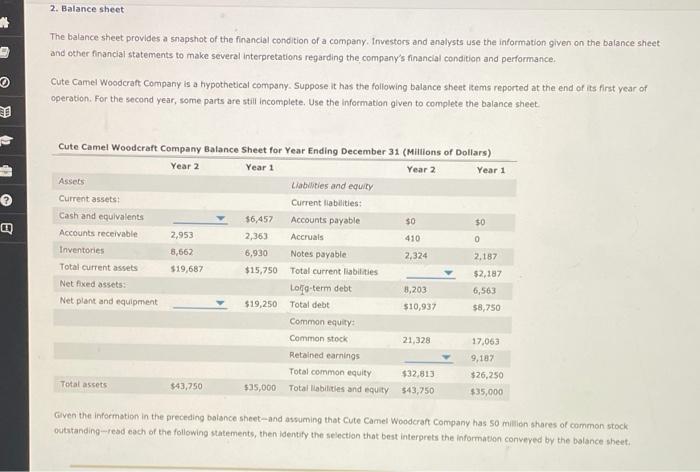

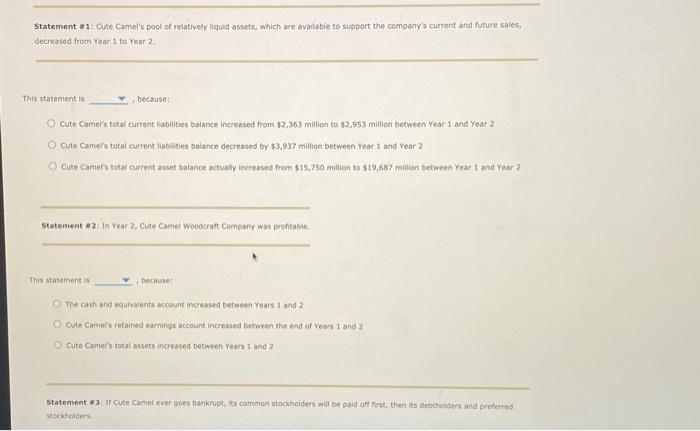

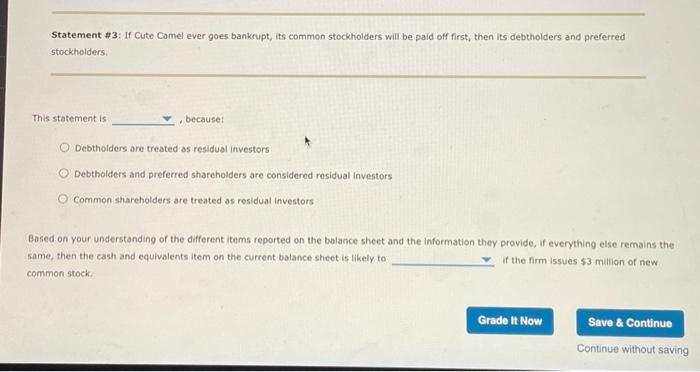

2. Balance sheet The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance Cute Camel Woodcraft Company is a hypothetical company. Suppose. It has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet Cute Camel Woodcraft Company Balance Sheet for Year Ending December 31 (Millions of dollars) Year 2 Year 1 Year 2 Year 1 $6,457 $0 $0 410 0 Assets Current assets Cash and equivalents Accounts receivable Inventories Total current assets Net Fixed assets: Net plant and equipment 2,953 8,662 $19,687 2,363 6,930 $15,750 2,324 Llabilities and equity Current liabilities: Accounts payable Accruals Notes payable Total current abilities Loisg-term debt Total debt Common equity Common stock Retained earnings Total common equity Total liabilities and equity 2.187 $2,187 6,563 $8,750 8,203 $10,937 $19,250 21,328 17,063 9.187 $26,250 $35,000 Total assets $43,750 $32,813 543,750 $35,000 Given the information in the preceding balance sheet-and assuming that Cute Camel Woodcraft Company has so million shares of common stock outstanding-read each of the following statements, then Identity the selection that best interprets the information conveyed by the balance sheet Statement #1: Cute Camel's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2 This statement is because: Cute Came's total current liabilities balance increased from $2,363 million to $2,953 million between Year 1 and Year 2 Cute Camel's total current liabities balance decreased by $3,997 million between Year 1 and Year 2 cute camel's total current asset balance actually increased from $15,750 million to $19,687 million between Year 1 and Year 2 Statement. In Year 2, Cute Camel Woodcraft Company was profitable, This statements because The cash and equivalents account increased between Years 1 and 2 O cute Camel's retained earnings account increased between the end of years 1 and 2 Cute Camer's total assets increased between Years 1 and 2 Statement #3: Cute Camel ever goes bankrupt, its common stockholders will be paid off first, then its debtholders and preferred stockholders Statement #3: If Cute Camel ever goes bankrupt, its common stockholders will be paid off first, then its debtholders and preferred stockholders This statement is because: Debtholders are treated as residual investors Debtholders and preferred shareholders are considered residual investors O common shareholders are treated as residual investors Based on your understanding of the different items reported on the balance sheet and the information they provide, if everything else remains the same, then the cath and equivalents item on the current balance sheet is likely to If the firm issues $3 million of new common stock Grade It Now Save & Continue Continue without saving