Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Based on your valuation of HFC, do you believe the company was fairly valued by the market before the announcement of the sale? Calculate

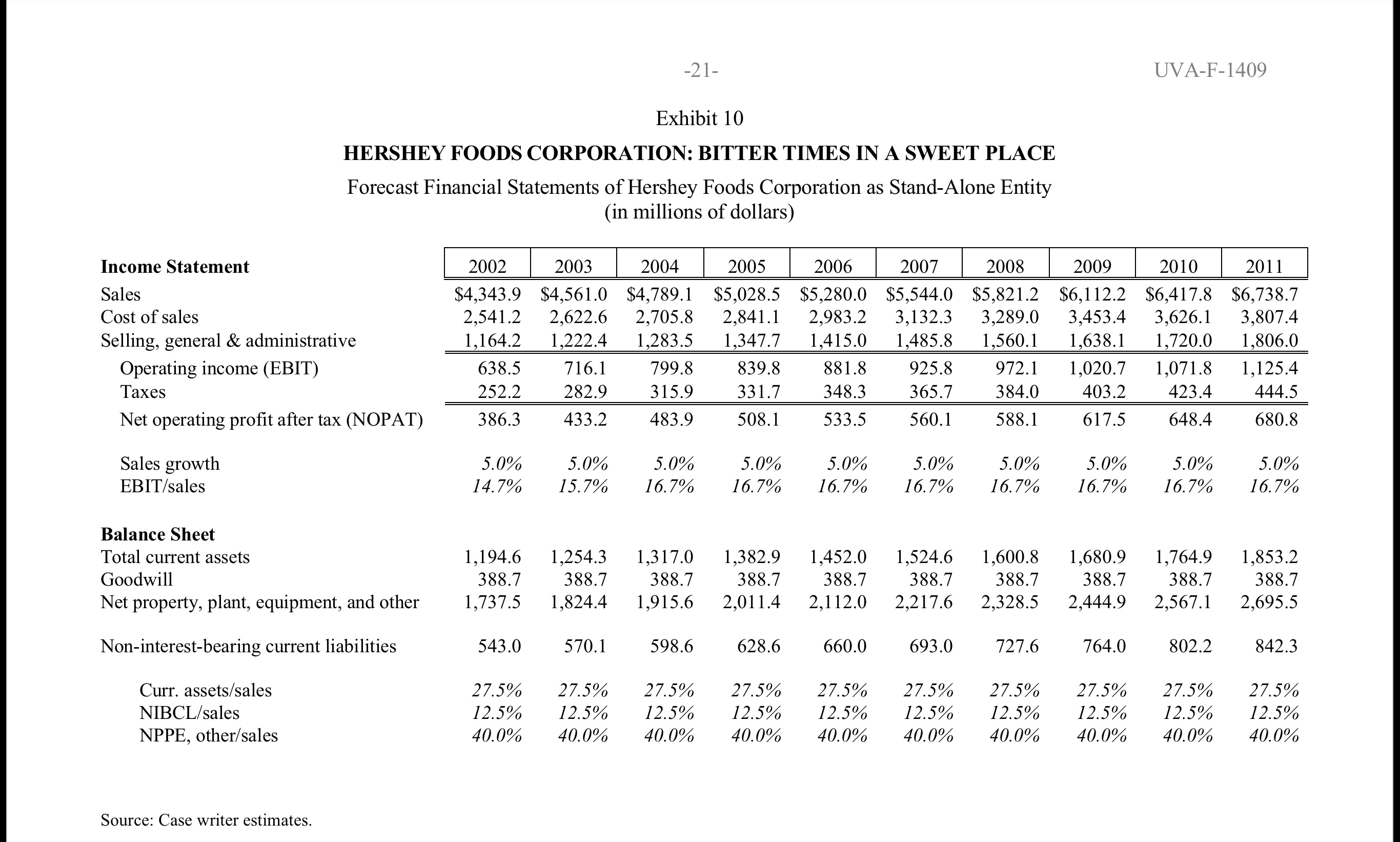

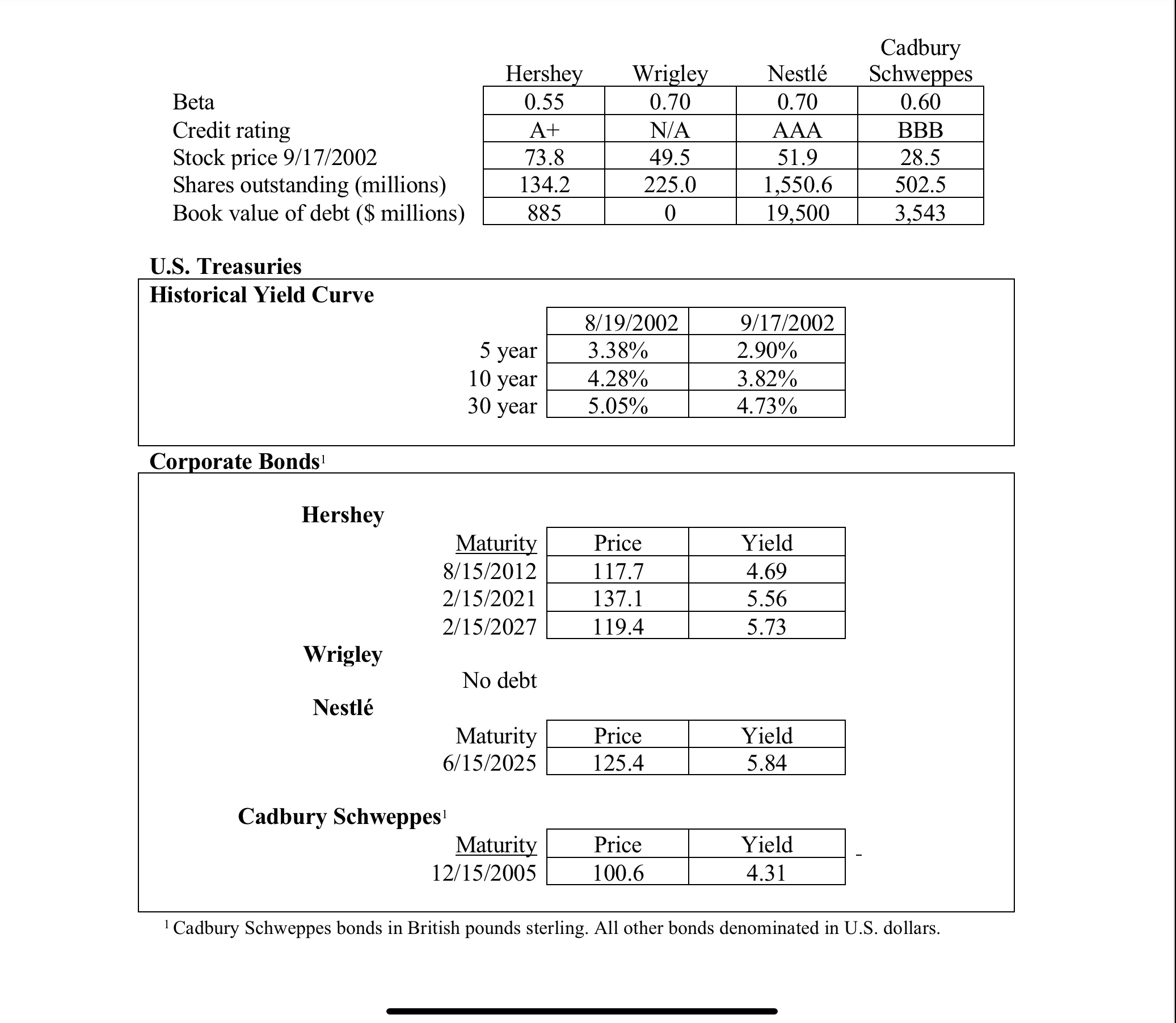

2. Based on your valuation of HFC, do you believe the company was fairly valued by the market before the announcement of the sale? Calculate the WACC for HFC using the data provided in the exhibits; assume a Market Risk Premium of 5.5%. Estimate the stand-alone value ofHFC using the free-cash-flow projections provided in case Exhibit 10.

HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Forecast Financial Statements of Hershey Foods Corporation as Stand-Alone Entity (in millions of dollars) Source: Case writer estimates. U.S. Treasuries 1 Cadbury Schweppes bonds in British pounds sterling. All other bonds denominated in U.S. dollars

HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Forecast Financial Statements of Hershey Foods Corporation as Stand-Alone Entity (in millions of dollars) Source: Case writer estimates. U.S. Treasuries 1 Cadbury Schweppes bonds in British pounds sterling. All other bonds denominated in U.S. dollars Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started