation and economic development agency, is considering writing S50 million notional in swaptions at some point in the first quarter. Krassen, like of his counterparts at other U.S. municipal bodies, is eyeing the big upfront payments investment banks are willing to make for the optionality embedded in the debt that this relatively small local government body - which mainly operates bridges and commuter trains1Ssues. For example, say a U.S. local authority is paying a fixed 6% on debt it has already issued, but has the right to call the securities in three year's time at par. The going rate on current U.S. tax exempt debt is about 4.5%. A dealer, will, therefore, be willing to pay to have the option to receive the above-market 6% rate three years from now and in return pay the local authority a floating rate. If market rates are still less than 6% three years from now, the dealer will exercise the option and start to receive a premium cashflow from the authority. The local authority would then typically issue variable rate refunding bonds, and so pay a floating rate to investors while receiving a floating rate from the dealer. It is, however, left with the above-market fixed to the swaptions dealer "The issuer is stuck paying his old rate, but in exchange for that, he got an option premium payment, so he took he payment upfront," says Jeff Pearsell, Philadelphia- based manager of the swaps and derivatives practice at Public Financial Management, an advisory company. Of course, if interest rates move above the option's strike price the local authority has no refunding problem and simply pockets the option premiums In theory it would usually be easier for the issuer to strip off the call option embedded in the bond and sell that as a separate instrument. But that is not possible under current U.S. tax laws on tax-exempt securities. many payment This problem asks you to analyze this transaction using a Ho-Lee interest rate lattice with annual time increments and an initial yield curve which is given in the file hw4.xls. All rates in the spreadsheet are continuously compounded rates. DRPA has $50 million face amount outstanding of 7.25% coupon debt. The bonds have 10 years remaining until their rnaturity and are callable at par three years from now. The bond coupons are payed annually (i.e., a S7.25 coupon payment is made every year for each S100 face amount). Ignore any tax considerations in this problem. GoldBank has offered to buy a 3-year European swaption from DRPA. If GoldBank exercises the swaption, they will receive 7.25% fixed and pay floating in a swap. The 7.25% fixed rate is a simply compounded rate, to match the debt payments of the DRPA bond. If the receiver swaption is exercised by GoldBank in three years, the swap would have a 7-year maturity at that time. The underlying notional of the swap is 850 million. (a) What is the fair dollar price today of the receiver swaption assuming a notional of $50 million? (b) As an advisor to DRPA, briefly explain the advantages and disadvantages of selling this swaption to GoldBank. Be as specific and quantitative as possible. (c) Suppose that DRPA and GoldBank execute the swaption transaction today. GoldBank plans to hedge the swaption by buying or selling five-year zero coupon bonds. What face amount